Xero adds 467k new users in the past year (XRO, GNC, SSG)

WHAT MATTERED TODAY

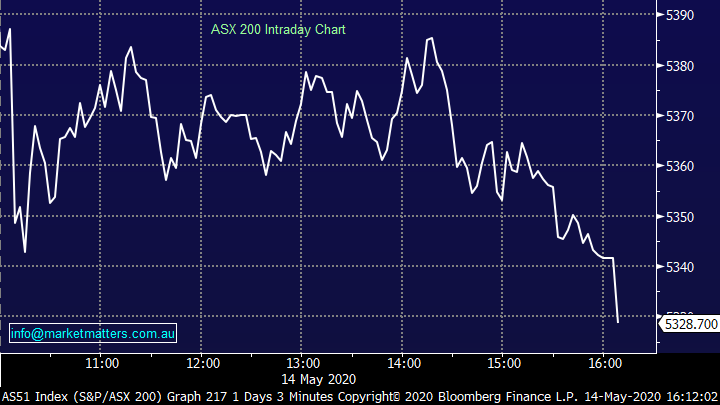

Yesterday the market enjoyed a strong +120pt rally from the morning lows, today that was turned on its head with a late sell-off that saw the market close on its knees. Recent strength in both Energy and IT was hit by profit taking while the financials had another tough session. The banking stocks were hit in the US overnight thanks largely to talk of negative interest rates. While Fed Chair Jerome Powell said negative rates were off the table, there are some in the market believing they’re inevitable. Negative interest rates would be a major headwind for financial institutions.

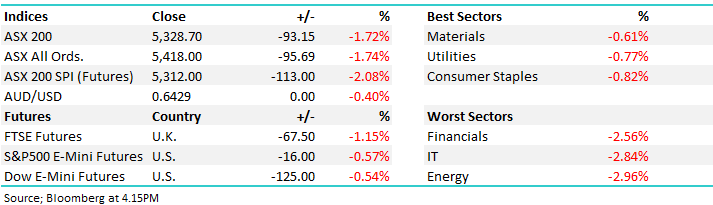

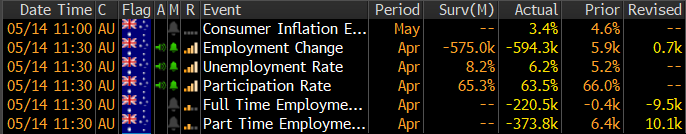

Locally, employment data was top of the docket today with 575k jobs lost in April. The unemployment rate was 6.2%, lower than the 8.2% expected however that was largely a result of lower participation which is not a good thing. The loss was split between 373k part time and 220k full time and reaffirmed the Government’s believe that unemployment will hit 10%. While the numbers are staggering, they’re not a surprise with the main test being how they look once lockdowns are eased i.e. how bumpy & steep the path to normality is.

Economic data

Source: Bloomberg

Asian markets were weaker across the board today, mostly down around 1.5% while US Futures also tracked lower during our time zone.

Today the ASX 200 fell -93pts / -1.72% to close at 5328 - Dow Futures are trading down -125pts/-0.54%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

AUSBIZ: Quick chat at 11am this morning on Xero (XRO), Graincorp (GNC) & Shavershop (SSG) – back working from home today, office tomorrow.

Xero (XRO) -4.77%: Full year results for the accounting software provider and the stock dropped on the back of it. The short-term numbers were a tad below market expectations which accounts for the weakness, revenue $718m v $730m exp, EBITDA $137.7m v $150m expected while they booked a small net profit for the year.

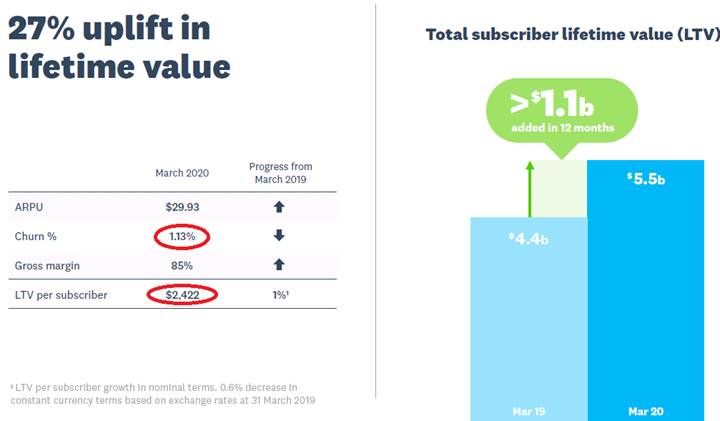

This business is all about growth and to that end they added 467k subscribers for the year taking total subscribers to 2.285m. As a subscription business (similar to MM on a bigger scale), two things are really important – I look at these closely for MM and their important for Xero. Churn rates which mean the amount of subs that sign up then leave remains low (1.13%) and falling, although there was an uptick in the UK which shows a degree of linkage between churn and the economic situation - higher business failures not a good thing. In any case, customer churn of 1.13% is low and implies customers love the product – I certainly do as does my accountant.

