6000 the magnet as the range continues to tighten (HUB, BSL, Z1P)

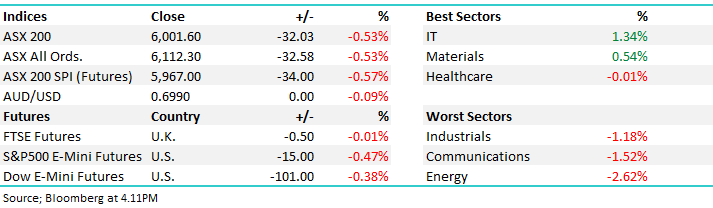

WHAT MATTERED TODAY

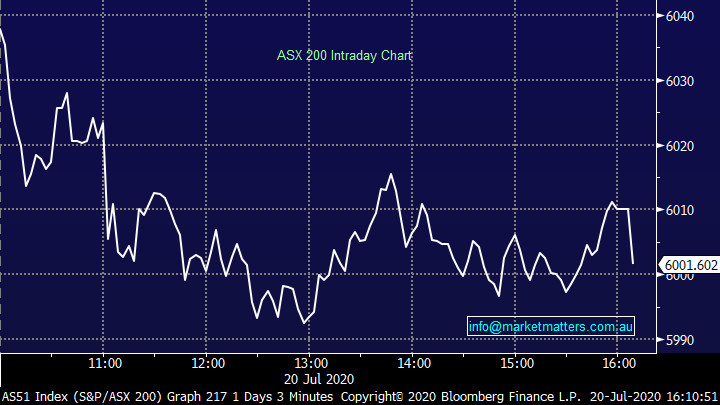

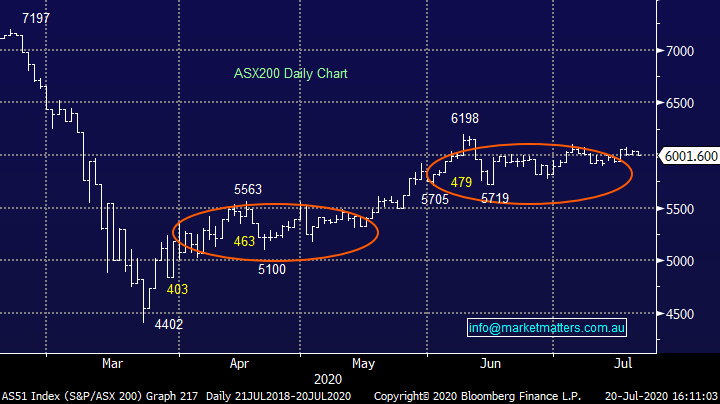

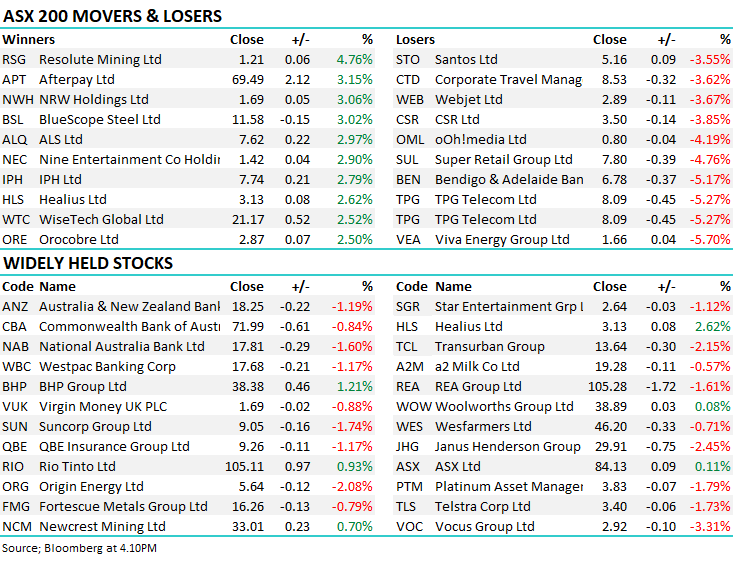

The ASX continues to oscillate around the 6000 level down mildly today with twice as many stocks in the red, energy, telecommunications and industrials suffering the steepest declines. This week see’s the mini-budget out on Thursday with some more detail around how the various support packages will be rolled out post September, while RBA Governor Phillip Lowe speaks tomorrow on "COVID-19, the Labour Market and Public Sector Balance Sheets" – this should be an interesting update.

US Futures were softer during our time zone today while in Asia, it was green across the screen with China the star adding +2.4%

Overall, the ASX 200 fell -32pts / -0.53% to close at 6001. Dow Futures are trading down -120pts / -0.48%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

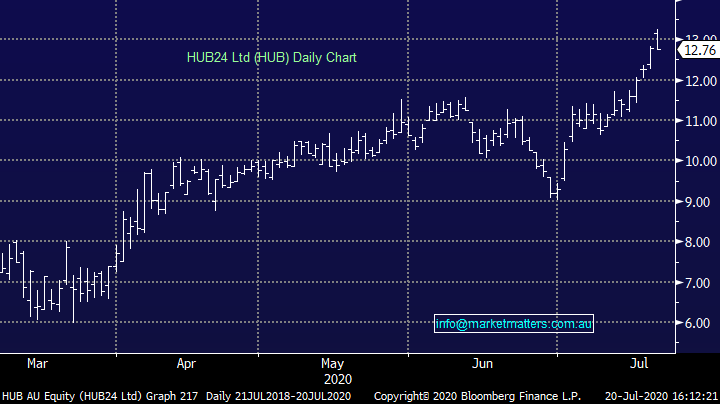

HUB24 (HUB) -0.16%: started with a bang, finished with a whimper though still marginally outperformed the broader market after providing a FUA update for the July quarter, rounding out FY20. It was a record year for HUB with further inflows in the final quarter, and the benefit of a strong market increasing FUA by 14% to $17.2b – an increase on $2.1b with a near even split between inflows and market performance.

