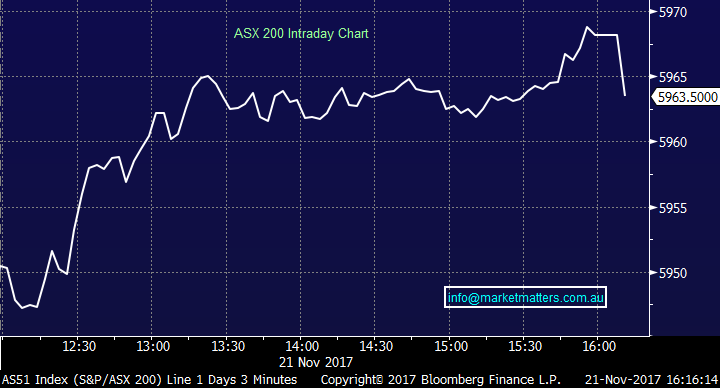

Will A2 Milk make the Income Portfolio? (A2M, NAN, ALQ)

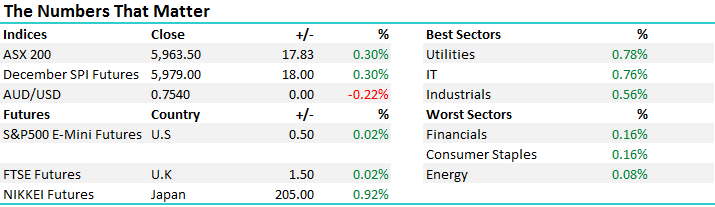

The tight range does little to describe the swings happening in the market today, a strong opening was given back, the market actually lower very briefly around midday, before buyers stepped up throughout the afternoon. RBA minutes today provided little new commentary, almost a copy and paste of last month’s report with wage inflation particularly lacklustre. All sectors finished higher today, utilities performed well on the back of dovish RBA comments, while energy was the weakest after oil did little in overseas trade.

Overall, a range today of +/-23 points, a high of 5969,a low of 5963, and a close of 5963, up 17pts or +0.3%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

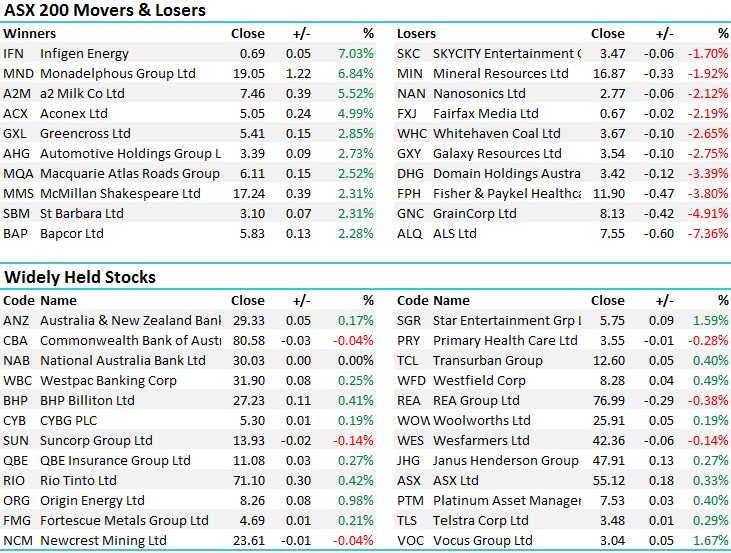

A2 Milk (A2M) held it’s AGM today and commentary around the first few months of FY18 were taken well, with 4 month EBITDA of $NZ78.4mil, tracking to a full year EBITDA of $235mil – this is 3% above the most bullish in the market, and the stock popped accordingly. A weak NZD and better than expected growth in the Chinese market has driven earnings higher, once again proving naysayers wrong, more than offsetting increasing marketing costs. The result even lead to the CEO to comment on potential dividend payments – a huge call for a recently listed company still running on a PE of over 60x. Although the dividends would be unfranked and relatively low yielding, it would just add to the attractiveness of a company that has performed strongly since listing in 2015. We hold A2 Milk in the Growth Portfolio, the 5.5% jump today means we are now up over 15% on the position.

A2 Milk (A2M) Daily Chart

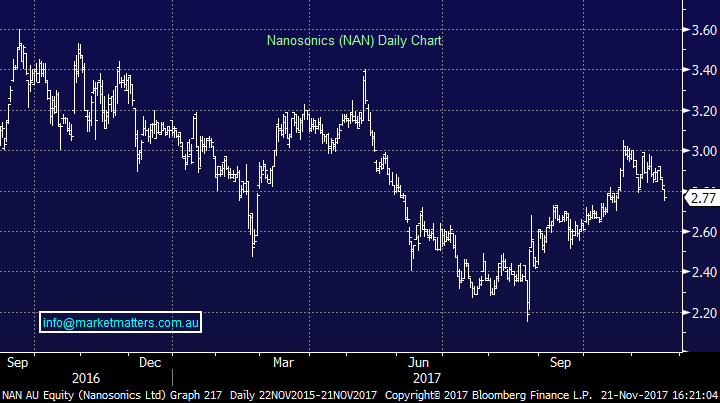

Nanosonics (NAN) was downgraded to a hold by Bell Potter, with no change to the price target, leading to a 2% fall in the stock today. We are holding NAN in the Growth Portfolio and holding tight for now, however appreciate this stock has a high mkt cap and low earnings, more a momentum play than anything, and although we remain happy to hold through some short term volatility, we’ll cut if buyers don’t step up shortly.

Nanosonics (NAN) Daily Chart

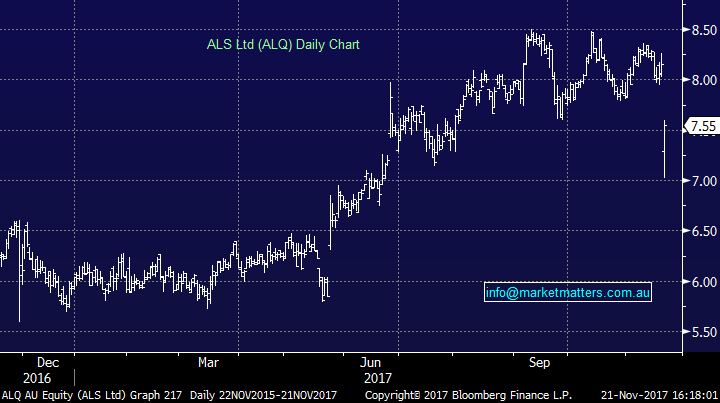

ALS Ltd (ALQ) disappointed with poor half year numbers after market yesterday. The analytical testing provider, although increasing profit to $70m for the 6 months, fell 5% short of market expectations, hitting the bottom end of guidance. The $7 mill restructuring costs also hindered the result, however the divestment of the oil & gas businesses helped the company launch a buyback of 4% of stock. ALQ finished down over 7% today at $7.55, which was a long way off lows of $7.02.

ALS Ltd (ALQ) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/11/17. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here