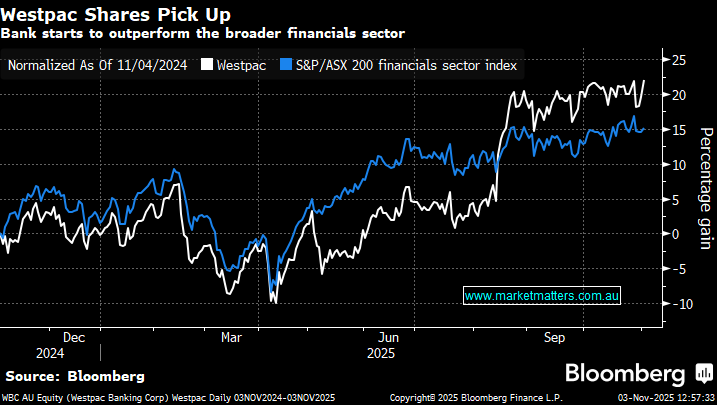

Westpac (WBC) tests its all-time high following a solid FY25 Report

Westpac helped turn market sentiment around through Monday morning rising ~2.5% from its soft opening to be up over +2% into lunch. WBC raised its dividend to 77c despite a 1% drop in annual profit on higher operating costs and fierce competition for deposits and loans.

- Revenue rose by 3.7% to $22.38bn, above analyst consensus of $22.26bn.

- Net Interest Margin fell 1.94% from 1.95% YoY.

- NPAT came in at $6.92bn, above analyst consensus of $6.86bn.

- Mortgage lending grew +5% YoY and Business lending +15% YoY.

The stocks extended gains into the early afternoon after growth in loans boosted the lender plus not many local holders will be looking to sell ahead of this month’s 77c fully franked dividend.