Where is the value in Flight Centre?

The following report is an extract of the MarketMatters Income Report that was published on June 17. Click here to get access to the full report and more

The well-known travel business has had a tough 12 months trading from ~$70 to a 2019 low below ~$39. The most recent hit came on an earnings downgrade at the end of April and the stock fell sharply. It was a poor update following a poor period of sales, however the obvious question is to what extent did the election have on consumer appetite to book travel? FLT’s customer base is skewed primarily to the demographic that were likely to lose income if Labor’s proposed changes to franking credit legislation got up. Uncertainty often breeds inactivity and that was shown in the downgrade.

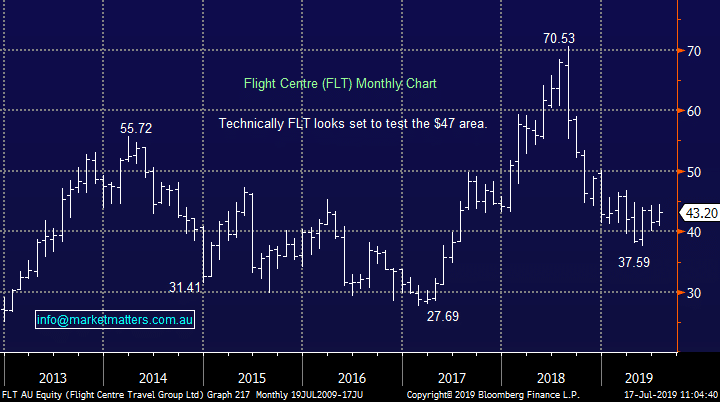

Flight Centre (FLT) Chart

At MM, we share a similar customer demographic to FLT and the election had an impact on our business, however we’ve seen a sharp post-election rebound - we’re betting that FLT has seen something similar, or at least some green shoots to underpin more upbeat commentary for FY20 when they report on the 22nd August (they don’t typically provide guidance). FLT is currently on an Est P/E of 16x relative to downgraded earnings, however when this is adjusted for the ~$300m in cash on the company’s balance sheet the P/E looks closer to 15x and an expected yield of 4.42% fully franked, FLT looks interesting. We recently added FLT to the MM Income Portfolio.

Yesterday I sat down with Darren Vincent, Shaw & Partners Analyst in FLT for his take on the business.

Video update – click here

At MM, we share a similar customer demographic to FLT and the election had an impact on our business, however we’ve seen a sharp post-election rebound - we’re betting that FLT has seen something similar, or at least some green shoots to underpin more upbeat commentary for FY20 when they report on the 22nd August (they don’t typically provide guidance). FLT is currently on an Est P/E of 16x relative to downgraded earnings, however when this is adjusted for the ~$300m in cash on the company’s balance sheet the P/E looks closer to 15x and an expected yield of 4.42% fully franked, FLT looks interesting. We recently added FLT to the MM Income Portfolio.

Yesterday I sat down with Darren Vincent, Shaw & Partners Analyst in FLT for his take on the business.

Video update – click here