6000 – a bridge too far again today…(IAG, JHG)

WHAT MATTERED TODAY

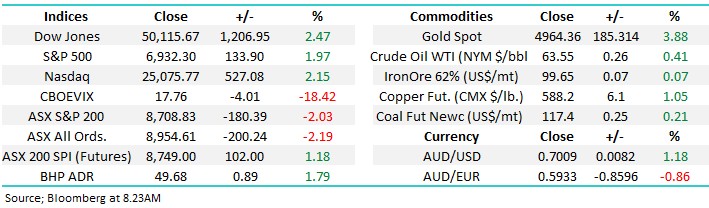

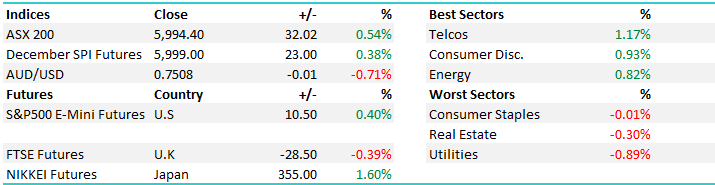

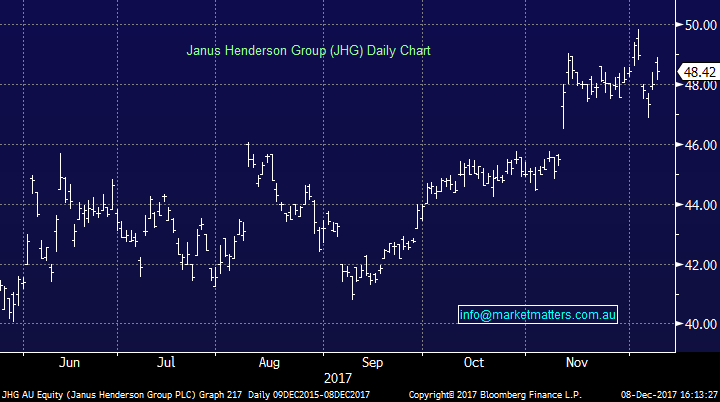

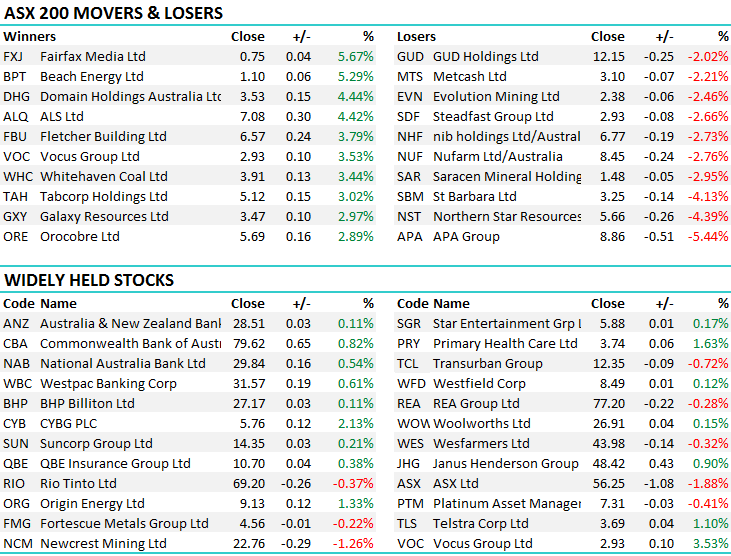

The market had another crack at the 6000 level today, but once again sellers stepped up and pushed the index lower into the close. No real bid tone in US Futures during our session, while Iron Ore Futures were trading more than 3% lower prompting some weakness amongst the miners. The overseas earners – the likes of Aristocrat (ALL), Macquarie (MQG), CYBG (CYB) did well today however it was the banks that provided most index support. Banks typically rally in December and we’re starting to see that play out, CBA the best of them adding +0.94% and we continue to like our overweight banks / financials call for the next few months. To that end, we paid up for Janus Henderson (JHG) today in the Growth Portfolio, getting set at $48.28 after failing to get filled around the $47 region over the past couple days. The stock closed at $48.42

