What are our picks in the oil stocks?

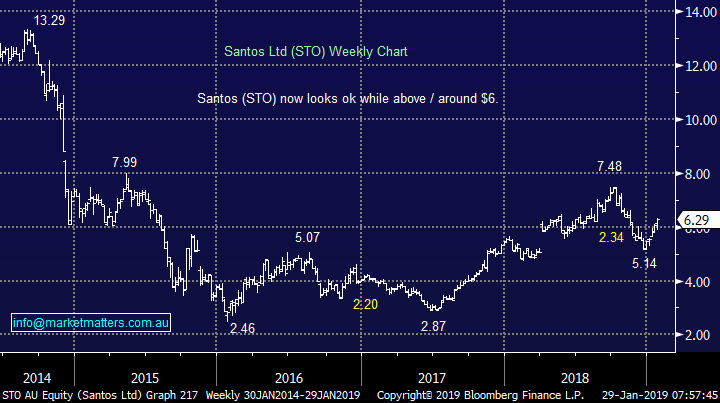

Santos (ASX: STO) $6.29

Santos has been a tale of woe over the last 5-years but the stock’s regained at least some “mojo” since 2017.

The 22% bounce by STO over the last 5/6 weeks shows it’s an ideal vehicle to invest in for our anticipated choppy recovery in oil up towards $US60/barrel.

MM likes STO into weakness, ideally around or below $6, looking for a strong few months ahead and potentially a test above $7.

Santos (ASX: STO) Chart

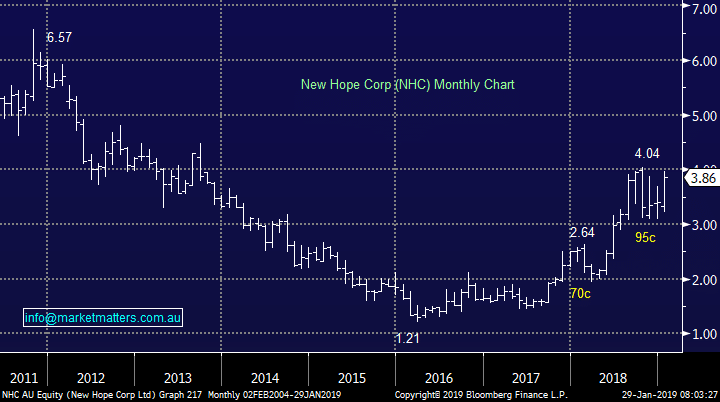

New Hope Coal (NHC) $3.86

We remain bullish NHC although from a risk / reward basis the ship may have sailed.

MM are keen buyers of NHC around $3.50 targeting fresh highs above $4.

New Hope Coal (ASX: NHC) Chart

New Hope Coal (NHC) $3.86

We remain bullish NHC although from a risk / reward basis the ship may have sailed.

MM are keen buyers of NHC around $3.50 targeting fresh highs above $4.

New Hope Coal (ASX: NHC) Chart

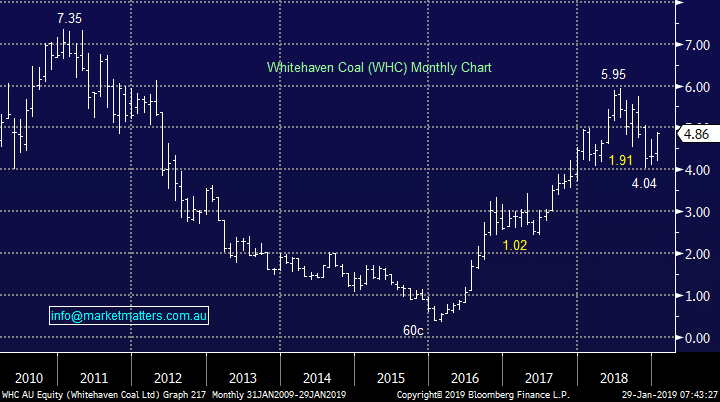

Whitehaven Coal (WHC) $4.86

We remain positive WHC targeting an eventual break above $6.

MM likes WHC back towards $4.70 in the next few weeks.

NB We have a preference for NHC in the Growth Portfolio and Whitehaven Coal in the Income Portfolio.

Whitehaven Coal (ASX: WHC) Chart

Whitehaven Coal (WHC) $4.86

We remain positive WHC targeting an eventual break above $6.

MM likes WHC back towards $4.70 in the next few weeks.

NB We have a preference for NHC in the Growth Portfolio and Whitehaven Coal in the Income Portfolio.

Whitehaven Coal (ASX: WHC) Chart

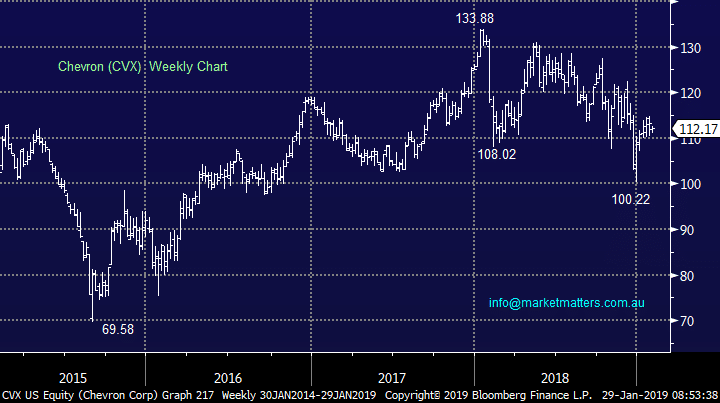

Chevron (US: CVX)

Interestingly enough, looking overseas at US energy giant Chevron, this has generated has generated a technical buy signal targeting a 20% rally.

The ideal area for CVX is $US108-110 – only a few % lower.

It’s encouraging to our outlook for the local energy sector to have a positive look / feel around this large Dow stock.

Chevron (US: CVX) Chart

Chevron (US: CVX)

Interestingly enough, looking overseas at US energy giant Chevron, this has generated has generated a technical buy signal targeting a 20% rally.

The ideal area for CVX is $US108-110 – only a few % lower.

It’s encouraging to our outlook for the local energy sector to have a positive look / feel around this large Dow stock.

Chevron (US: CVX) Chart