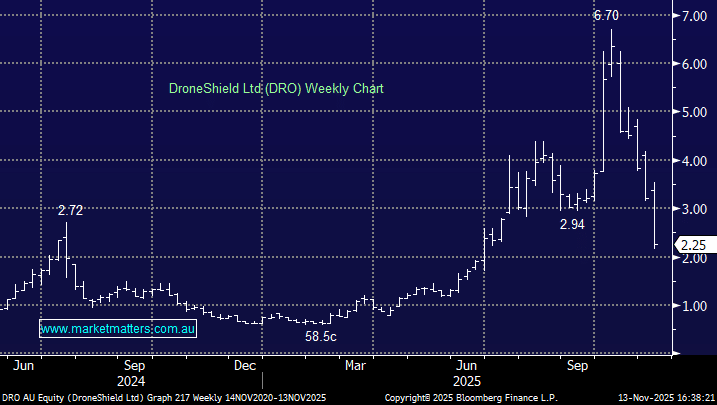

Why is DroneShield (DRO) crashing 30%!

DroneShield Ltd.’s stock plummeted ~30%, the most in five years after Chief Executive Officer Oleg Vornik sold $49.5 million worth of shares in the Australian defence company.

The stock dropped as much as 35%, the most since March 2020, after Vornik sold 14.8 million shares between Nov. 6 and Nov. 12, according to an exchange statement. That parcel of shares became payable under 15 million performance options on Nov. 5, a previous filing showed.

Also, Chairman Peter James and non-executive director Jethro Marks also offloaded shares amounting to $12.4 million and $4.9 million, respectively, according to separate filings.

Shares in the Sydney-based counter-drone firm have roughly tripled this year amid an explosion of interest from retail traders swept up in its meme stock buzz. DroneShield faces plenty of skepticism around its valuation as a result, with the stock trading at a premium to Australia’s benchmark ASX 200 Index even amid Thursday’s selloff, according to Bloomberg data.

Adding to the firm’s woes, DRO was forced to withdraw a statement on Monday disclosing that it had secured a package of contracts worth $7.6 million, later saying that these represented previously issued orders mistakenly marked as new. The stock pared most of its 10% gain after notifying investors of the mix-up.

- This felt like amateur hour at the time, it looks potentially worse now.