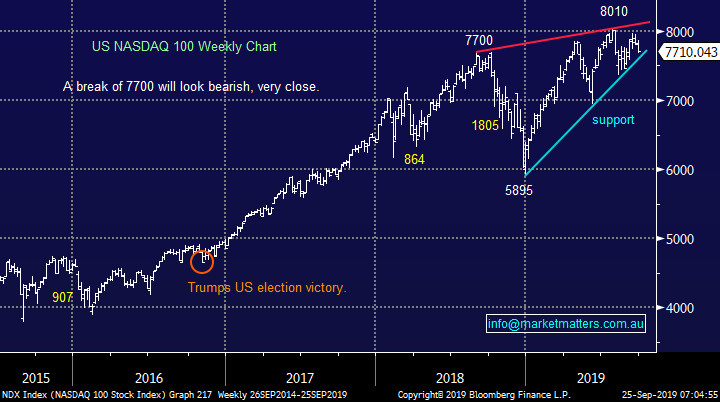

Overseas Wednesday – International Equities & ETF Portfolios (AMZN, AAPL, MSFT, DTYS, GBP)

The ASX200 closed unchanged yesterday after attempting to rally early in the day before encountering some mid-morning selling, most noticeably to me in the resources and IT stocks – they picked it perfectly as these sectors look set to be hit fairly hard this morning after coming under pressure in the US. We believe stock markets are positioned very optimistically into Octobers US – China trade talks in Washington, any hiccup in the process could easily see a 5% drop in stocks. We only have to look at BREXIT to remind us how rarely countries politicians / leaders resolve major issues like mature adults. From a simple risk / reward perspective our major view as October approaches remains intact (detailed later in today’s report) :

1 – We feel the next 5% move in stocks is more likely on the downside hence we are positioned relatively defensively e.g. the Growth Portfolio is holding 23% in cash.

2 – Global bond yields look set to make fresh lows for 2019 as we see central banks fight to avoid a recession, plus we may get a flight to the perceived quality of bonds if stocks “wobble” for a few weeks.

3 - Gold and its respective stocks looks poised to make fresh 2019 highs.

Hence MM remains comfortable holding higher cash levels / being more defensive than during the first 6-months of 2019.

Overnight US stocks were sold off fairly aggressively following some poor Consumer Confidence data and renewed aggressive comments by President Trump towards China, he doesn’t stay quiet for long! The SPI futures are calling the ASX200 to open down around 75-points / 1.1%, led by BHP & RIO who both fell around 3% in the US.

In today’s report as usual we are going to look at our Platinum, International and ETF Portfolio’s after firstly looking at some of our broad macro opinions on markets.

ASX200 Chart

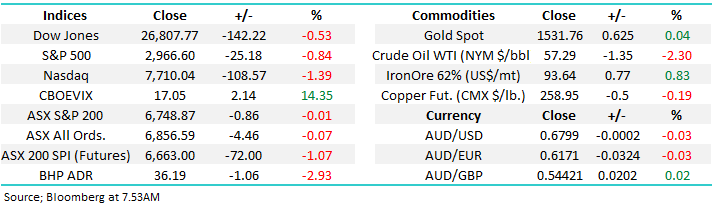

Bond yields remain the key

No major change, bond yields and especially the US 10-year’s are currently having a large influence on equities, the recent sharp 2-week countertrend bounce led to aggressive sector rotation but we felt it was just an early warning for what might unfold in later 2019 /2020. At this stage we continue to believe the US 10-years have started to “look for a low” but ongoing choppy price action back towards 1.5%, and potentially lower, is our preferred scenario. A correction in stocks would more than likely see the safety of bonds again enjoy a strong bid tone sending their respective yields lower.

MM believes the bear market for bond yields is very mature but new lows would not surprise.

We believe the risk / reward favours the cyclicals into any pullback towards 1.5% for the US 10-year bond yield, MM is likely to invest accordingly.

US 10-year bond yields Chart

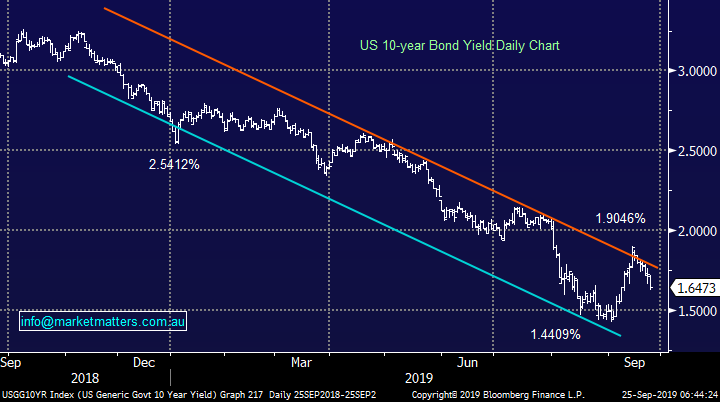

Local 3-year bonds remain on course to make fresh all-time highs as markets factor in 2 rate cuts by the RBA in the coming months i.e. the Official Cash Rate is poised to halve from 1% to 0.5%. However we reiterate a move towards 99.50 / 0.5% is one we are likely to fade as opposed to embrace i.e. avoid “yield play” stocks in preference to cyclicals.

