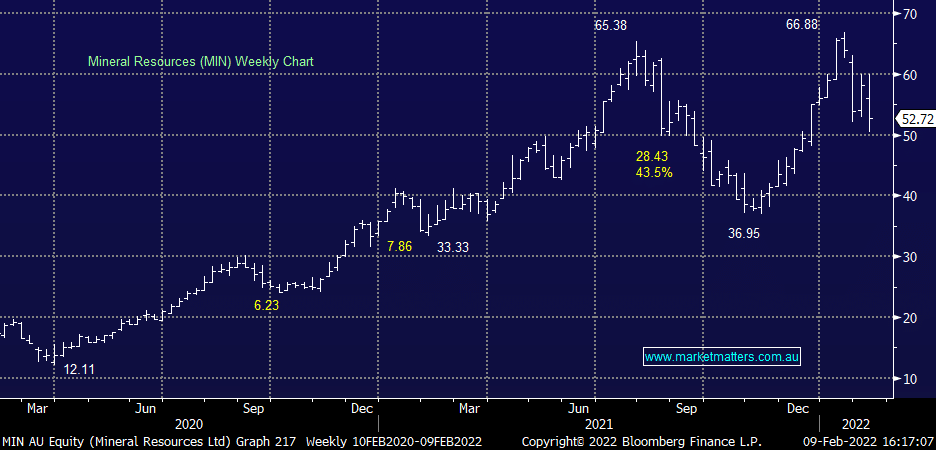

Why Mineral Resources (MIN) shares fell

MIN -8.91%: Missed 1H22 earnings expectations delivering a loss for the period even when Lithium prices skyrocketed. A few issues for MIN in the near term however the ~10% drop today is starting to look interesting. Iron Ore prices were weak in the period and MIN is a high cost operator mining generally lower quality Ore. Chinese steel mills were prioritising efficiency and therefore had a greater appetite for higher quality product. In terms of Lithium, prices were high but costs also went up due, fairly materially. To own / buy MIN (we don’t yet) you to buy into the vision for the next 5 years and back the MD Chris Ellison to deliver on it.