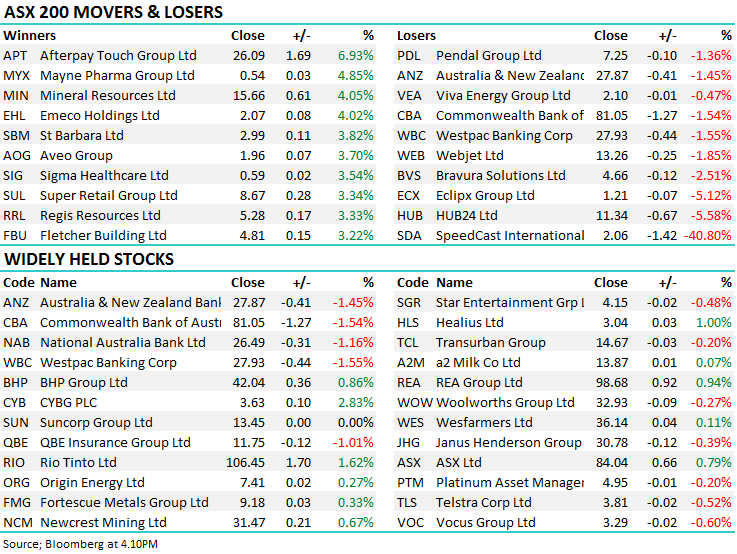

Why we trimmed our banking exposure? (CBA, TLS, SDA)

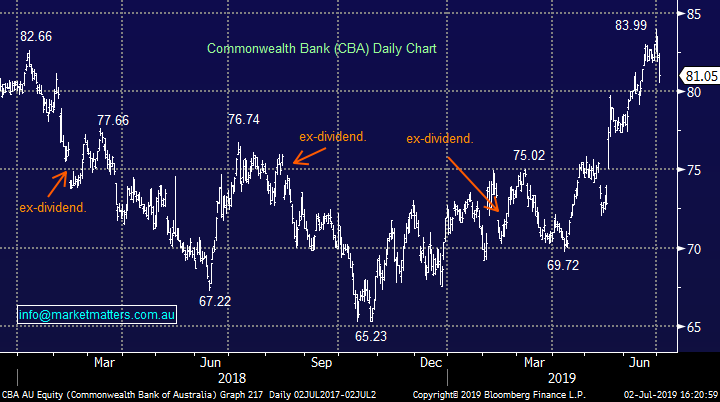

WHAT MATTERED TODAY

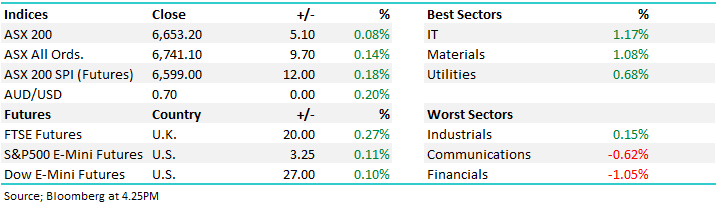

The RBA cut interest rates by 25bp at 2.30pm this afternoon taking the benchmark rate to an all-time low of 1%, its first consecutive monthly reduction since 2012. Governor Philip Lowe sighted spare capacity in the economy, employment and inflation as the reason underpinning the cut that was around 70% priced in by futures markets with 21 of 32 economists expecting a decline of 0.25%.

In terms of house prices, Lowe said that falling property prices have prompted households to rein in spending, a significant concern given consumption accounts for nearly 60% of GDP; however, lower prices and policy easing have begun to encourage buyers back into the market, with Sydney property prices rising for the first time in almost two years in June.

While the move today was expected by most – MM included, the market reaction was an interesting one and supports our thesis that lower rates are priced into stocks at these elevated levels – even the Aussie dollar was flat on the news when all settled down – currently trading at US69.84c

At the index level, the market was strong early – up +38pts at the highs however straight after the RBA cut the market dropped by 40+pts and was actually down at the lows. Banks took -22pts from the index providing the biggest drag by a mile.

Overall, the ASX 200 added +5 points today or +0.08% to 6653. Dow Futures are trading up +32pts / +0.13%.

