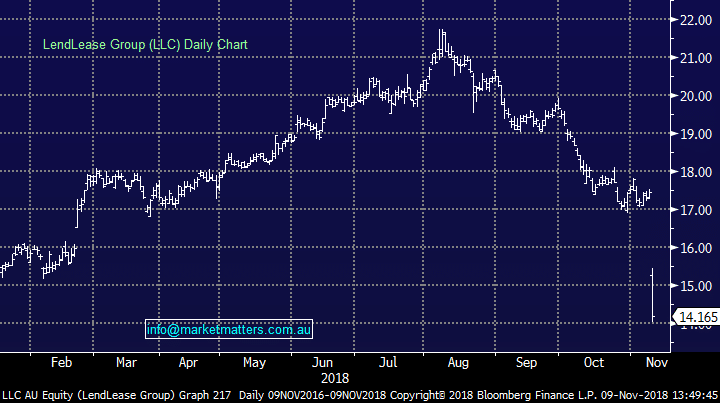

Why such a big drop for Lend Lease (ASX:LLC) today?

Stock Lend Lease (ASX:LLC) $14.09 as at 9/11/2018 Event This morning Lend Lease (ASX:LLC) came out with a downgrade saying that they anticipate taking a ~$350m after tax impairment charge against its Engineering division in 1HFY 19. This has been a problematic part of the LLC operation for some time with such slim margins offering very little cushion if one of two projects have issues. From the conference call with management;

- Cost inflation in projects

- Wet weather and lower productivity issues

- NorthConnex plus some smaller projects problematic

- Spin off of Engineering business a possibility

- LLC is worth more today without engineering based on applying a higher multiple to the stocks ex-engineering

- Engineering is a management distraction

- Engineering lacks scale and building scale will increase risk (which then had a negative influence on the multiple the market will pay for the group)

- Limited synergies with development and funds management

- An in-specie distribution avoids selling the business at the wrong time

Market Matters Take/Outlook

Market Matters Take/Outlook