Westpac pencils in further rate cut, stocks rally (VOC, KMD)

WHAT MATTERED TODAY

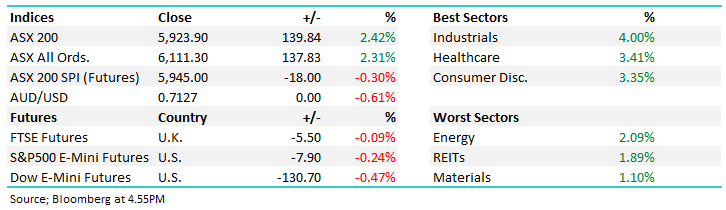

The strong rally today for stocks and a busy day on the Shaw Insto desk with early indications looking like it will smash through the 200k target set for the day, once again, thanks to all the institutions / fund managers that supported the day. As suggested in the Income Note around lunchtime, Westpac’s influential Chief Economist Bill Evans changed his expectations around interest rates today, now forecasting the RBA to cut rates to 0.10% in October, plus reduce the 3 year bond yield target rate to the same level while also reducing the rate banks pay when they draw funds from the RBA. All of these initiatives reduce the cost of capital and improve its availability. Higher amounts of liquidity at lower rates is supportive of asset prices, hence the markets strong move.

While this is simply one forecast by a bank, it does highlight the available options for central banks moving forward. Bond proxies which are heavily influenced by interest rates such as Transurban (TCL) +4.94%, Sydney Airports (SYD) +4.88%, APA Group (APA) +3.67% had strong sessions pushing the broader industrials up by 4%, a good backdrop for the MM Income Portfolio. Materials on the other hand lagged, up 1.1% as a sector to be the weakest link on a very strong day.

The outperformance in Australia was stark today, Asian stocks were mostly lower while US Futures were fairly muted ticking around par during our time zone.

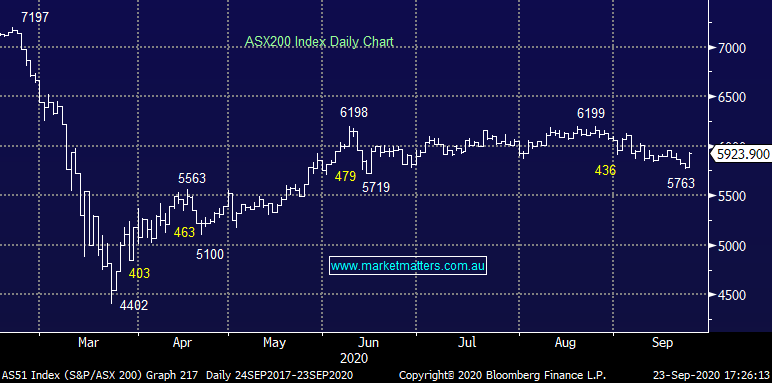

By the close, the ASX 200 was up +140pts / +2.42% o 5923. Dow Futures are trading up 93pts/+0.34%

ASX 200 Chart

ASX 200 Chart

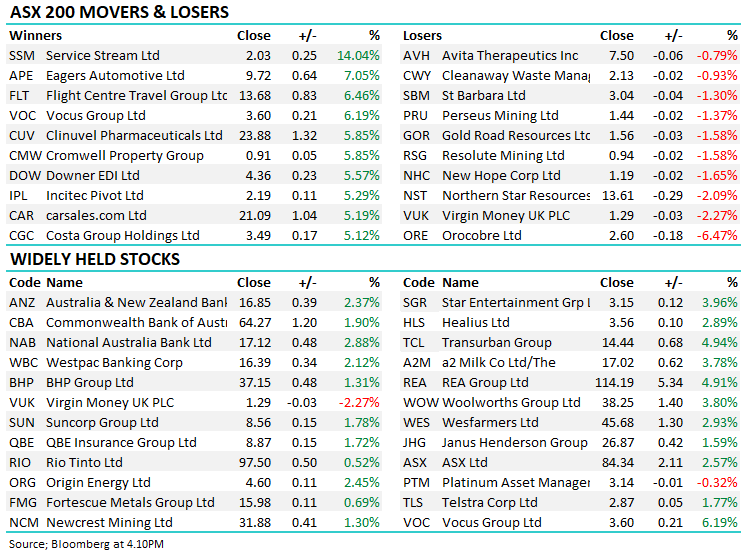

CATHCING MY EYE

Telcos: Lots of focus in the sector today after the Federal Government announced plans to invest a further $3.5bn in NBN upgrades. They will offer last-mile fibre upgrades to half of NBN Co’s fibre-to-the-node footprint with the aim of supporting up to gigabit speeds. The upgrades will happen based on usage where free upgrades will be conditional on usage where users sign up to bigger plans. More investment in the NBN is a positive for the Telco sector and today they were on fire, frustratingly led by Service Stream (SSM) which put on 14% not long after we cut the position from our growth portfolio. As a ‘sort of’ second prize for us, Vocus (VOC) which we hold rallied by 6.2%, while Telstra (TLS) which we recently bought in the Income Portfolio put on +1.77%.

Vocus Communications (VOC) Chart

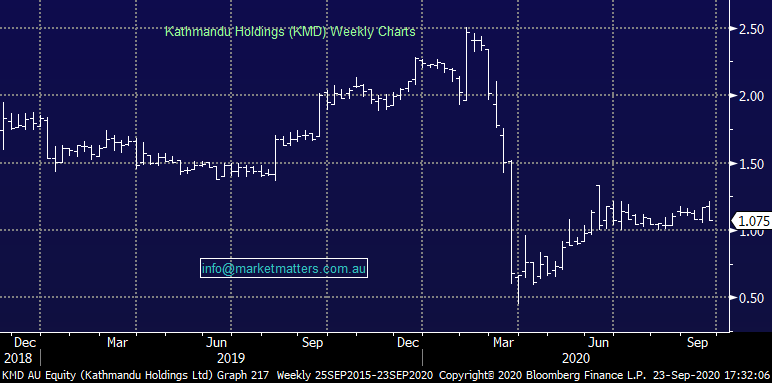

Katmandu (KMD) -8.51%: Reported full year earnings today and the numbers were weak. Top line sales of NZ$801m came in well ahead of consensus (NZ$735.87m) expected however weak margins and a string of large one offs meant a decent miss at the profit line which came in at just $NZ10.35m. Kathmandu has a range of outdoor wear while they also bought Rip Curl during the year, before a deeply discounted & dilutive equity raise forced on them by their bankers during COVID. A tough year for KMD however they attempted to talk up the future in terms of demand for outdoor and active gear. They cancelled the dividend today, however that shouldn’t really come as a major surprise. Hard to get excited about KMD here.

Katmandu (KMD) Chart

BROKER MOVES

- Inghams Raised to Buy at Morningstar

- Fortescue Raised to Buy at Citi; PT A$18.50

- Mineral Resources Rated New Neutral at Goldman; PT A$26

- Immutep ADRs Rated New Buy at Alliance Global Partners; PT $5

- Qube Raised to Buy at Jefferies

OUR CALLS

No changes today

Major Movers Today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.