Westpac (WBC) finally lets go of the wealth division

Stock

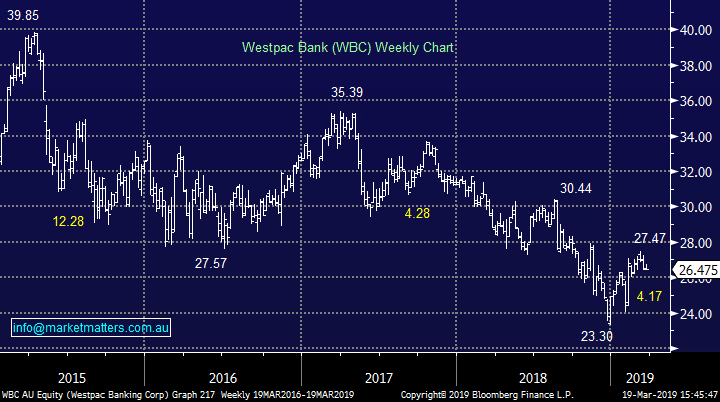

Westpac (WBC) $26.41 as at 19/03/2019

Event

Just a few days after CBA bailed out of their immediate plans to offload their wealth division, Westpac has finally folded on its own operation. The bank announced today that it will restructure the wealth division by exiting advice while still retaining the BT Financial brand by dissolving the group between its consumer and business divisions.

The exit strategy will include the option for salaried planners to move to Viridian where Westpac has been trialling an external referral system since early 2018. Last year the wealth business lost $53m – immaterial for the bank, but that is pre-remediation costs that has plagued each of the big 4’s wealth operations as a result of the Hayne Royal Commission. The total loss was $190m last year, rising from a $48m loss in FY17.

The plan does not include an upfront payment just yet with the announcement that proceeds will be dependent on the amount of business that does transition to Viridian, but Westpac will likely benefit from an ongoing relationship with the independent planner. It is worth noting that Viridian is run by ex-Westpac employees.

This is not necessarily the end of wealth advice at Westpac which has long maintained that it has a place within the banking system. The bank still plans to invest in robo-advice technology, while they'll integrate the superannuation, platform and private banking areas into to the business division and insurance will be managed from the consumer banking division.

Westpac (WBC) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook