What…No upgrade from CSL!! Happy Birthday CB. (BAP, CPU, CAR, CSL)

WHAT MATTERED TODAY

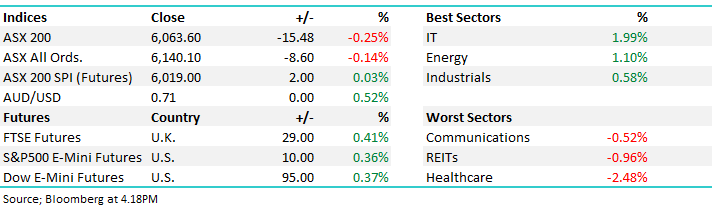

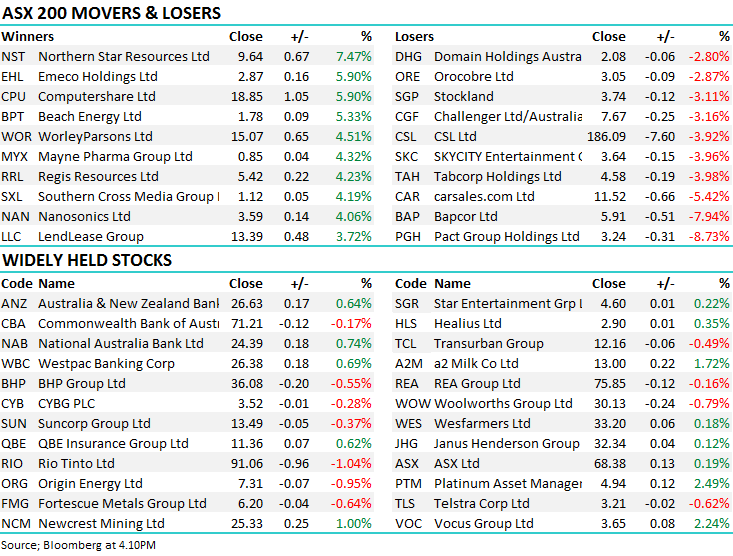

Without much in the way of news flow from an economic or political perspective other than Trumps twitter account claiming victory on The Wall and Russia, the local market was left with its own thoughts for the day and early strength was sold into – the market showing its first sign of weakness for the last week or so. CBA traded ex-dividend for $2.00 plus franking which equates to $2.85, and fell by $2.12 taking 12 index points from the ASX 200 which didn’t help.

The tech names did well, spurred on by a solid result out of Computershare (ASX: CPU), Healthcare dragged after CSL’s result was met with selling (the stock taking -11 index points from the market) and there was also a broker downgrade on Cochlear (ASX: COH). Energy was one sector that did have a go today after Beach Energy (ASX: BPT) upped guidance for the full year - new profit guidance was above the most bullish analyst. The result dragged all the energy names with it, helping to offset some of the weakness seen earlier this week – rumblings that Monday’s softness was caused by a big portfolio sell down in the space.

Overall, the ASX 200 closed down -15points or -0.25% to 6063. Dow Futures are currently trading up +95pts or +0.37%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

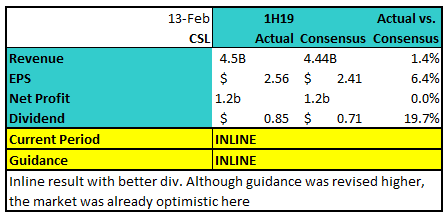

Reporting; A bigger day for company results with a couple of marque companies out with numbers. A lot of attention as always applied to CSL which reported well as Harry outlines below, however the market is very much engrained for beats, not meets in that stock. While they tightened full year guidance to be at the top end of the guided range, the market was already there. The other element to the result which Harry didn’t discuss was a slight decline in R & D expense – I must admit I didn’t dig into this as we don’t currently own the stock, however lower expenses while the result came inline suggests a softer underbelly than we’ve seen in the past. It’s hard to fault the quality of this business but when the whole market is positioned one way on a stock it scares me.

The share registry business Computershare (ASX:CPU) was a standout on the market today, adding ~6% to close at $18.85 on the back of strong 1H numbers plus an upgrade to guidance. They said FY19 profit would increase by 12.5%, which is up on the 10% they had previously guided towards, and above current consensus which sat at growth of 10.7%. CPU had been sold off fairly hard yesterday – from what I can see, a more bearish note from Morgan Stanley to blame, so todays move came off a lower base, but a good rally non-the-less. The market remains fairly negative the stock with PT’s below the current share price which could amplify the SP reaction to today’s upgrade i.e. bears start to capitulate. For those looking for a global business with strong consistent earnings, CPU fits the bill, my only real concern is around their recent acquisition of Equatex, a European employee share plan administration business, for €355 million – they look to have overpaid plus this is becoming a very competitive, technology driven area of the market. MM is neutral CPU at current prices.

Bapcor (ASX:BAP) -7.94% was on the flipside of the ledger today, trading down to $5.91. The result in itself was okay, although slightly messy however is was the guidance that prompted the sell-off. They forecasted an increase in net profit of 9% from FY18 to FY19, however that was at the lower end of prior guidance which was given at the AGM in October, which was for growth of 9-14%. While they’re clutching onto the bottom end of that range, they’ve obviously had a fairly soft trading period since then. While this is clearly a quality retailer its trading on 17x versus a peer group trading around 14x, and it doesn’t operate in a bubble! We were silly to sell NCK from the income portfolio at the level we did – it was a call against the Aussie consumer however NCK is a quality operation trading on 10x. BAP is also a quality operation but its trading on ~17x which creates more downside potential.

