Why is the Coles (COL) share price rallying today?

Stock

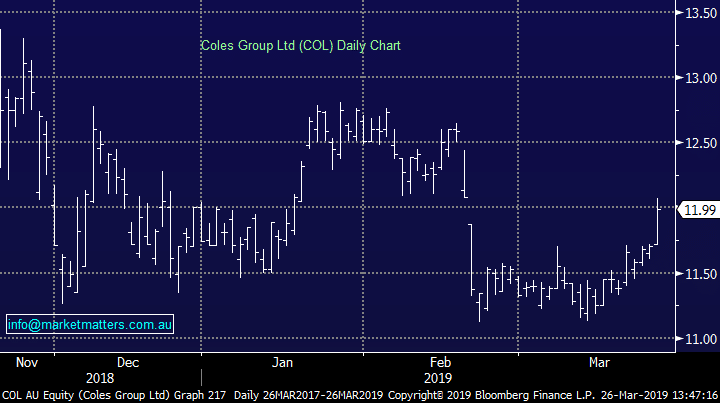

Coles (COL) $12.00 as at 26/03/2019

Event

While ex-owner Wesfarmer’s takes a hit today as it plans a takeover of Lynas, the new standalone supermarket stock is rallying on news of an agreement it has signed with UK listed Ocado Group.

Ocado is a world leader in innovation for grocery supply chains and will be bringing its smart platform (OSP) technology down under into two new Coles distribution facilities, or Customer Fulfilment Centres, in Sydney & Melbourne by FY23. The project will cost around $150m over the next four years prior to the launch.

Ocado’s product is a highly automated system that will do the bulk of the work inside the distribution centres by collecting groceries for online orders and readying them for delivery. Delivery services from our biggest supermarkets have lagged the rest of the retail market, and the rest of the world. The new facilities and agreement will look to double Coles’ online order and delivery capacity, with capacity at each centre between $500m to $750m per year. The hope is that the partnership will allow Coles to expand offering and margins on online sales.

Coles (COL) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook