Will Fortescue become a ‘yield stock’? (FMG, VOC, BSL)

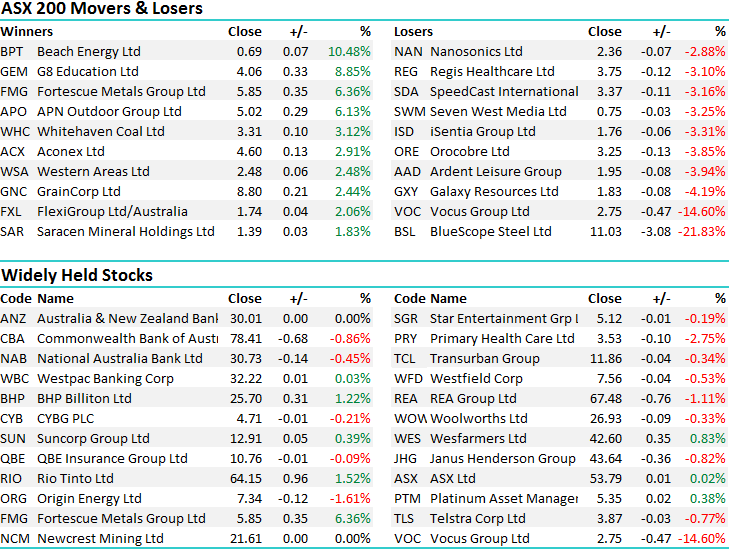

A good fight back by the market this afternoon to overcome some decent selling in early trade – the index closing ~26pts from the session lows with support seemingly found amongst the banks and the insurers – SUN + QBE which have been under a lot of pressure in recent times. A few extremes in terms of results today, Bluescope (BSL) delivered a good set of FY17 numbers, better dividend, $150m buy back however their guidance was a big miss and the CEO is stepping down – the stock dropped -21.83%, while on the flip side, Beach Energy (BPT) did well post report adding +10% as did G8 Education (GEM) which put on +8.85% - ditto for Fortescue which added 6.36% to close at $5.85 – more on that below.

Overall, strong Oil prices ensured that the energy stocks found some form while on the flipside, Vocus was hit hard after the two private equity bidders pulled their bids for the company – shares closing down 14.6% to $2.75. The mkt had a range of +/- 48 points, a high of 5747, a low of 5699 and a close of 5725, off -21pts or -0.37%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Fortescue (FMG) – reported full year results this morning and despite missing slightly in terms of earnings – the stock was strong on mkt today closing up more than 6%. Missing on earnings but beating in terms of capital management is the key takeout from the miners this reporting season thus far. In terms of FMG’s numbers, full year earnings printed $2.09b versus the markets expectations of $2.14b – so 2.5% below however they beat on other metrics.

The key area of today on FMG was around the dividend (now) but more importantly what they plan to do with it in the future. For FY17 they printed a 45cps full year return (25cps final) which compared to 37c consensus however the main change was around dividend pay-out ratio guidance which increased to a range of 50-80% of NPAT – up from around 40%. Based on current earnings expectations, this equates to something like a 4.5-7% dividend yield plus Iron Ore has stayed higher for longer than most analysts have factored in – so, FMG is probably cum upgrade in terms of earnings as well. These guys were going out the backdoor when it was trading at $1.47 a share and look at them now. Who knew that putting lipstick on a pig could deliver such a beautiful dividend paying princess!!!

We’ll address FMG as a yield stock in the AM report tomorrow.

Fortescue Metals Daily Chart

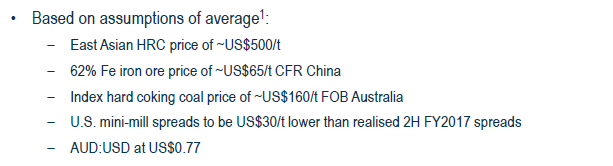

Bluescope (BSL) – a strong outcome for FY17 with a beat in terms of earnings and dividend plus a share buy-back, however the market was looking for continued growth in FY18, and got a likely reduction instead which equates to about a 20% downgrade relative to where the mkt was positioned. We also got the resignation of well-respected CEO Paul O’Malley, which is never a positive. One aspect that caught my eye was around the impost of higher input prices – Energy was key (coal etc) as was Iron Ore. I always like looking at company assumptions around pricing and currency, and here are BSL’s…..so lower Aussie Dollar, lower Iron Ore etc

Bluescope Daily Chart

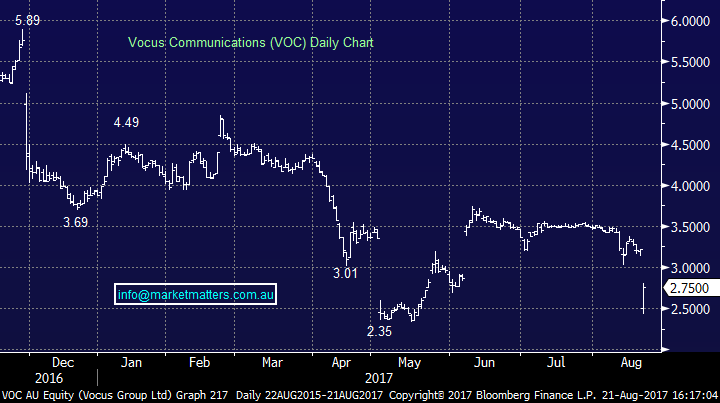

Vocus Communications (VOC) – can’t take a trick it seems with both potential suiters walking and the stock down around 14%. They also updated guidance saying that they expect $366.4m EBITDA, net profit $152.3m for 2016/17 which is relative to prior guidance of $365m-$375m and profit guidance of $160m-$165m. If you recall, the PE bids were conditional upon earnings being met and clearly, there is a bees…. eyebrow in it at the moment. In short VOC can’t afford to have a profit downgrade or it will breach debt covenants and possibly need to raise equity.

Vocus Communications Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here