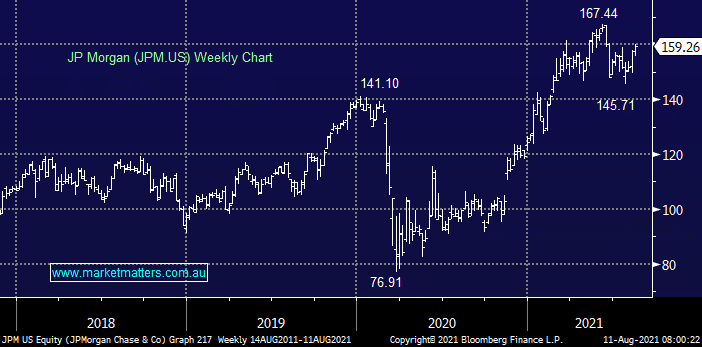

JPM is tempting us considering both our large cash position and macro-economic view into Christmas. The stock looks great after its recent 13% correction, this would potentially be relatively short-term foray into the investment bank but a 10-15% return over 4-6 months is more attractive than cash in today’s low rate world.

scroll

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish JPM at current levels initially looking for 10-15% upside

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.