Z1P rallies on strong US growth (EHL, Z1P, FMG, BIN)

WHAT MATTERED TODAY

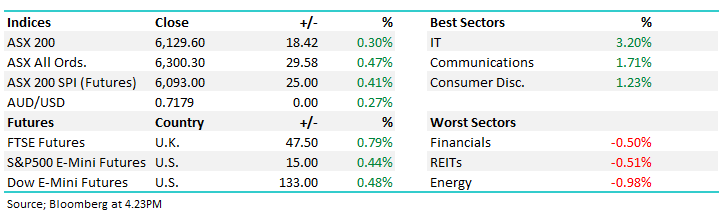

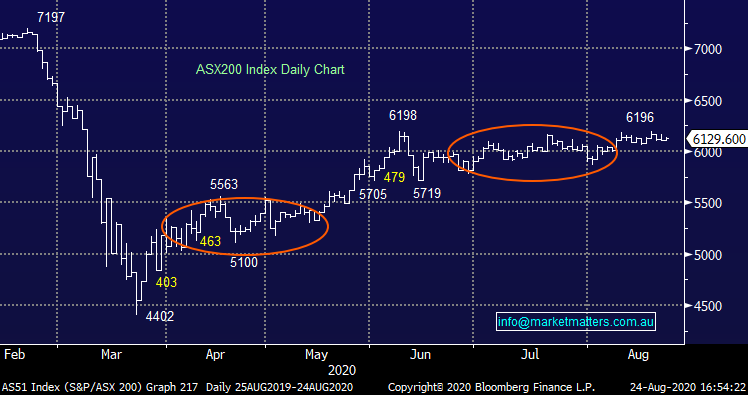

It feels like the momentum is building again for the ASX 200 to have an assault on the 6200 handles with the majority of companies that reported today doing well. Some of the beaten down cyclicals (RWC for example) showing how hard stocks will rally from a low base, here’s hoping for BIN tomorrow! Tech stocks the real standout today, specifically the BNPL area with Z1P Co (Z1P) leading the charge / +13% on a strong trading update around their US business Quadpay.

Asian markets were solid today, all edging higher while US Futures were in the green during our time zone.

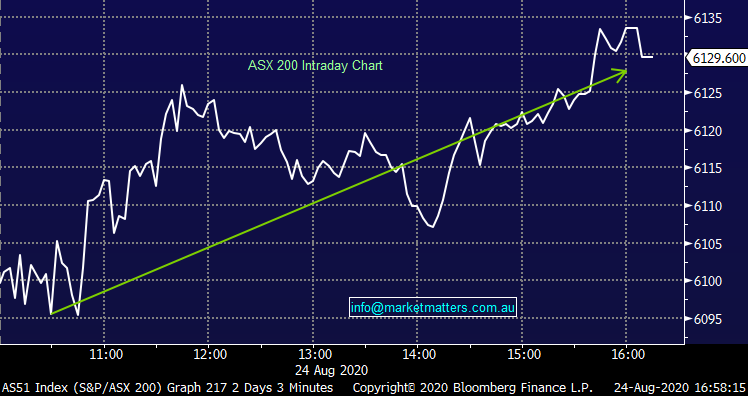

Overall, the ASX 200 added +18pts / +0.30% to close at 6126. Dow Futures are trading up +133pts / +0.48%