Australian 3-year bond yields Chart

Where to now for Golds?

No change, MM has used the recent weakness in the gold sector to buy Evolution Mining (EVN) and Newcrest Mining (NCM) – note we currently anticipate holding these stocks for weeks, not months.

The inverse correlation between the gold sector and bond yields implies that for MM to be correct, and the gold sector stages a rally from here that bond yields continue the last few days decline and stocks in general probably correct - Overnight US 10-years continued lower enabling the US based Gold Miners ETF (GDX US) to gain a +1.1% in a falling market.

MM likes the gold sector now targeting ~8% upside.

VanEck Gold Miners ETF (GDX AU) Chart

Newcrest Mining (NCM) Chart

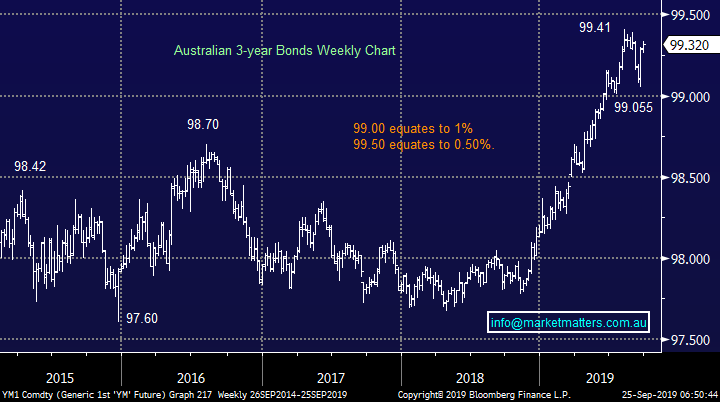

Where to now for US stocks?

Last nights aggressive decline by US stocks hasn’t triggered any sell signals for MM but its starting to feel like when, not if, we see a decent pullback. Importantly MM will be looking to buy such a pullback, not sell into the weakness.

Bull markets die through excessive optimism, not old age, and this current post GFC bull market maybe the longest in history but its most definitely not loved, more like hated in my opinion, hence history tells us its not over yet although pullbacks occur in the most impressive of bull markets.

MM believes US stocks are poised to correct at least 5%.

US NASDAQ Chart

Lastly the Aussie dollar which continues hold firm around 68c, we believe its forming a base, our contrarian view is we see 80c before 60c i.e. the little Aussie Battler will win the fight!

MM believes the $A is looking for / has reached a major point of inflection.

Australian Dollar Chart

Growth Portfolio

Currently MM is comfortable with our MM Growth Portfolio which is holding 23% in cash and 6% in golds: https://www.marketmatters.com.au/new-portfolio-csv/

We are looking for some weakness in the coming weeks to move to a more fully invested stance with a bias to cyclicals while also taking $$ on our gold position in the process.

We are contemplating taking a short-term position in the leveraged Bear ETF , the BBOZ.

International Equites Portfolio

Our MM International Portfolio continues to perform steadily supporting our patient approach to this relatively new offering: https://www.marketmatters.com.au/new-international-portfolio/

MM still hold 72% in cash looking to buy weakness through October, plus we hold 8% in bearish S&P500 ProShares ETF (SH US) and 5% in Barrick Gold (Gold US) both of which will probably be closed / switched if our anticipated pullback scenario unfolds.

MM still believes the risk / reward for US stocks is on the downside into October, they may have just started to listen.

The recent sector rotation has reduced slightly our anticipated downside objectives for the broader indices as we feel cyclicals will continue to attract buying into weakness, although we can still see a sharp decline for the tech based NASDAQ. Today I have briefly looked at 3 stocks we are considering buying into a market pullback; our focus has been on stocks that struggled overnight as we look for candidates who might get oversold into a correction, hence the tech bias.

US NASDAQ Index Chart

1 Amazon.com (AMZN US) $US1741.61

MM believes AMZN is poised for an aggressive leg to the downside with an initial target below $US1600, however our interest will be perk up if we spike down to test the Christmas lows.

MM likes AMZN around $US1400

Amazon.com (AMZN US) Chart

2 Apple Inc (AAPL US) $US217.68

Household name AAPL could easily get “walloped” if markets believe US – China trade might deteriorate further, easy to comprehend considering some of the players. If we see a spike lower in AAPL MM is considering increasing our holding.

At this stage MM likes Apple below $180.