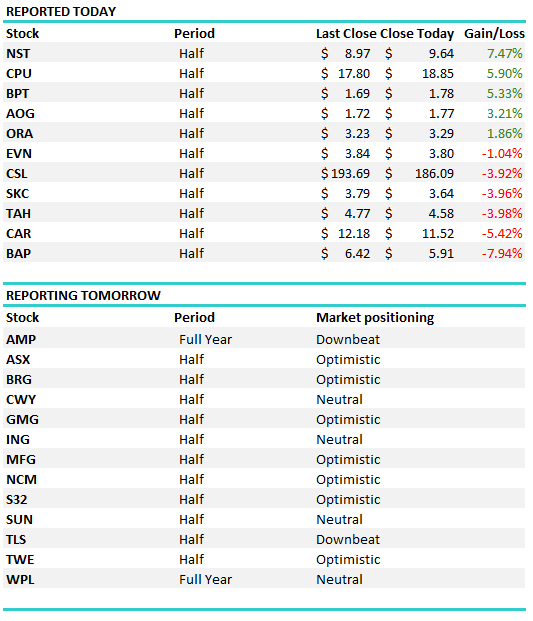

A mixed bag overall today with some decent moves either side of the ledger. Tomorrow really starts to ramp up….TLS & COH in focus for us.

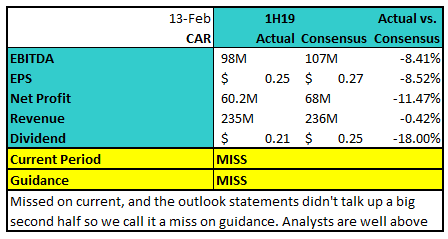

Carsales.com (ASX: CAR) -5.42%;CarSales reported first half numbers this morning, and the stock was walloped early on, trading down nearly ~9%, however weakness was bought into and the stock has traded higher as the day went on – for mine, that is a selling opportunity. The result was poor relative to market expectations leaving a lot of work for the company to do in the second half to meet full year numbers.

While the reported net profit after tax of $11.1m was very low, this included an impairment of the Stratton Finance business, which had been flagged. The write down ‘reflected the adverse impact of ASIC’s legislative changes on car financing, as well as continued tight credit market conditions’.

The underlying profit figure for the half was $60.2m which was a big miss versus consensus – more than 10%. The market was expecting full year underlying profit of $142m. In terms of guidance, they expect moderate growth in 2H 2019 which sounds okay, however to hit current consensus they would need to print growth of ~30% – this now looks like a pipe dream.

CarSales (ASX: CAR) Chart

CSL (ASX: CSL) -3.92%; The share price for the blood plasma business originally traded higher this morning before quickly selling off, falling over 6% from high to low as the market digested their first half numbers.

On first glance it looks like a decent start to the year, but the market seems to have been positioned for another upgrade – a consistent theme of CSL earnings over the past few years. Instead of an upgrade, the result is pretty much in line with already heightened expectations. Guidance for the full year net profit was revised to the higher end of the previous $US 1.88b to $US 1.95b range, and with consensus already at $US 1.94b it feels like a miss when it really should be an upgrade.

While early days, the technical picture on the daily chart below is a bearish one. We are particularly wary of companies which investors may be overly confident in.

CSL (ASX: CSL) Chart

Broker Moves; The big one below was Cochlear (ASX: COH) which copped a downgrade from Morgan Stanley today. The broker called the bottom well, and the stock is up around 20% since they slapped the equivalent to a buy on it back in November. The share price had run through the analysts target and they now fear the market is positioned for an unreasonable level of growth heading into the result - reports tomorrow – we own it.

We also saw DB downgrade CGF today to a SELL and $7 PT.

· Lendlease Upgraded to Buy at UBS; PT A$15.70

· Stockland Downgraded to Sell at UBS; PT A$3.60

· Challenger Downgraded to Sell at Deutsche Bank; PT Set to A$7

· Contact Energy Cut to Neutral at Woodward Partners; PT NZ$6.18

· Transurban Downgraded to Neutral at Macquarie; PT A$11.89

· Pact Group Downgraded to Underperform at Macquarie; PT A$3.40

· Pact Group Downgraded to Reduce at Morgans Financial; PT A$3.01

· Bendigo & Adelaide Downgraded to Sell at UBS; PT A$9.50

· Sigma Healthcare Limited Downgraded to Hold at Morningstar

· Medibank Private Downgraded to Hold at Morningstar

· Aurizon Downgraded to Sell at Morningstar

· Synlait Milk Rated New Neutral at Forsyth Barr; PT NZ$10.50

· Northern Star Upgraded to Overweight at JPMorgan; PT A$10

· Link Administration Raised to Neutral at JPMorgan; PT A$7.70

· Suncorp Downgraded to Hold at Bell Potter; Price Target A$13.75

· Cochlear Downgraded to Equal-weight at Morgan Stanley

· Super Retail Downgraded to Hold at Morgans Financial; PT A$8.56

· Fortescue Upgraded to Buy at Clarksons Platou; PT A$8

OUR CALLS

We added AusDrill to the MM Growth Portfolio today. Clearly volume is a bit of an issue in the stock and we had some trouble getting fully set. Just a reminder, when I discuss a price ‘Around’ a price point, I mean +/- 1% however it is obviously up to the individual on whether or not to ‘pay up’ for the stock.

For those not familiar with the company, Ausdrill is a mining services business that primarily has operations in Africa & Australia. Ausdrill works mostly on drilling and blasting, earthmoving, mineral analysis as well as logistics & equipment for mining activities. Recently Ausdrill bought Singapore listed services firm Barminco which has a number of Asian based contracts, as well as Australian & African exposure and is seen as a pathway to grow substantially.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.