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

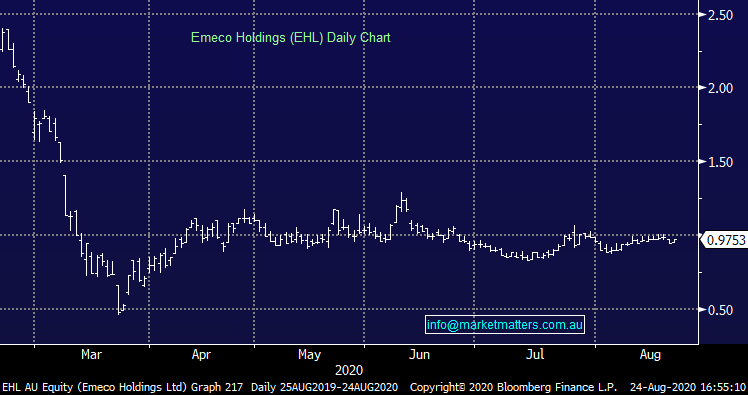

Emeco (EHL) Halted: In a trading halt today on news they’ll raise $149m to buy back some of their more expensive funding, plus they extended the maturity of additional notes due in 2020. The raise is a 1 for 2.1 at 85c meaning its big for the company however post raise they’ll have, $A56m cash, $A97m undrawn revolving credit facility ($153m total liquidity) plus $A267m debt due 2024. Net debt falls from 1.5x EBITDA to 0.9x which gives it the best-looking balance sheet since listing. Importantly, it also reduces interest costs by $19m p.a. The major share/bond holder Black Diamond committed to the raise plus they will sub-underwrite up to 3% of shares on issue post the offer (minor, only ~10% of new shares underwritten +17% committed by Black Diamond - more of a confidence giver, no fee taken for underwriting).

They also reaffirmed their guidance provided at the recent results presentation. While the raise is dilutive, the balance sheet was one of the issues that EHL have grappled with for a while, I tend to think this raise will be a good thing. We plan to take up our entitlement.

Emeco (EHL) Chart

Z1P Co (Z1P) +13.05%: Ripped higher today after announcing an earlier than expected July trading update, which was strong overall. The focus was on their recent QuadPay acquisition and todays update confirmed the business is accelerating in the US - it was ~$98m for TTV for Quad in July alone with further seasonally strong periods to come, or in other words Quad now delivering A$1.2Bn in annualised volumes prior to a seasonally strong period. Here’s more from Jono Higgins on the stock (I did a Webinar with Jono here)

· QuadPay added 133k customers in July passing 2m customers. This saw Quad adding ~4,300 customers a day during July up 25% on 4Q20 and likely to materially underwrite a stronger growth profile into 1H21 (More customers + more merchants average = Higher TV & Revenues);

· Advised of a number of large merchant wins (that’s likely to accelerate). This includes Fanatics & Mercari, which are top 100 online retail merchants and have US$3Bn+ in annual volume. Further partnership with Fiserv (NASDAQ FISV) a US$64Bn+ payments company. Also announced partnership with Mastercard Vyze (business MC acquired to enter digital POS space across alt financing – Similar to Zip with eWays Adyon etc); and

· Line of credit (known) secured for US$200m with well-known names of Goldman Sachs and Oaktree Capital. This allows US$2.5Bn+ of annual volume across the group (which they’re likely targeting in the next 12-18 months). Quad is delivering +2% NTM’s above the sector currently with growth ramping.

Overall a strong update from QuadPay ahead of Zip results on the 27th. We have management presenting in the office next week. Z1P resides in the MM Growth portfolio

Z1P Co (Z1P) Chart

Afterpay (APT) +4.79%: Also had some news out today saying it had bought Spanish credit provider Pagantis which is worth around $A80. Pagantis provides traditional buy now, pay later credit services across Spain, Italy and France with approvals in place to operate in Portugal. The Barcelona based fintech has 1400 active merchants and about 150,000 active customers. It’s another small positive for APT.

Openpay (OPY) +11.17%: jumped on the coattails of the bigger rivals today and rallied strongly, the stock’s breaking out of its trading range on no new news. We had a few of these across portfolios and sold them a little too early today. I think we’ll get an opportunity to buy them back however for those clients reading this note, we could have done better today on this one!!

Super Retail (SUL) +1.62%: Reported FY20 results today however they had already updated the market at the end of July so todays result was a more a confirmation of existing news. As you’d expect the numbers were in line with current mkt expectations while they also provided an update on the first 7 weeks of FY21 trading, with like for like group sales up 32% yoy (including the impact of Victorian lockdown) as more people travel domestically while exercise and fitness sales have also been strong. One of my favourite stores (BCF) have seen sales up +72% - huge! We hold SUL in the income portfolio.

Reliance Worldwide (RWC) +17.77%: strong result for the plumbing brand with growth in the Americas driving revenue 5% higher for the year. Costs were higher though, and EBITDA fell 9% on last year, but the result was a ~2.5% beat to expectations. Surprisingly, March and June were record sales months for the group, despite being impacted by COVID. Momentum has continued into the new financial year with North America witnessing sales 22% higher in July vs the prior year and all geographies trading flat to higher on pcp for the first few weeks of August. The market is expecting just 2% growth at the EBITDA line for FY21 which the company appears to be beating so far. While business is doing well, the pop today was largely on the back of the low hurdle the market had in place for RWC.