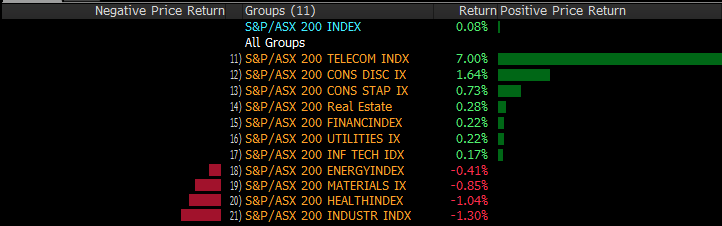

For the week, we’ve seen most buying in the Telco space for a change, with Telstra fighting back against the huge wave of negativity, while the Industrials has been out of favour

Weekly sector performance

Source: Bloomberg

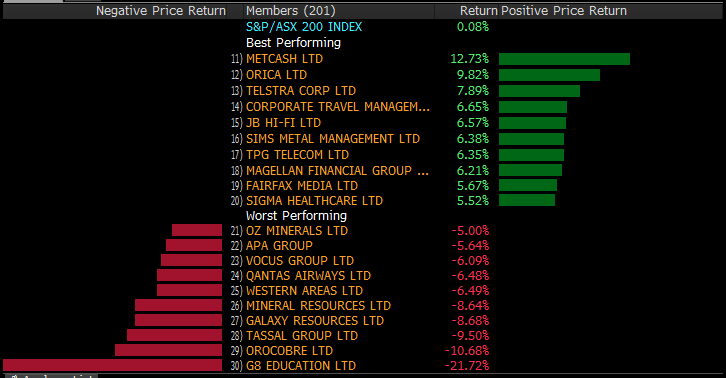

Big stocks movers over the week

Source: Bloomberg

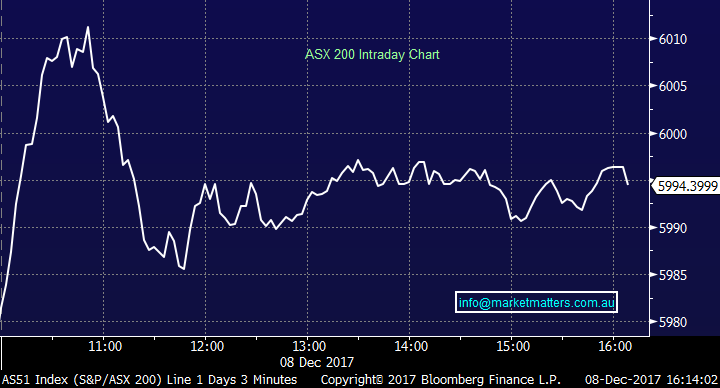

On the mkt today, the Telcos were again the standout while on the flipside, the Utilities struggled and closed -0.89% lower. An overall range today of +/- 33 points, a high of 6012, a low of 5979 and a close of 5994, up +16pts or +0.28%

