Wesfarmers (WES) Retail trading update

Wesfarmers (WES) +0.14%: the retail side of the business provided an update to the market today, part of which highlights why they recently bit the bullet on Target with some decent write-downs. For the 2nd half to the end of May, Target sales fell 2% while Kmart saw 4% growth compared to the same period last year. While sales were strong, they did flag that higher costs and temporary closure of NZ stores would impact the full year result. The same goes for Bunnings and Officeworks too though sales were a for stronger given the rush to buy both home improvement gear and home office equipment. Bunnings second half saw total sales growth of 19.2% while Officeworks added 27.8% for the first 5 months of the second half. Bunnings alone saw cleaning & security costs of $20m, while the shut down in NZ and a few small format store closures will also take $70m worth of gloss off the full year result.

The fortunate timing of the Catch acquisition which was completed in August last year is another boost to Wesfarmers FY20. The online focus of Catch helped generate growth naturally as consumers were pushed for the internet bargain. Catch saw gross transaction volume rise a huge 68.7% for the first 5 months of the calendar year. Online sales was a driver of a large part of the sales growth in Wesfarmers in general, up 60% even before the inclusion of Catch. The business will be one of a handful to see growth in revenues despite the COVID impact.

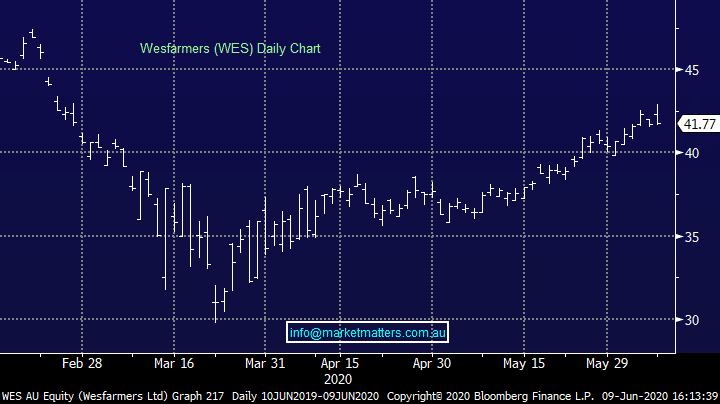

Wesfarmers (WES) Chart