Woolworths (ASX:WOW) – A messy result as expected

Stock

Woolworths (ASX:WOW) $29.35 as at 20/08/2018Event

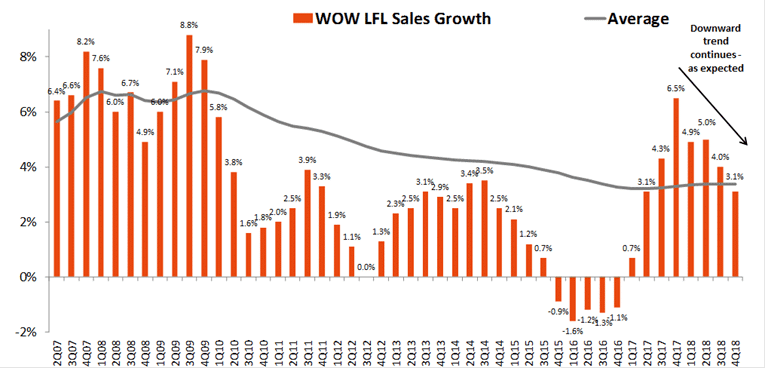

This morning Woolworths reported their full year results and they were marginally below expectations, although in fairness, as was the case with Wesfarmers they were messy. WOW had lots of one-off discontinued operations in the results (Petrol, Masters) that led to FY17 restatements and FY18 normalisation. The special dividend of 10cps was a surprise to the market. The food business remains front and centre in the result, and the downward trends in terms of like for like sales growth was still evident (as shown in the chart below). For 4Q18 LFL sales growth fell to 3.1% just inline with the markets expectations of somewhere in the range of 3-4% - clearly the lower end. They sighted food and veg deflation which is pretty normal of late however they also said (specifically) that infant formula sales took a hit. It seems Coles are ‘dropping their pants’ to support better growth while Woolies are maintaining prices to defend margins.

The food business remains front and centre in the result, and the downward trends in terms of like for like sales growth was still evident (as shown in the chart below). For 4Q18 LFL sales growth fell to 3.1% just inline with the markets expectations of somewhere in the range of 3-4% - clearly the lower end. They sighted food and veg deflation which is pretty normal of late however they also said (specifically) that infant formula sales took a hit. It seems Coles are ‘dropping their pants’ to support better growth while Woolies are maintaining prices to defend margins.

Source; Shaw and Partners

Looking forward, WOW has weaker momentum than Coles in the first 7 weeks of the new financial year, with the company saying that sales have continued to “slow”, unlike Coles who said they were increasing to above 2.0% helped by the Little Shop promo. If you’ve got young kids, you’ll understand how popular this has been! However, the bright spot of the result continues to be good margins in food which still remain strong at 4.7% (well ahead of Coles 3.7%) vs 4.5% last week.

In terms of the outlook, nothing quantitative but capital management may be considered post exit of Petrol.

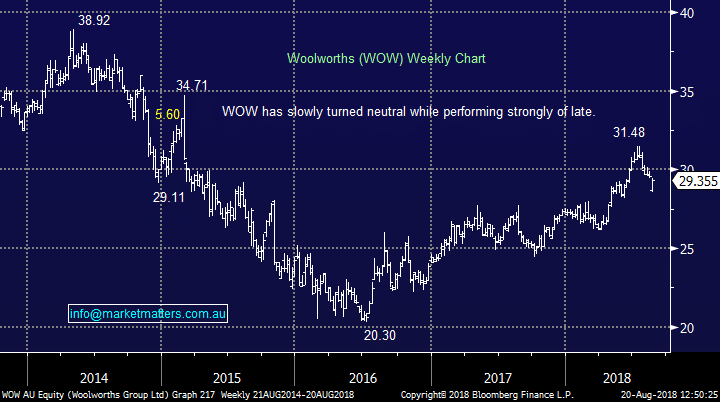

Woolworths (WOW) Chart

Source; Shaw and Partners

Looking forward, WOW has weaker momentum than Coles in the first 7 weeks of the new financial year, with the company saying that sales have continued to “slow”, unlike Coles who said they were increasing to above 2.0% helped by the Little Shop promo. If you’ve got young kids, you’ll understand how popular this has been! However, the bright spot of the result continues to be good margins in food which still remain strong at 4.7% (well ahead of Coles 3.7%) vs 4.5% last week.

In terms of the outlook, nothing quantitative but capital management may be considered post exit of Petrol.

Woolworths (WOW) Chart

Market Matters Take/Outlook

It’s hard to get excited about Woolies at these levels, even though the result was a reasonable one with food margins remaining strong. The street is also somewhat cautious on WOW at current levels, with the seemingly universal view that its ‘fully priced’. We agree.