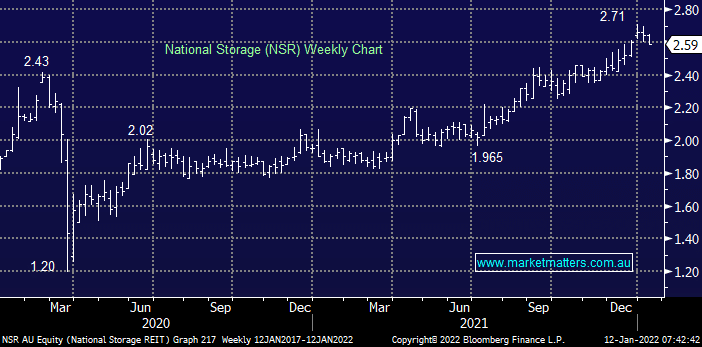

National Storage REIT (NSR), Australia’s largest owner of self-storage assets is now trading on a cap rate of ~4.5%. The cap rate (standing for capitalisation rate) is a widely used measure in property which divides the net income generated by the property by its value. In other words, it’s the return the property (or portfolio of properties) will spin off relative to its value expressed as a percentage. A cap rate of 4.5% is low meaning NSR is on the expensive side. We hold NSR in this portfolio and while we like the thematic of self-storage, we are now assessing this position.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Global X Data Centre & Digital Infrastructure ETF (DTCR US)

Global X Data Centre & Digital Infrastructure ETF (DTCR US)

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is now neutral NSR around $2.60

Add To Hit List

Related Q&A

Real Estate Stocks

Abb and NSR

NSR JV Plan

Thoughts on a2 Milk (A2M) and National Storage (NSR)

Thoughts on Aristocrat (ALL) and National Storage (NSR)

Update of MM’s Webinar – “Pulse check 7 Highest conviction calls”

How much further can real estate stocks appreciate?

REITS

Does MM have a preference between CNI and NSR?

MM updates on DXS, NSR and ABB

Which REITS have the most capital upside?

What are MM’s current thoughts on ABG/ASK and NSR?

What stocks for property exposure?

Relevant suggested news and content from the site

chart

Global X Data Centre & Digital Infrastructure ETF (DTCR US)

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.