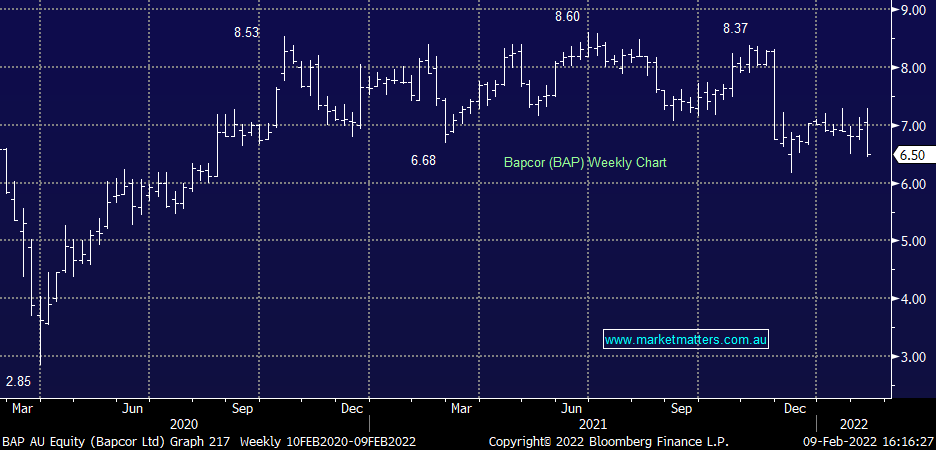

Why Bapcor (BAP) shares struggled today

BAP -7.93%: 1H result for the auto parts business today, a tough first test for the new CEO Noel Meehan the day after he was appointed. Revenue was slightly higher to $900m, but EBITDA (-6%, $137m) and NPAT (-14%, $61m) both fell. Costs were on the rise, particularly warehousing and transit costs, eating into margins. They maintained full year guidance of “pro forma earnings at least at the level of FY21,” however the market had baked in around 8% earnings growth which wold require a far stronger second half. The company also denied it had received takeover offers late last year, a story The Australian was printing on the weekend. Ultimately a small miss, driven by a short term factors with the market compounding the issue with a new CEO.