Apple Inc (AAPL US) Chart

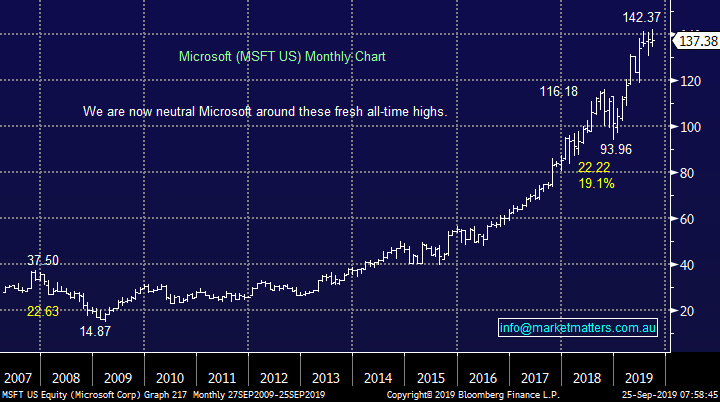

3 Microsoft (MSFT US) $US137.38

Very often the best companies whose shares have been performing strongly become rapidly oversold on profit taking when markets have a pullback, we will be very keen buyers of Microsoft if this occurs, ideally around $US120.

MM is bullish MSFT around $US120.

Microsoft (MSFT US) Chart

MM Global Macro ETF Portfolio

No change, MM increased our portfolio holdings earlier in the month by buying into the Silver ETF (SLVP US) and increasing our ProShares Short S&P500 ETF position, we now have 72% in cash, coincidentally the same as the International Portfolio: https://www.marketmatters.com.au/new-global-portfolio/

We remain comfortable with our 4 positions but further tweaks are set to unfold in the weeks ahead:

1 – As implied earlier MM is going to average our long $A position following the local currencies fresh multi-year lows below the 67c area level, we believe the time is now:

MM is increasing its AUD BetaShares ETF holding from 7.5% to 10%.

2 – Secondly the very topical bond market, we feel that US 10-year bonds are in their final leg of declining yields for 2019. MM are keen buyers of a dip to fresh lows in the Bear ETF (DTYS US), ideally around the ~7.50 area.

Details of this ETF are explained on this link : https://etfdb.com/etf/DTYS/

iPath 10-year Bond Bearish ETF (DTYS US) Chart

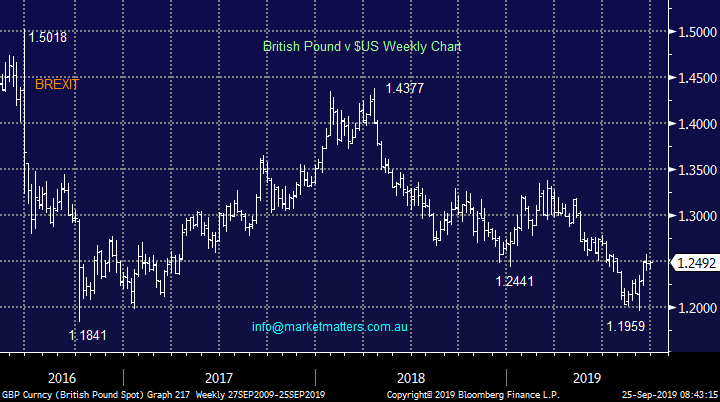

3 – Thirdly, the debacle called BREXIT which we believe is slowly but surely coming to conclusion although it might still claim its last casualty with Prime Minister Boris Johnson enduring a tough time at present. MM is watching for any panic spike lower in the Pound as a potential buying opportunity because we believe things wont be as bad as many fear in the years ahead i.e. markets hate the unknown!

Details of our preferred British Pound ETF are explained on this link : https://etfdb.com/etf/UGBP/

British Pound Chart

Conclusion (s)

· No change, MM likes sitting on our hands at this stage but we are dusting off the buy button in tune with our targeted pullback for global stocks – Amazon, Apple and Microsoft will all be on the menu at the levels discussed above.

· We are adding to our long AUD position in the Global ETF Portfolio

· MM remains net bearish global stocks in the weeks ahead and will be looking for opportunities to switch our “book of positions” around if a pullback unfolds.

Overnight Market Matters Wrap

- The US equity markets closed lower overnight following a reported weak consumer confidence number and further criticism of China trade practices commented by President Trump.

- Across to the UK, the FTSE lost 0.47% overnight following Britain’s high court ruling the PM, Boris broke the law in suspending Parliament, with Brexit deadline back to the unknown territory.

- On the commodities front, Aluminium and nickel traded lower on the LME, while crude oil slid 2.30%.

- BHP is expected to underperform the broader market yet again after ending its US session off an equivalent of -2.93% from Australia’s previous close.

- The December SPI Futures is indicating the ASX 200 to open 60 points lower, towards the 6690 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.