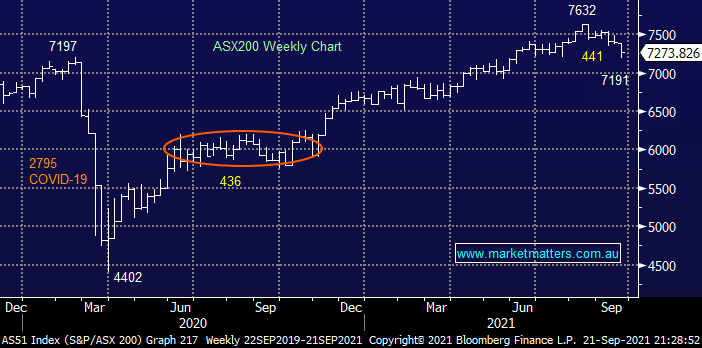

The ASX200 staged a strong recovery yesterday after initially taking Septembers sell-off to 343-points / 4.6%, coincidentally testing our 7200 target area in the process. Ultimately Tuesday was a frustrating session for MM as we sat poised to increase risk into the pullback but our targeted purchases all fell short of our ideal levels discussed in recent reports. We must always remember that investing is rarely a perfect science and our main focus running into October will be more around whether MM pays up for the stocks it likes as opposed to looking elsewhere for value – a main focus of today’s report. We’ve been looking for this pullback to migrate up the risk curve but it’s always unsettling to see portfolios fall in value, even if it was expected!

I’m sure most subscribers had never heard of Chinese property developer Evergrande a few weeks ago and yet suddenly the media is calling it Chinas Lehman Brothers, drawing a long bow there however a few quick statistics to put things into perspective:

- Evergrande’s debts are currently sitting at around $400bn i.e. it has roughly the same amount of debt as the combined market values of Australia’s big 4 banks

- The company employs around 200,000 people across 1300 projects in 280 Chinese cities, Beijing will be reticent to make them all of them unemployed in one go especially with the knock on impact even greater.

- The companies success has been through residential property and if this bubble bursts the global economy will sustain a meaningful jolt, especially as we’ve seen to the likes of iron ore which is so heavily used in construction.

- Xu Jiayin & co are struggling to sell assets and have started missing debt repayments – the vultures are going to have fun with this one.

The stock has been falling aggressively for over 12-months hence we don’t believe its demise will have a lasting impact on global equity markets although it’s maybe a warning sign of what may unfold in 2022

MM believes that Evergrande will survive in some shrunken form as the opportunists chip away at its cut price assets but even if it fails it wont be a black swan (surprise / unforeseen) event with the stock already down 90% over the last year – we feel the Chinese government will step in to avoid any damaging contagion style event across its economy and financial markets in general. Two important takeout’s for MM moving into 2022:

- The Chinese property market will slow dramatically with some deleveraging forced declines likely – this may help the Australian market if the rich Chinese again look for ways to squirrel away their money offshore.

- Iron Ore will probably find a base around $US100/wmt now that most analysts have slashed their estimates but we prefer other areas of the Resources Sector unless we see ongoing panic weakness in the bulk commodity.

Its amazing how seasonality has a habit of coming true but we must remember as the Chinese property market creates a cloud over equity markets that buying September weakness usually delivers excellent returns for the brave through Q4 with the “Santa Claus Rally” looming fast. In our opinion the stability in the likes of global bond and oil markets illustrates Evergrande is very unlikely to significantly undermine the post GFC bull market.

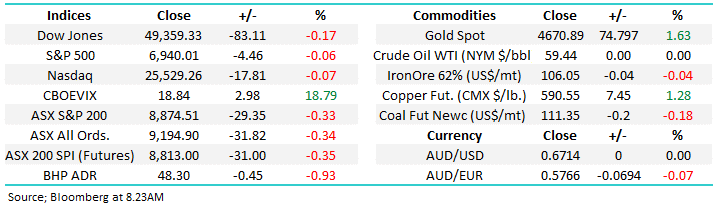

US stocks closed mixed overnight after enduring their largest decline in 4-months on Monday, the SPI futures are looking for the ASX to open down 0.2% this morning as markets start to contemplate this week’s FOMC meeting, the statement should provide further clues around the Feds plans to taper stimulus moving into 2022.