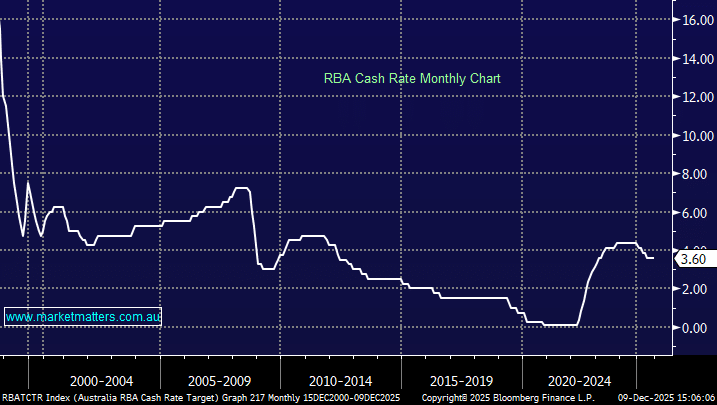

The RBA holds the Cash Rate at 3.60% leaving markets nervous as to its next move

The RBA left interest rates at 3.60% on Tuesday but 3-year bond yields continued to edge higher and credit markets are now pricing in a 65% chance of two hikes in 2026. The RBA noted the risk of higher inflation and vowed to do whatever it took to reduce the threat of higher prices, nothing new but it scares investors who are used to the tailwind of rate cuts.

- We believe markets are too hawkish and the RBA will be keen to hold rates steady, if possible, through 2026.

The accompanying statement was balanced in our opinion, but it does suggest the RBA will be paying very close attention to future inflation (CPI) prints:

- “Inflation has picked up again more recently. Some of this increase is being treated as temporary and while there is uncertainty about how much signal versus noise is contained in the new monthly CPI report, the data points to a broader-based rise in inflation, part of which could prove persistent.”

- “The Board therefore judged that it was appropriate to keep rates on hold at its last meeting of the year and updating its view of the outlook as the data evolves.

The markets pivot from rate cuts to hikes in 2026 illustrates how fickle it can be as economic data flows, some weak prints in early next year could see things reverse in a flash.