Zip (Z1P) shoots higher on business update

Z1P Co (Z1P) +13.05%

Ripped higher today after announcing an earlier than expected July trading update, which was strong overall. The focus was on their recent QuadPay acquisition and todays update confirmed the business is accelerating in the US - it was ~$98m for TTV for Quad in July alone with further seasonally strong periods to come, or in other words Quad now delivering A$1.2Bn in annualised volumes prior to a seasonally strong period. Here’s more from Jono Higgins on the stock (I did a Webinar with Jono here)

· QuadPay added 133k customers in July passing 2m customers. This saw Quad adding ~4,300 customers a day during July up 25% on 4Q20 and likely to materially underwrite a stronger growth profile into 1H21 (More customers + more merchants average = Higher TV & Revenues);

· Advised of a number of large merchant wins (that’s likely to accelerate). This includes Fanatics & Mercari, which are top 100 online retail merchants and have US$3Bn+ in annual volume. Further partnership with Fiserv (NASDAQ FISV) a US$64Bn+ payments company. Also announced partnership with Mastercard Vyze (business MC acquired to enter digital POS space across alt financing – Similar to Zip with eWays Adyon etc); and

· Line of credit (known) secured for US$200m with well-known names of Goldman Sachs and Oaktree Capital. This allows US$2.5Bn+ of annual volume across the group (which they’re likely targeting in the next 12-18 months). Quad is delivering +2% NTM’s above the sector currently with growth ramping.

Overall a strong update from QuadPay ahead of Zip results on the 27th. We have management presenting in the office next week. Z1P resides in the MM Growth portfolio

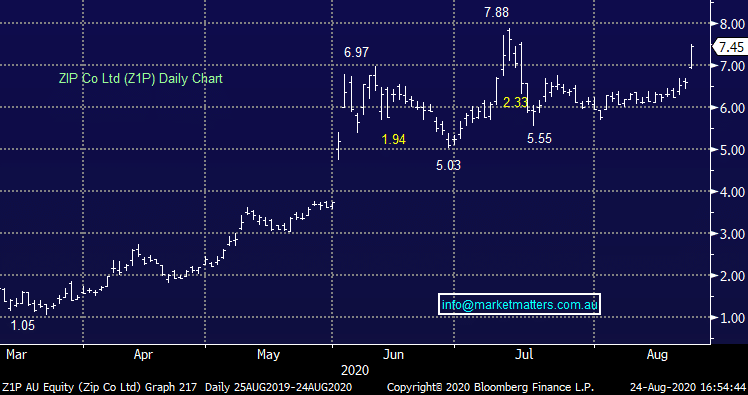

Z1P Co (Z1P) Chart