The other one is total lifetime value. A subscriber is worth $2,422 Xero over their lifetime multiplied by the number of subscribers. In Xero’s case, its $5.5b up $1.2bn on the year or 27%. Interestingly, the SP is up about 30% over the past 12 months.

Source: Xero

We own in the Growth Portfolio and would add to the position into more protracted weakness.

Xero (XRO) Chart

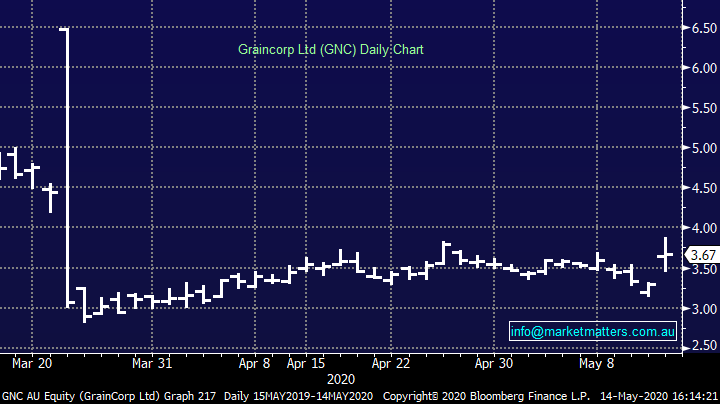

Graincorp (GNC) +11.55%: shot higher, reversing a soft start to the week with the market concerned with China’s keenness to tariff Australian exports. Today though the focus was turned back on to the businesses strong first half trade which saw earnings swing back into a profit. The 1st half EBITDA figure of $183m was a beat on consensus – though the consensus did house a wide range of views from $40m to $255m.

It was a busy first half for the company which saw the sale of the Bulk Liquid Terminals segment as well as the demerger of United Malt (UMG) back in March. The successful completion of both deals means GNC has no debt on balance sheet. They talked to positive signs ahead of the FY21 harvest with recent rainfalls meaning soil moisture levels are favourable as well as talking up exports into the second half. A fight with China would hit GNC, but we see this as an unlikely path, and now with a bit more direction, Graincorp looks reasonable.

Graincorp (GNC) Chart

Shaver Shop (SSG) +30.23%: a pretty swift turnaround in fortunes for Shaver shop over the past 7 weeks. Late March saw the company flag an 11% decline in LFL sales on the week forcing guidance to be withdrawn. Today though the company has seen a significant lift in online sales more than offsetting the 50% decline in foot traffic. YTD now LFL sales have risen 12.2%, while online is up a whopping 171% in the first 18 weeks of the calendar year. SSG traded to a 2-month high on the back of the news. The company is in a good financial position and is likely to look at paying a full year dividend where others can’t.

Shaver Shop (SSG) Chart

BROKER MOVES:

- Flight Centre Raised to Neutral at Macquarie; PT A$11.25

- Newcrest Raised to Neutral at Macquarie; PT A$28

- Ainsworth Game Cut to Neutral at Macquarie

- Elders Cut to Underweight at Wilsons; PT A$7.82

- Integral Diagnostics Raised to Buy at Ord Minnett; PT A$4.07

- CSR Raised to Overweight at Wilsons; PT A$4.87

- SkyCity Entertainment Raised to Buy at Morningstar

- Amcor GDRs Cut to Hold at Morningstar

- James Hardie GDRs Raised to Outperform at Credit Suisse

- Stockland Raised to Outperform at Credit Suisse; PT A$3.56

- BHP Group PLC Raised to Buy at UBS; PT 1,700 pence

- Kogan Cut to Neutral at Credit Suisse; PT A$8.36

OUR CALLS

No changes

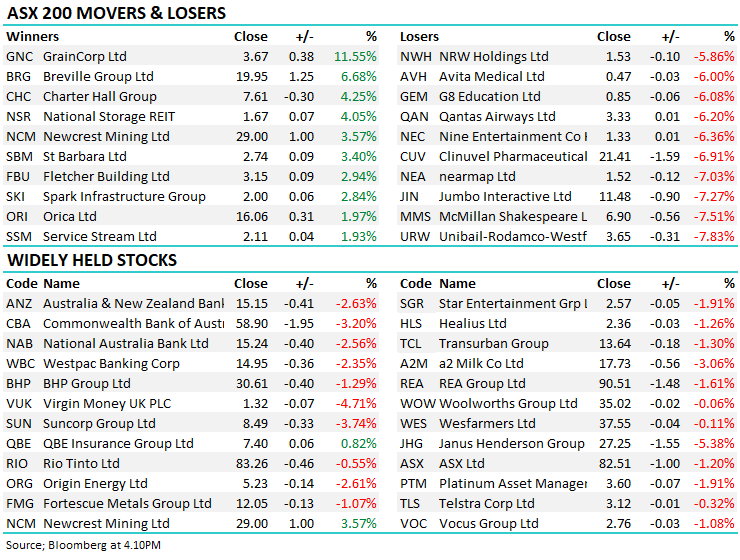

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.