What does MM think about HUB24 Ltd (HUB) shares?

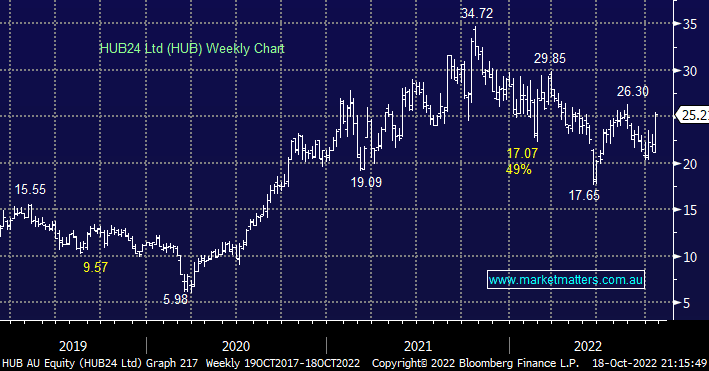

MM was delighted to see HUB soar over +14% yesterday after announcing net flows of $3.0bn and FUA of $68.4bn, up 8% year on year, taking it to the number one listed platform position for net flows. Overall it was a very strong quarterly update and a definite positive to see HUB lead the independent platforms on net flows despite trading at a discount on a PE basis (valuation). Following its exciting new cash deposit agreement, we are looking for continued tailwinds on net flows and margins to support the next leg higher for HUB.

The standouts for us all dovetailed nicely with our bullish outlook and positioning:

- HUB now leads the market in net flows, they are winning more business than Netwealth (NWL) despite trading on an enterprise value which is ~60% lower i.e. its cheap compared to its peers.

- They struck an excellent cash deposit agreement which beat expectations as they move from ANZ to the BOQ in an effort to maximise returns on uninvested funds i.e. often in the $4.5-5bn region.

- HUB’s shares compare favourably to its peers trading on a PE of 29x compared to NWL on 33x, given its relative valuation and range of favourable metrics including very sticky recurring revenue we expect this 10% valuation gap to narrow.

- We believe the outlook remains robust for HUB with advisors on the platform growing to 3,639 in 1Q23, up 4.4% quarter on quarter which when combined with 32 new distribution agreements lays the foundation for ongoing strong inflows.

In our opinion, there’s nothing not to like in this update and we see no reason that the stocks trading at a 10% discount to NWL.

- We are initially still targeting the $29 region but in a healthy market fresh highs wouldn’t surprise.

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.