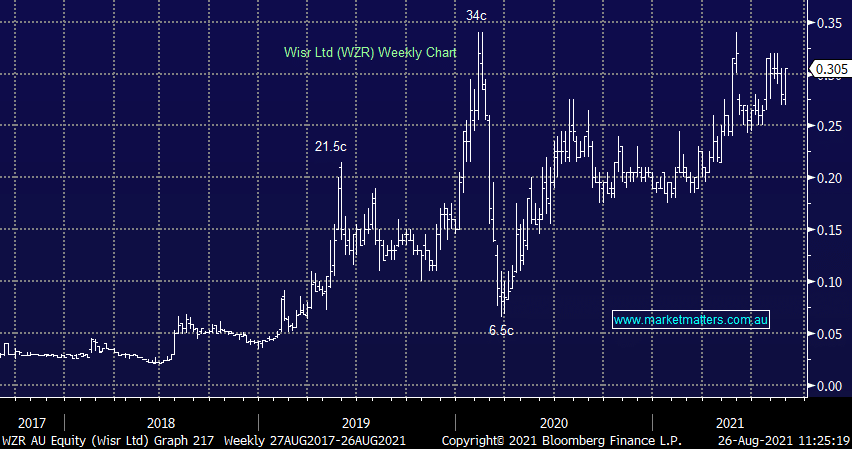

Wisr (WZR) shares rally with positive outlook

FY21 Result: While the result was largely pre-released todays update did re-affirm the strong position the personal lender is in. Revenue jumped 280% to $27m while EBITDA losses tightened to less than $10m, both slightly ahead of expectations in FY21. Loan growth and lower funding costs are key to the story, and both are performing well. Wisr managed to grow total loan originations 149% in the year while bad debts tracked only marginally higher to 0.92%, speaking to the exceptional credit quality of the book. Funding capacity continues to improve with Wisr managing their first asset-back security (ABS) sale in the period which cut funding costs in half. Overall a positive update with WZR trading up over 6% at the time of writing.