What happened to Praemium (PPS) shares today?

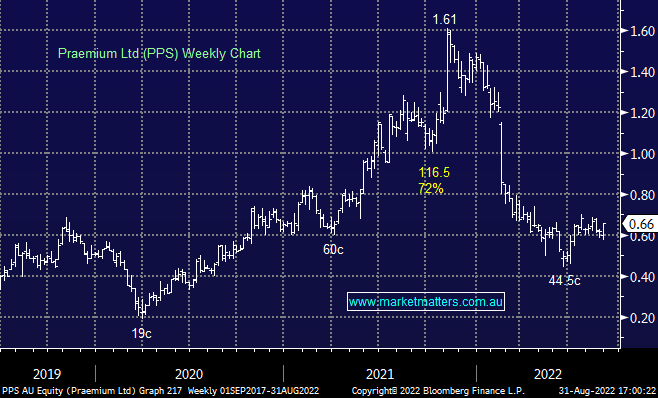

PPS +12.82%: the investment administration platform announced in-line FY22 results today, but the share price got a boost from improving underlying performance. The company printed EBITDA of $16.6m, marginally below consensus but sneaking into the bottom end of the guidance range. Profit was boosted by the sale of the international business with the company paying a 5c special dividend at the time and will use the remaining proceeds to buy back up to 10% of shares on issue, starting the buyback tomorrow. While there was no guidance provided, revenue margins were running at 0.34% in June, which compares to 0.31% in December. The positive trend has been driven by the higher cash rate and winning higher margin business which bodes well for FY23.

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.