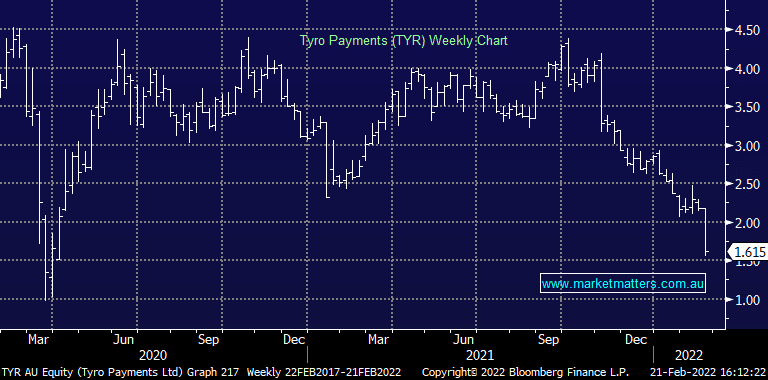

Why did Tyro (TYR) shares fall?

TYR -25.92%: a very weak first half result today saw significant pressure put on shares in the payments solutions business today. Tyro saw transaction volume and revenue jump around 30% each, but EBITDA fell 67% to $2.8m on higher costs. There was a significant jump in merchant numbers but transactions were weighed on by extended lockdowns in NSW and Victoria. Costs were also up, the company noting wage inflation, higher investment costs associated with their Telstra partnership and recent Medipass acquisition and extending assistance to merchants including deferring fee increases. The result was a decent miss to expectations and they are now well behind the 8-ball in terms of meeting full year expectations. There was an obvious (large) seller of the stock in the market today.