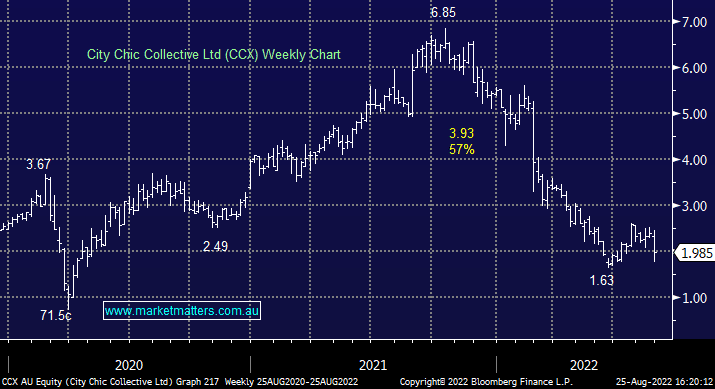

Why did City Chic (CCX) shares crash yesterday?

CCX -19.31%: retailers have largely surprised to the upside this reporting season, however, shares in City Chic were sold off heavily after today’s weak FY22 result and outlook. Sales grew 39%, but fell short of consensus, while profit rose just 3% as margins were squeezed, the $22m posted was an 18% miss to expectations. Inventory ballooned in the second half to $195m, up more than 50% from the first half, fanning fears of an inventory write-down or higher carry costs. FY23 trade is in line with the same period last year though management flagged consumer spending uncertainty. Inventory is expected to normalize to $125-135m and they expect to be net cash positive in the second half of the year.

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.