Whitehaven Coal (WHC) heads up long list of quarterly reports

Stock

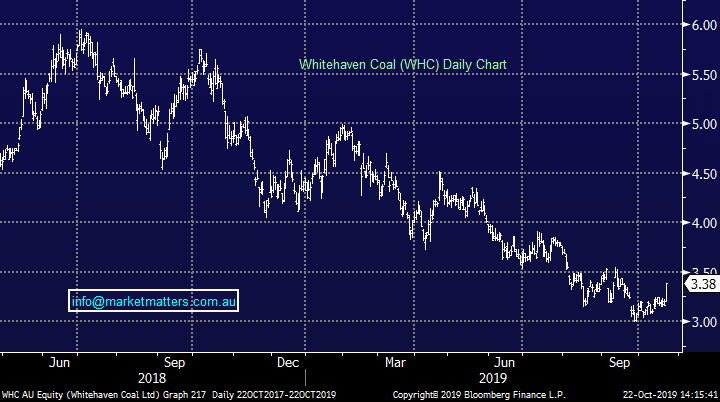

Whitehaven Coal (WHC) $3.38 as at 16/10/2019

Event

The September quarterly production reporting seems to be keeping the market busy at the moment. Today alone we have seen the following companies update:

Orocobre (ORE), -3.8% on a 10% fall in production vs the June quarter with lithium prices less than half of levels seen in pcp.

Saracen (SAR), +3.12%, out with lower than expected cost guidance alongside production annualized above the top end of guidance. Saracen are set to pay their first dividend this financial year.

Gold Road (GOR), -1.56%, despite guiding to the higher end of the range for production while costs are set to fall as production ramps up.

Oil Search (OSH), -0.35%, missed with revenue falling 5% from the previous quarter with lower oil price and production.

Independence Group (IGO), +1.36%, earnings surged along with copper production. Costs climbed but the company maintained guidance.

Whitehaven is the best resource stock that reported today, currently trading over 5% higher for a one month high. The miner saw coal production up 22% in the quarter thanks for the most part to the Narrabri mine where production doubled vs pcp.

The outlook commentary from Whitehaven was also upbeat. Coal prices have been in reverse over the last few years with the average price received for both thermal and met coal falling around 30% in the year. Now the company is seeing lower seaborne thermal coal as high cost producers are forced to cut back, while signs of life appear in demand from China. The met coal side is a little more subdued with the trade war impacting demand.

Whitehaven Coal (WHC) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook