We’ve developed a very special bond…says Trump! (NCM, RHC, CTX)

WHAT MATTERED TODAY

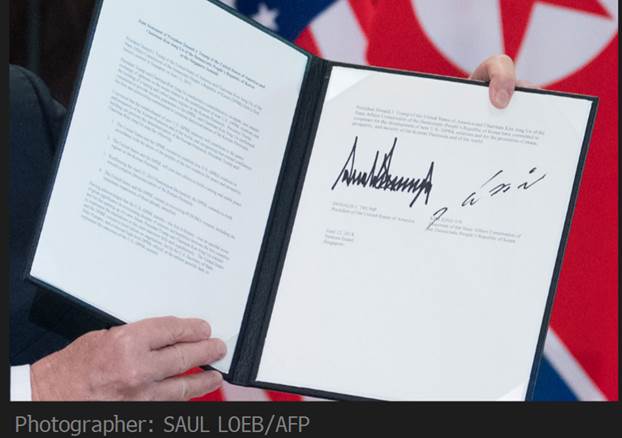

The central focus today was the much anticipated – talked about – on / off meeting between Mr Trump and the North Korean Dictator Kim Jong-un. The meeting started this morning and went over lunch culminating with the signing of some agreement – the details of which remain scarce, although from photographers at the news conference there are a few points that can be deciphered, the main one being that North Korea agrees to stand by its declaration from the South Korean summit to move towards CVID -- complete, verifiable, irreversible denuclearization.

Here’s a snap from of the signing sourced from Bloomberg…how good is KJU’s signature!!!

Looking at reports post the announcements, there remains a lot of unanswered questions, some of the more pertinent ones being…How much detail is there around the "CVID" of the denuclearization process? What sort of concrete assurances on security has the U.S. promised North Korea, if any?

Is there concrete, immediate sanctions relief for North Korea? Are human rights mentioned at all? These may be nutted out over time between senior officials from both nations, or they may not, however clearly, today is a historic day on the global stage – a very symbolic meeting if nothing else. From a markets perspective, our market chopped around while US Futures edged higher, but not significantly so.

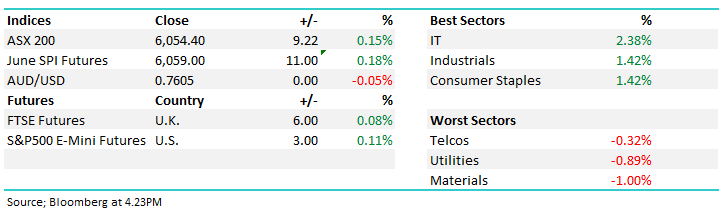

Overall the ASX 200 index added +0.15%, or 9 points to 6054 underperforming the Futures lead, while the DOW Futures are trading up +47pts at time of writing.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Australian Housing Data; More bearish property data out today which is again painting a negative picture for east coast property with home-lending data printing the longest losing streak in almost a decade. Housing finance fell 1.4% in April, the fifth straight monthly drop and the longest stretch of declines since September 2008, when Lehman Brothers Inc. collapsed and a month before the Reserve Bank of Australia cut rates by 1%. Sydney seems to be in the firing line (ouch!) where prices slid 4.2% in May from a year earlier.

They are coming off a strong top however both official data + BBQ conversation is confirming that house prices have cooled – a lot in some places. One of the bigger reasons being tighter credit, as regulators force banks to cut back on the riskiest mortgages + Chinese buyers have dropped given reported issues in getting funds out of China and we’re seeing tighter lending standards…All up, a negative backdrop for local housing.

Broker Moves; The lithium space remained in focus today with Citigroup putting out another negative note saying… Lithium supply wave continues to build, and prices set to soften through middle of next decade. The other interesting aspect on the broker front was Macquarie talking up Ramsay’s Healthcare and their brownfield growth opportunities – the stock adding 2.68% on the back of it.

Ramsay Healthcare (RHC) Chart

Elsewhere…

- AusNet Upgraded to Neutral at Citi; Price Target A$1.54

- Tegel Group Cut to Underperform at First NZ Capital; PT NZ$1.16

- Rio Tinto Downgraded to Hold at Deutsche Bank

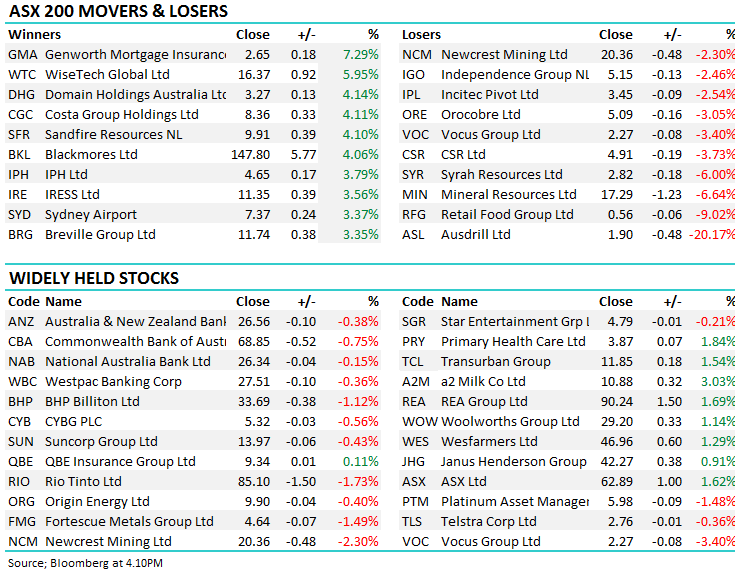

Newcrest Mining (NCM) $20.36 / -2.30%; There was some confusion this morning around the disproportionate drop in Newcrest on open – down around ~3% with gold reasonably flat. It looks like it’s down to index rebalancing to the major Nth American gold indices

Quarterly Index changes to the major North American gold indices – GDXJ etc. – occur on the 15th day of the month prior to quarter end i.e. this Friday 15 June. The market is never wrong (see below) – so index desks/funds preparing for the changes this week. These changes are global hence impact gold equities in Australia, Canada, Brazil, South Africa etc. NCM and SBM look set for an index down weighting … probably courtesy of some new entrants coming into the respective Gold indices. More detail should come out shortly however out shortly however NCM will likely be volatile until after the rebalance

Newcrest (NCM) Chart

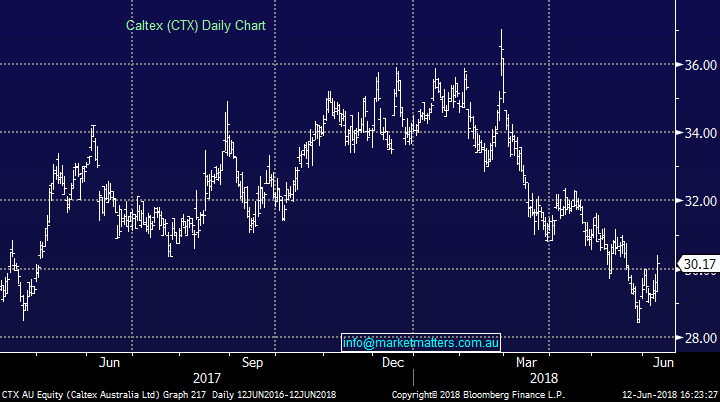

Caltex Australia (CTX) $30.17 / +2.79%; The petrol station operator / retailer released profit guidance for the year and the market was pleasantly surprised by the numbers. It was a small upgrade at the first half EBIT line, with the company targeting $442-$472mil while the market was looking for $440m = 3.9% beat to the middle of guidance. While only a small upgrade, it was a relief for shareholders after seeing the stock price fall ~20% from early March. Weakness had come from falling refinery margins and the impending loss of large client in Woolworth’s petrol business, which Caltex supply $150mil of petrol. To plug the gap, Caltex has focused on their convenience business which continues to grow as a proportion of the business – now representing ~1/3 of earnings. We expect this guidance announcement to support the share price in the short term as the market becomes more confident in the company’s outlook.

Caltex (CTX) Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here