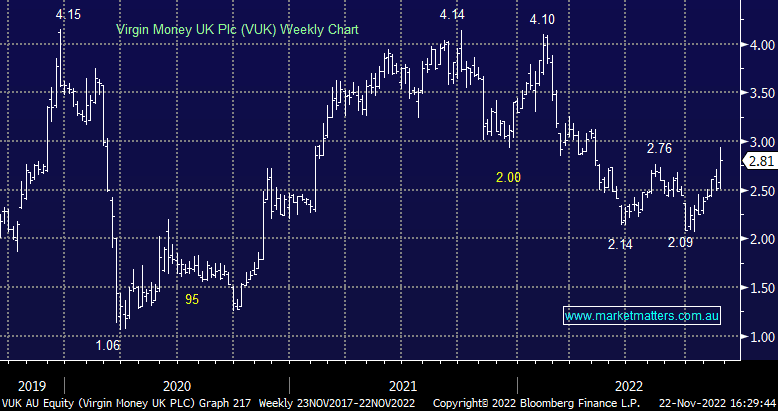

What happened to Virgin Money UK (VUK) shares today?

VUK +10.63%: Rallied strongly overnight in the UK and today in Oz following a strong FY22 result that showed impressive leverage to rising interest rates. Their 2H22 profit before tax (PBT) result of £401m (£789m for FY22) was 7% ahead of consensus.

Key points to catch our eye:

- Margins were inline with optimistic guidance at 185bps, with upside here going into FY23 and beyond given higher rates.

- The loss charge was low at 9bps and helped to drive the beat. While the headlines from the UK a dire, we’re not yet seeing a lot of stress.

- Capital levels were better than expected

- They announced a further buy-back of £50m and 7.5p final dividend taking FY buybacks to £125m and dividends to 10p. 2022 total payouts of £267m are ~13% of mkt cap.

- Costs were 1% higher.

- FY23 guidance implies modest upside to consensus.

All in all, another solid bank result with the sector enjoying (for now) the benefit of higher rates. VUK remains one of the cheapest global banks trading on just 0.4x price to book (for context CBA is the most expensive on 2.5x).

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.