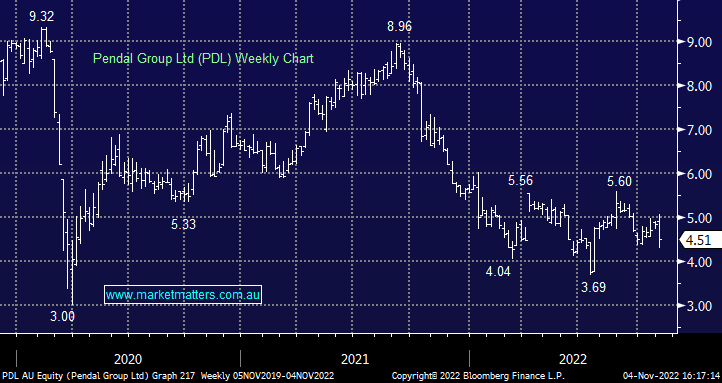

What does MM think about Pendal (PDL) full year results?

PDL -0.22%: Putting the three way takeover tussle to one side, Pendal (PDL) reported full year results this morning that were solid, all key metrics were in line to slightly above market expectations with revenue of up 8% to $629.7m and underlying profit up 17%. The dividend of 3.5cps for the half was below 22cps expected however the dividend comes off the cash component of the Perpetual bid so it’s net net neutral, as we suspect they would pay the difference out if the deal falls over. On the earnings call this morning, Pendal CEO Nick Good was stressed multiple times that the deal with Perpetual was a “legally binding contract”, that he didn’t anticipate any problems with the Pendal shareholder vote and both teams were “moving forward with the path laid out”.

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.