Advisor numbers continue to grow adding to market share which came in just below the 2% level in a market still dominated by the bank aligned platforms. With a number of brokers signing up through the quarter, and advisors moving away from the old models, we expect market share to continue to climb with HUB the market leader of the independent names.

HUB24 (HUB) Chart

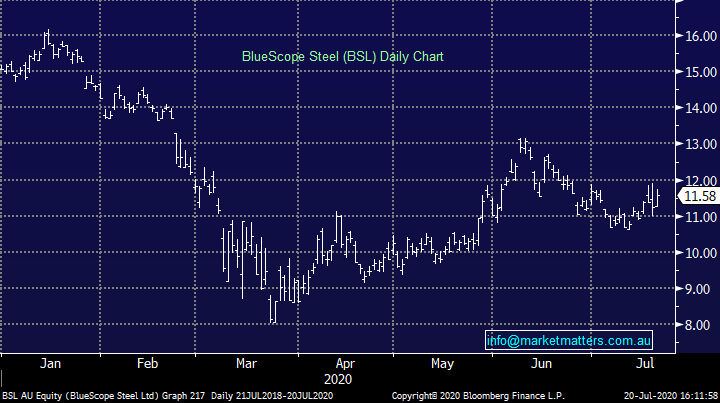

BlueScope Steel (BSL) +3.02%: found some supporters in the analyst department with a number of brokers pushing price targets higher after pre-releasing FY20 results late last week. The company guided 2nd half EBIT to “around $260 million” which would be -48% on last year, taking full year EBIT to around $560m, off ~60% on FY19. The market’s initial reaction to sell on Friday was more than reversed by today’s move higher. The market had taken a knife to earnings after BlueScope withdrew guidance in March, though today’s announcement has come in just 7% below the previous figure.

The company said that Australian demand was little changed on the first half, and while demand from car manufactures had fallen with shutdowns, the North Star site had maintained utilisation rates above 90%. North America saw the benefit of an improved manufacturing performance and while performance in Asia was mixed, it doesn’t look as poor as first feared. It is another example of the panic that COVID brought far outweighing the impact to the business and the market being forced to boost estimates. They also commented on the start of FY21, saying that steel spreads had tightened while continuing to flag further impacts of COVID. BlueScope is in a good position to benefit from a broader economic recovery though and one to keep an eye on for global growth exposure.

BlueScope Steel (BSL) Chart

BROKER MOVES:

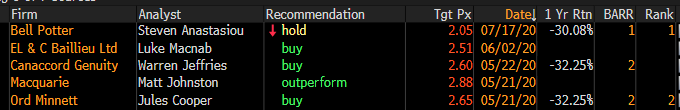

Steve Anastasiou at Bell Potter downgraded Service Stream (SSM) from a buy to a hold and $2.05 PT, down from $2.50. Steve is the No 1 rated analyst on the stock hence the share price weakness today. SSM resides in the growth portfolio but has been a real disappointment in recent times – Bells rationale for the downgrade is based on lower BNB activations. Given the backdrop of a decline in nbn activations, no more nbn construction revenue, and the re-introduction of stage 3 restrictions in Victoria, we believe it will be difficult for SSM to deliver an FY21 result that matches its FY20 performance. With median market consensus expecting SSM to do just that, we are of the view that current market expectations may be too high.

Broker Forecasts for Service Stream (SSM)

Source: Bloomberg

· ALS Raised to Buy at Jefferies; PT A$9

· REA Group Cut to Neutral at UBS; PT A$107

· Codan Rated New Outperform at Macquarie; PT A$9

· OceanaGold GDRs Raised to Outperform at Macquarie; PT A$3.70

· Coles Group Cut to Neutral at Credit Suisse; PT A$18.70

· CBA Cut to Neutral at Citi; PT A$71

· Bendigo & Adelaide Cut to Neutral at Citi; PT A$7.25

· CSR Cut to Underweight at Morgan Stanley; PT A$3.10

· ARB Cut to Sell at Morningstar

· Ramsay Health Raised to Buy at Jefferies; PT A$74

· Ansell Cut to Hold at Jefferies; PT A$43.15

· Japara Raised to Hold at Jefferies; PT 50 Australian cents

· Helloworld Raised to Add at Morgans Financial Limited

· Service Stream Cut to Hold at Bell Potter; PT A$2.05

OUR CALLS

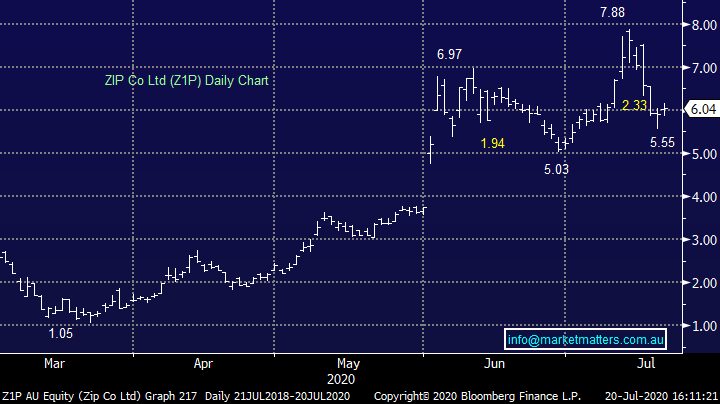

We added to our position in Z1P today in the growth portfolio.

Z1P Co (Z1P) Chart

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.