Fortescue Metals (FMG) +3.17%: came in marginally ahead of expectations across the board, with earnings 1% better but a juicy $1 dividend more than 10% above the market. The iron ore tailwind took FMG to a new all-time high today. Guidance was pre-released back at the Q4 production report so today’s move was mostly a result of investors rushing for the dividend. We like FMG but aren’t prepared to chase it here. It has run well ahead of the iron ore price lately and we expect that gap to close, and likely see iron ore ease as well. Great result, but a lot to live up to in years ahead now.

Fortescue Metals (FMG) Chart

Austal (ASB) -2.77%: the ship builder started the day better but eased as the session went on. The full year result was a beat of 3% at the EBIT line which grew 41% in FY20 to $130m. Big commercial wins and better support & maintenance revenue drove the beat, as well as some favourable FX moves. Austal has also locked up a number of large build contracts over the next few years, delivering nearly 70 naval ships to the US and Australia as well as a number of commercial boats under construction. It’s also locked up a deal to expand US operations to include steel hulled boats, with the expansion half funded by the US government unlocking access to a much larger market. We like Austal – defence spending continues to rise globally.

Strandline (STA) +4.65%: One speculative stock I like the look of after pulling back recently is Strandline, a small cap Mineral Sands hopeful with a big potential resource near Iluka in WA. I’m planning a Webinar in the next week or so – details to come with Peter O’Connor and Andrew Hinse who is a new analyst we’ve got covering junior Resources. He’s a big fan of STA, keep an eye out for the Webinar details in the coming days.

Bingo Industries (BIN) +5.91%: Reports full year earnings tomorrow and this is one that I’m (mildly) concerned about, however todays price action was good / encouraging. A lot of bad news has been built in here and an inline result will see the stock pop. Look for EBITDA to be $146m / the analyst range being $138-$158m.

Bingo Industries (BIN) Chart

BROKER MOVES

· Healius Raised to Buy at Goldman; PT A$3.66

· TPG Telecom Raised to Outperform at Macquarie; PT A$9

· Mayne Pharma Raised to Overweight at Wilsons

· Suncorp Raised to Equal-Weight at Morgan Stanley; PT A$9.50

· Suncorp Raised to Neutral at Credit Suisse; PT A$9.95

· TPG Telecom Raised to Neutral at Credit Suisse; PT A$7.40

· TPG Telecom Cut to Neutral at JPMorgan; PT A$7.70

· Alacer Gold GDRs Reinstated Overweight at JPMorgan; PT A$12

OUR CALLS

No changes today

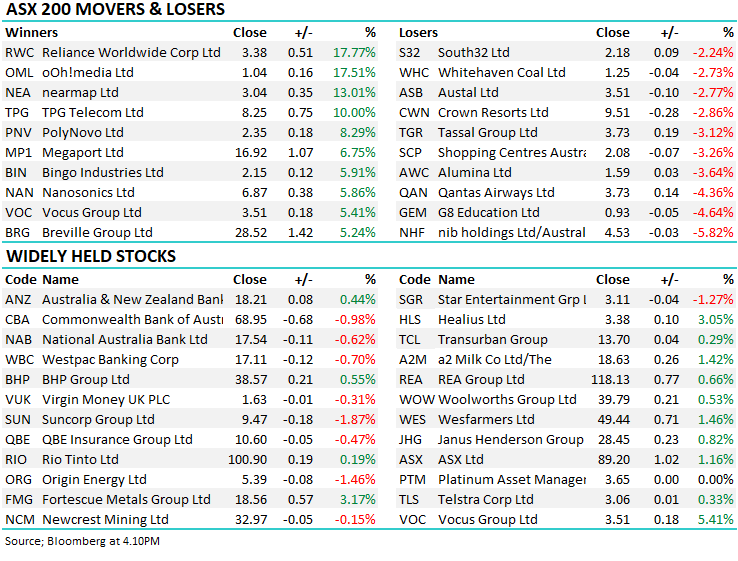

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.