Month: July 2020

WHAT MATTERED TODAY

Rio Tinto (RIO) -0.73% 1H20 results are just out for RIO and it’s a beat according to Peter O’Connor – mining analyst at Shaw & Partners. At the earnings line, they topped expectations by around 9% and 4% at the EBITDA line. That is a good outcome. Here are Peter’s main points: · NPAT beat saves […]

Wisr (WZR) -1.96% Alternative finance play Wisr was out with their 4th quarter update which showed more growth despite the resounding weakness in the broader economy. Loan originations for the quarter came in at $42.2m, 8% higher than the 3rd quarter, and nearly double that of the last quarter. Revenues followed suit, up 188% on […]

Emeco Holdings (EHL) -4.81% Ended the session down today after initially rallying +7% on a good set of FY20 results. It looks to me like the stock rallied pre-result which smells a little but I’d also think that some large cap managers are taking this as a selling opportunity after EHL was removed from the […]

Perpetual (PPT) unch Moved to raise $270m today as it looks to buy a controlling stake in US fund manager Barrow Hanley. The Aussie fundie will pay $US319m for the 75% stake, with around half of the price coming from existing cash and a new debt facility along with today’s equity raise. New shares will […]

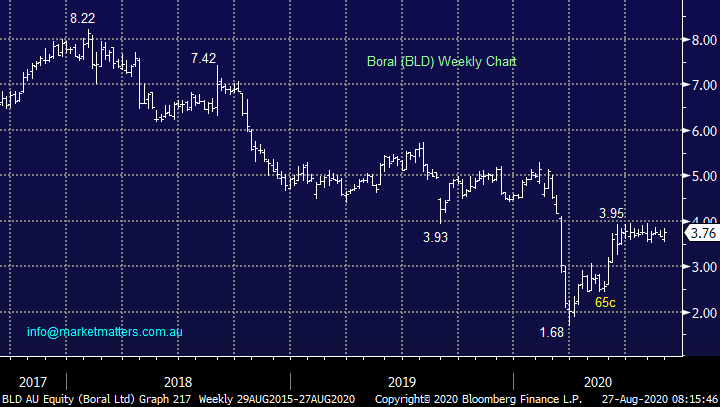

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.