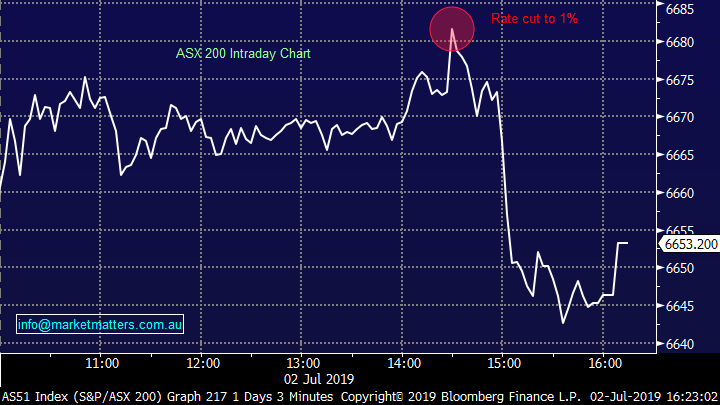

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

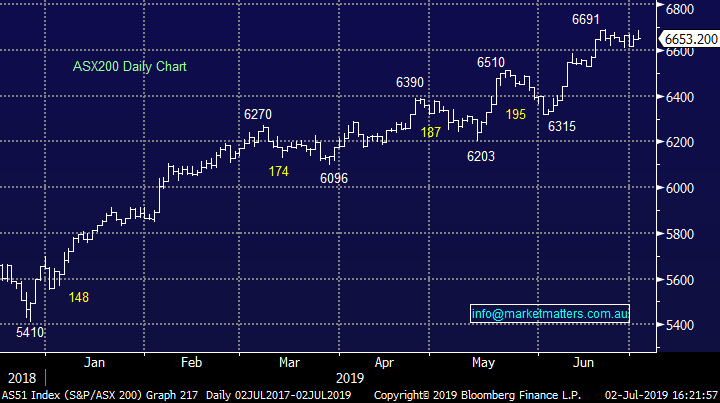

Banks: Were weak today and the weakness (after a strong run) was enough to see us trim back our overweight call and move more into cash for the short term. While lower interest rates stimulate economic growth, and bank earnings are exposed to broader economic trends, the offset is around lower margins which ultimately hurt profitability. Banks are under political pressure to pass on the full cut, however cutting rates for depositors by the full whack to protect margins is also a tough call. It’s estimated that today’s cut knocks around 3-4% off banks earnings and when banks are weak, the index struggles.

The conundrum about holding banks is a tough one – hold because rates are low and cash is yielding next to nothing, plus of course, lower rates could underpin the economy or at least curtail any rise in bad debts, or sell because rates are going lower on the back of a weakening economy, plus when rates are this low (1%) it’s hard for banks to protect margins.

At MM, we’re like many investors out there struggling with the concept however ultimately there’s enough evidence after a good run to take a more conservative stance towards the banks, trim the exposure rather than sell them entirely, increase cash after the market trades near post GFC highs and see if the upcoming earnings season throws up opportunity – which we suspect it will.

Today we trimmed back CBA, NAB & WBC

Commonwealth Bank (CBA) Chart

Speedcast (SDA) -40.8%; Remote and satellite connectivity provider Speedcast tumbled to 4 year lows today on a downgraded outlook ahead of their half year results. The communications name guided first half EBITDA to $US60m - $US64m, around flat on the half despite including a full contribution from the Globecomm acquisition that was completed in December. Speedcast also moved the goalposts for the full year expectations, revising guidance down around 13% at the midpoint on the EBITDA line to $US140m to $US150m, corresponding to a 10% miss to consensus estimates.

The company blamed the poor guidance on a number of contributing factors, with weaker emerging markets, NBN payment delays and timing of system integrations on a number of contracts in the energy space at the top of the list with the company calling these “non-structural” despite appearing to impact outlook as well as past performance.

Speedcast’s acquisition of Globecomm is also making investors nervous, with the company lowering expectations for the full year contribution of the purchase by around 20% despite maintaining cost synergy guidance. A big drop – a deservedly so, it’s a big downgrade with commentary suggesting it may not be the last. Not one for us.

Speedcast (SDA) Chart

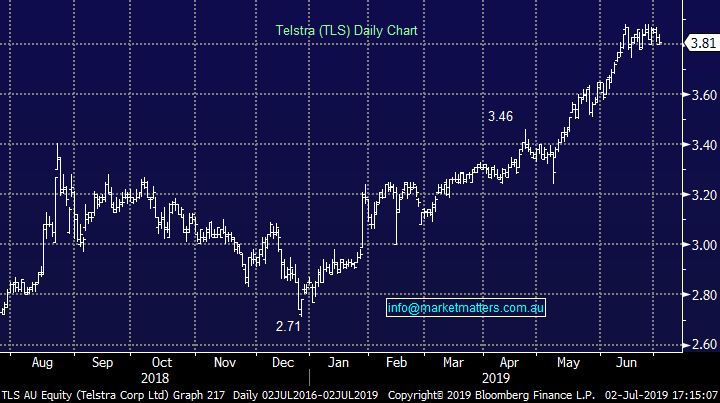

Telstra (TLS) -0.52%, fell on a UBS moving its recommendation to a hold despite pushing the price target 11% higher. Telstra shares have been on a tear this year thanks to an improving telecommunications market – NBN price cuts, Vodafone/TPG merger off the cards, best-in-class option for 5G roll out and new mobile plan pricing have all worked in Telstra’s favour. They now say most of the upside has been priced in and Telstra looks a bit too frothy to be buying. There certainly has been a big swing from pessimism to optimism in the name but technically it could have further to run. We are looking for a pullback to re-enter the stock, preferably after full year results.

Telstra (TLS) Chart

Broker moves;

- WorleyParsons Upgraded to Buy at Goldman Sachs

- Telstra Downgraded to Neutral at UBS

OUR CALLS

We trimmed our banking exposure today, by reducing CBA, NAB & WBC by 2% in the Growth Portfolio.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 2/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence