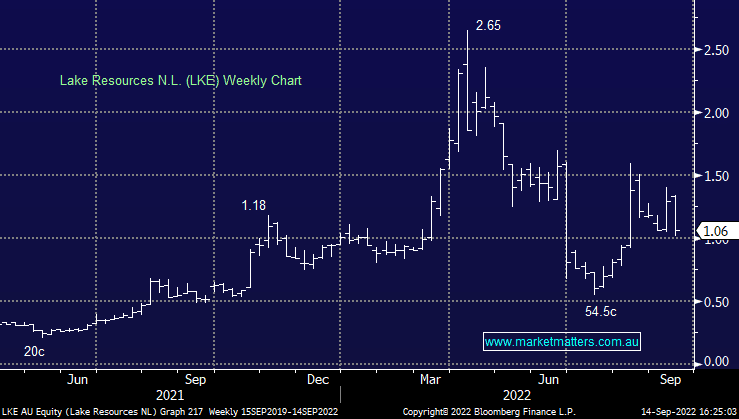

Why did Lake Resources (LKE) shares crash?

LKE -16.54%: the lithium hopeful tumbled today after getting caught in a tussle with the operations company they’ve employed at their Kachi site following a disagreement about milestone cut-offs. Lilac will earn a stake of up to 25% of the project if they complete 1,000 hours of operations and 2,500kg of lithium carbonate. Lake believes these milestones need to be met by 30 September, while Lilac believes they have until the end of November with the dispute now going to mediation. While Lake has been well-bid thanks to a strong rally in lithium stocks, it’s had ongoing issues with delays to studies and turnover in key management positions as well as an attack from short sellers earlier in the year. Clearly, a few things bubbling away under the surface.

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.