Month: January 2020

Stock Rio Tinto (RIO) $105.14 as at 17/01/2020 Event Out today with their December quarter production numbers and the stock is trading higher on the back of a reasonable effort for the full year. The two key production areas were all in line with guidance, while FY20 shaping up to be another sound year based […]

Stock Nufarm (NUF) $5.40 as at 17/01/2020 Event Nufarm has been forced to lower the market’s expectations for the half year result today with shares coming off more than 10% as a result. The company flagged issues – particularly in North America and Germany – in November, but was today able to give a more […]

South32 (S32) unch; This is a stock firmly on our radar and today they delivered their December Quarter production & sales numbers – all looked OK. Aluminium was flat QoQ but there was power issues so a reasonable outcome, Alumina was up on the quarter and the half although prices were weaker, Manganese production was […]

Whitehaven Coal (WHC) unch; mixed day for Whitehaven as they reported on their 2nd quarter production efforts. We have seen Whitehaven climb into the report – although more so on the back of some better coal prices than any real market exuberance about their chances today given the downgrade the company put through late last year. […]

Woodside (WPL) +0.56%; a reasonable 4th quarter production report helped Woodside close in the black today against a weaker the energy sector. Production was up 3% on the prior quarter to 25.7MMboe, with revenue up to $US1,446M with better sales volumes more than offsetting the easing in LNG prices. Woodside was keen to show off […]

Perpetual (PPT) +0.35%; released Funds Under Management (FUM) for the quarter this morning with outflows in equities offset by inflows into fixed income products, all in all total FUM ended the month at $26.3b, an increase of $200m. Shares were higher today, but still underperformed the broader market which is uncharacteristic of how Perpetual normally […]

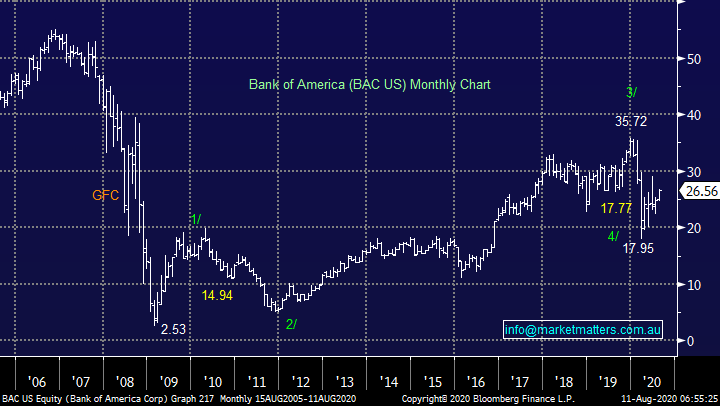

**This is an extract from the Market Matters Morning Report from 13 January. Click here to get access to the full report and more The chart below illustrates over the last few years the clear inverse correlation between the $US and Base Metals, if our opinion is correct on the $US then we believe there’s a […]

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.