What’s wrong with Wisetech?

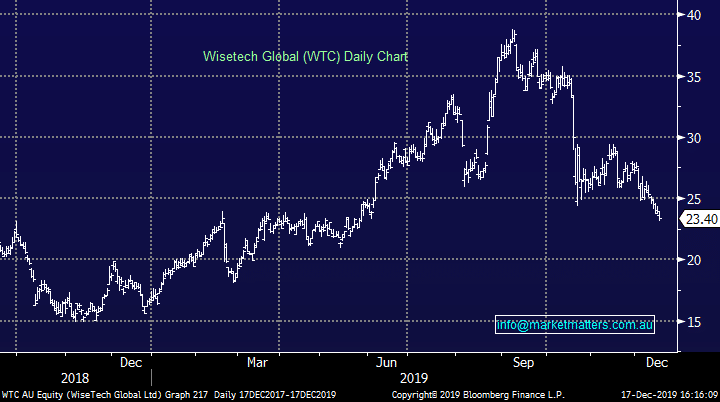

Wisetech (WTC) $23.40

More questions being asked about WTC today, this time from Bucephalus Research Partnership which is a research firm that delves into the accountancy practices of companies – fund managers use them as an outsourced research function and today they’ve weighed into the WTC debate following the recent attack by J Capital. In short, they don’t agree with all of J Caps assertions however they do cast a further shadow over the way WTC accounts for things. The focus remains on the definition being used for organic growth along with their capitalisation policies. Those running an IT based business would know that there are a number of ways to handle the costs of software development – MM is no different, so we’ve had some experience here. By capitalising costs, it essentially makes the shorter term look better than if costs were expensed in the period they were incurred. CSL is an example of a business that uses an expensed approach to their R & D spend.

In short, the firm concluded that if WTC followed similar policies to other software companies, it would be losing money. They go further by saying that while the balance sheet looks healthy now, most of the cash will have been consumed within 18 months and they believe that to avoid insolvency it needs to keep issuing stock. It simply all seems hard here at the moment

Wisetech (WTC) Chart