What Mattered Today

What Mattered Today

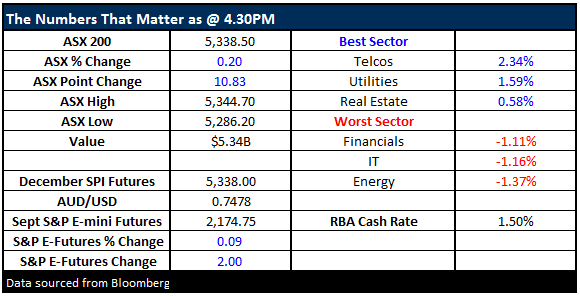

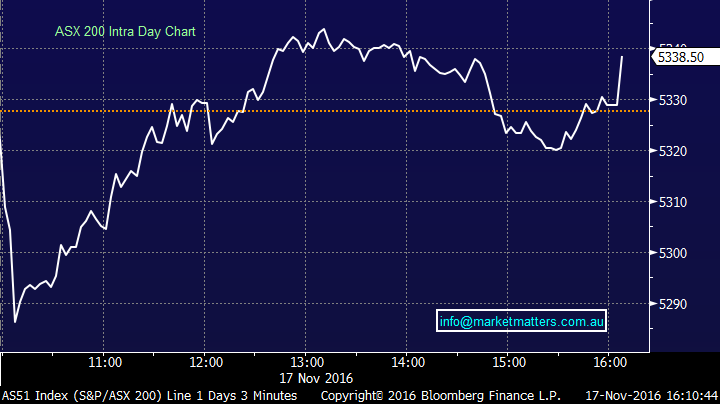

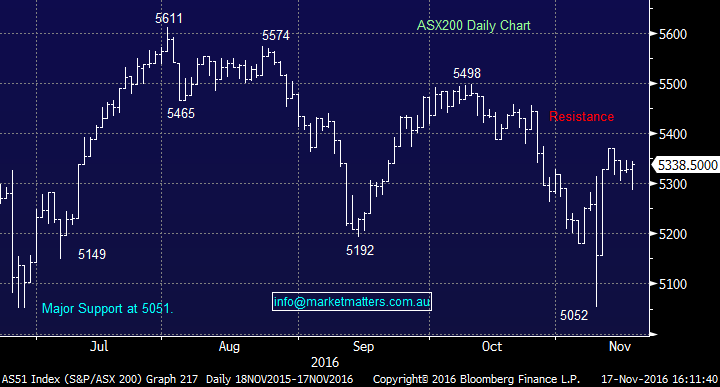

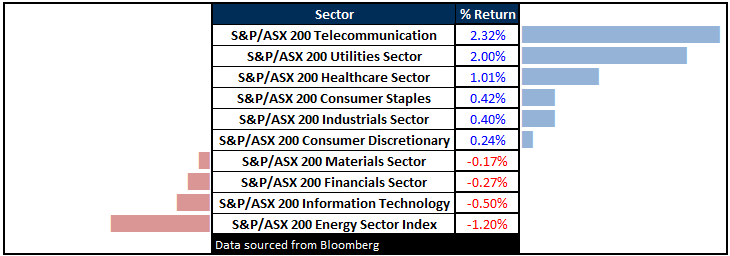

Volatile morning as expected, with the ASX 200 trading as lower as 5,286, only to recover and close mildly higher at 5,331. The range today was +/- 58 points, a high of 5345, low of 5286 and a close at 5339 up +11pts or +0.2%.

Unemployment data came in slightly better than expected at 5.6% vs. 5.7% expectation. The Telcos rebounded, with Telstra +2% to $4.82 a reverse of recent weakness. The weakest link of the day was Isentia (ISD), slumping 25% to $2.42 after issuing a profit warning… expect further weakness in this name.

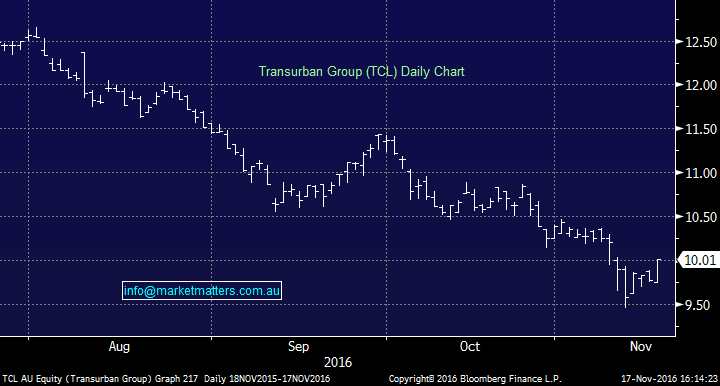

We saw some buying back into the beaten down infrastructure plays today which is a change from recent trends. Transurban closed on its highs – back up through $10 with higher levels expected in the near term.

A short note this afternoon after a busy day on the desk!!!

Transurban (TCL) Daily Chart

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

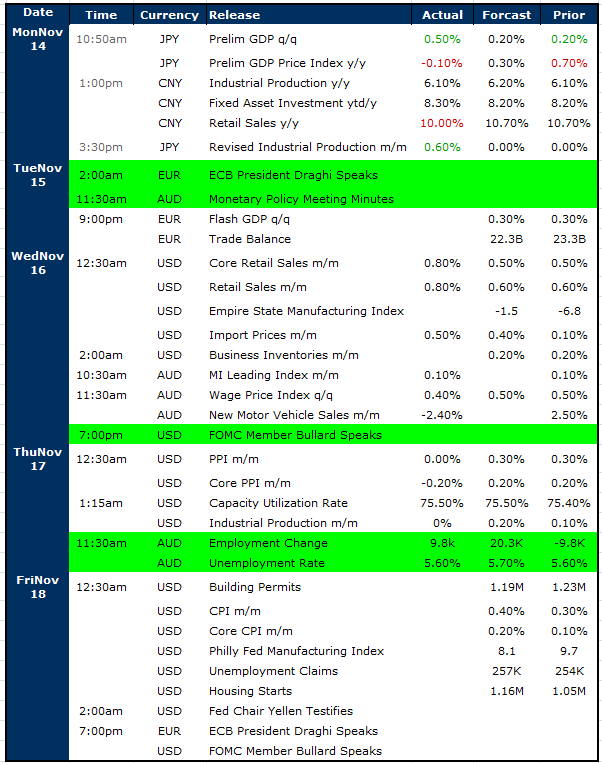

Select Economic Data - Stuff that really Matters in Green

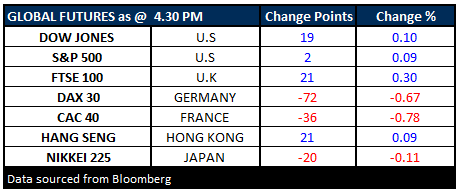

What Matters Overseas

FUTURES mixed….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/11/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here