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

TOP MOVERS

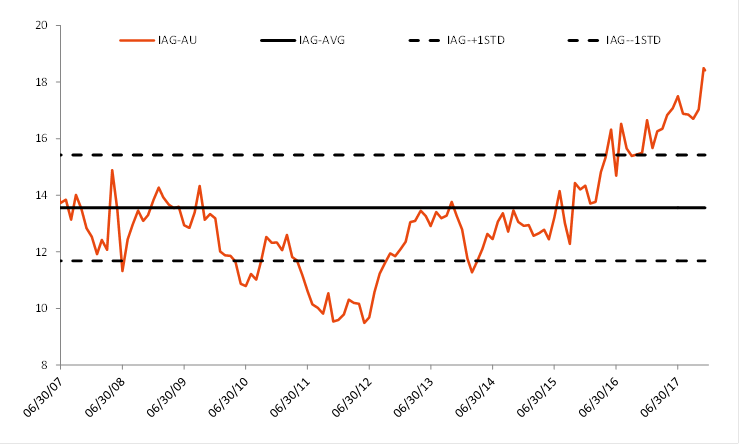

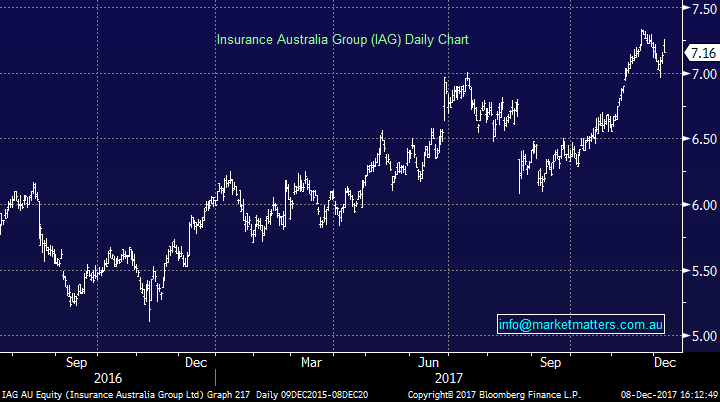

1. IAG – Similar to the Berkshire deal they did a while ago, IAG today has announced 3 new quota share agreements which will reduce earnings volatility, boost insurance margins 250bps on a full year basis and free up $435m of capital. Having a quick go at the numbers, this could add 2-3% to EPS – however this is a stocks that is incredibly expensive on a historical context BUT, the business does provide a low risk exposure to insurance, they will do a buy back of stock, something around the tune of 400m in FY18 which would improve earnings per share by around 2%. Overall, the deal announced in a good one and is definitely value accretive, as reduces earnings volatility, releases capital and lifts ROE.

The also came out with FY18 guidance saying that insurance profit broadly unchanged and their reported Insurance margin 13.75%-15.75% (up 125bps).

IAG PE – very stretched

Source; Shaw and Partners

IAG Daily Chart

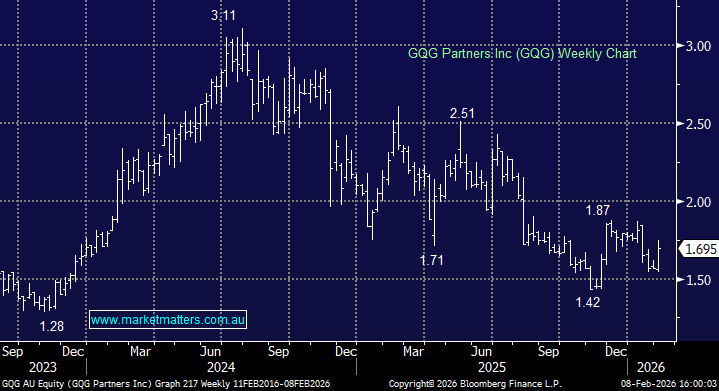

2. Janus Henderson (JHG) – A stock we like and we amended our BUY price up today to around $48.30 with a 3% allocation. This is a reasonably cheap global fund manager with scale, we like its international exposure, and believe the financial space is where most money will flow should the market continue to track higher, and sustain the break above 6000.

Janus Henderson Daily Chart

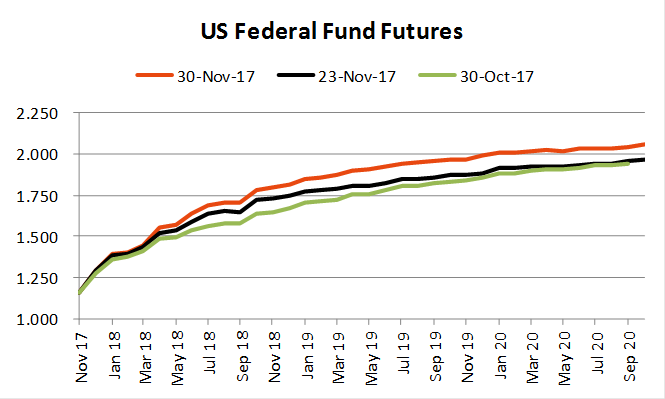

Not a lot else happening around the traps today as we await the non-farm payrolls in the US tonight, with the market forecasting another +198k jobs being created which is strong but down on last month of +261k. Watch for wages growth which is more meaningful and the mkt is expecting a print of +0.3% here. It’s the pressure on wages that really shows how tight a labour market is, and it has a big bearing on inflation and therefore interest rates.

The US cash futures curve just keeps moving higher – tax cuts are stimulatory!!

Have a great night & keep an eye out for the weekend report Sunday

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Wednesday or Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 8/12/2017. 4.15PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here