What a day to own the banks!! (WBC, NHF)

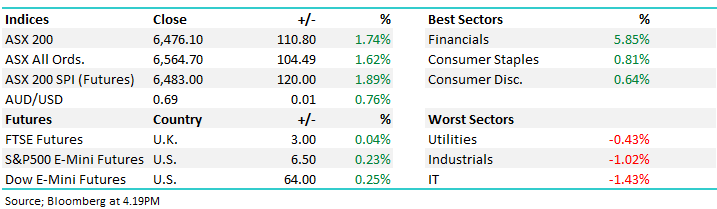

WHAT MATTERED TODAY

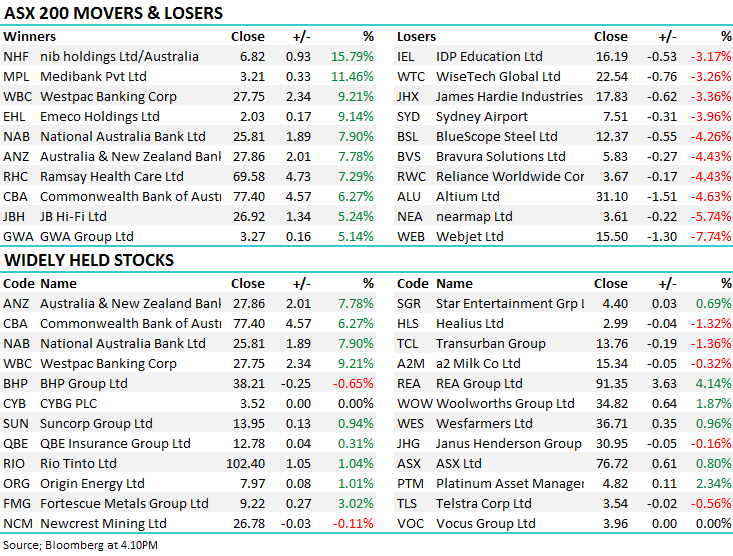

A huge day for some areas of the Australian market today, particularly the banking stocks and the private health insurers as they were aggressively singled out as net beneficiaries of the Coalition victory over the weekend. Westpac (WBC) closing 9.2% higher for its biggest one-day gain in almost 31 years shows how big the change in sentiment was today.

While the banks have most to gain from a coalition win given that policies like capital gains tax reform, negative-gearing reform, and of course changes to franking credit legislation are now a distant memory, the strength in today’s buying was exceptionally strong. WBC the best on ground however ANZ added +7.78%, NAB added 7.9% & CBA was up 6.27% with the BIG 4 banks accounting for ~87points or 80% of the day’s gains - banks, clearly the place to be. Sentiment is a very big influencer in the market, and the weekend’s victory by Scott Morrison could well be the sentiment circuit breaker in terms of consumer behaviour – from an investment perspective, from a consumer perspective and importantly, for the housing market.

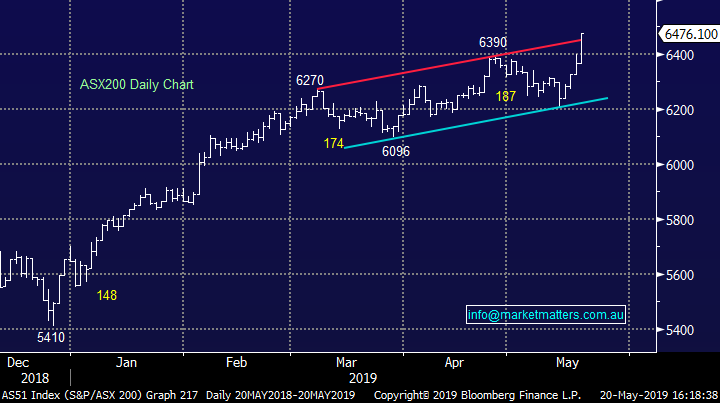

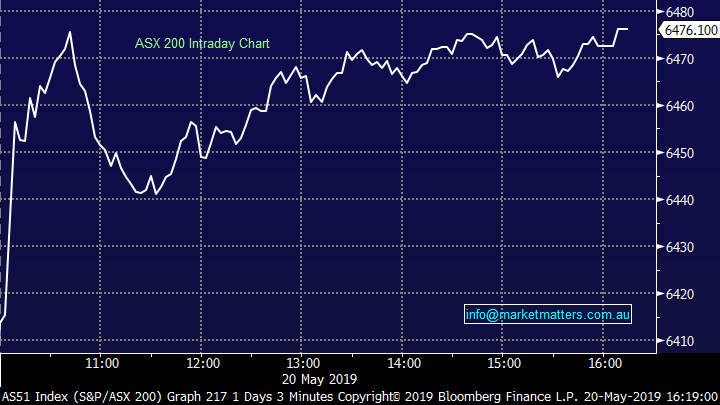

Overall today, the ASX 200 added +110 points or +1.74% to 6476. Dow Futures are trading up +64pts / +0.25%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Private health insurers Medibank (MPL), +11.46%, and NIB Holdings (NHF), +15.79%, also caught the tailwind of the surprise coalition victory. Both names had been trading in a reasonably tight range since late April as investors mulled the cap on premium increases as proposed by the Labor party heading in to the election. With the cloud removed, the insurers rallied strongly to top the leaders boards today. They also dragged private hospital stock Ramsay (RHC), +7.29%, higher as investors bet on an easier negotiating path for the operator with the insurers. RHC has traded in a tight range in the lead up to the election, unable to move higher with the market pricing in the risk of costs rising above revenue growth in a low premium growth environment. We own NiB (NHF) in the Growth Portfolio and enjoyed its run today. We remain bullish

NiB Holdings (NHF)

Banks – a huge day from a sector perspective with the banks opening firm and staying that way into the close. WBC the biggest contributor to the sectors gain adding +9% - best gains in more than 30 years. Short covering clearly playing out as the change of government removes some of the headwinds facing the sector. I did hear numerous times around the office today that banks are still ‘no growth’ and this is a sell day however, worth remembering that sentiment is a very big component around investing, and a coalition win has clearly improved overall sentiment – particularly towards the banks. The aggression in today’s buying looks to me like it has further to play out…

Westpac (WBC) Bank

Broker moves:

· NRW Holdings Downgraded to Neutral at UBS; PT A$3.10

· NRW Holdings Cut to Sell at Deutsche Bank; PT Set to A$2.31

· Vista Group Downgraded to Neutral at UBS; PT NZ$5.55

· James Hardie GDRs Downgraded to Neutral at UBS; PT A$19.60

· Qantas Upgraded to Outperform at Credit Suisse

· NAB Upgraded to Overweight at Morgan Stanley; PT A$25.70

· GWA Group Downgraded to Sell at Deutsche Bank; PT Set to A$2.85

· GWA Group Upgraded to Hold at Morningstar

· Ramsay Health Upgraded to Overweight at JPMorgan; PT A$75

· Lendlease Group Downgraded to Hold at Morningstar

· Pendal Group Downgraded to Hold at Morningstar

· Medibank Private Upgraded to Neutral at JPMorgan; PT A$3.05

· Virgin Australia Upgraded to Neutral at Credit Suisse; PT A$0.18

OUR CALLS

No changes today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.