Wesfarmers to spin out Coles

WHAT MATTERED TODAY

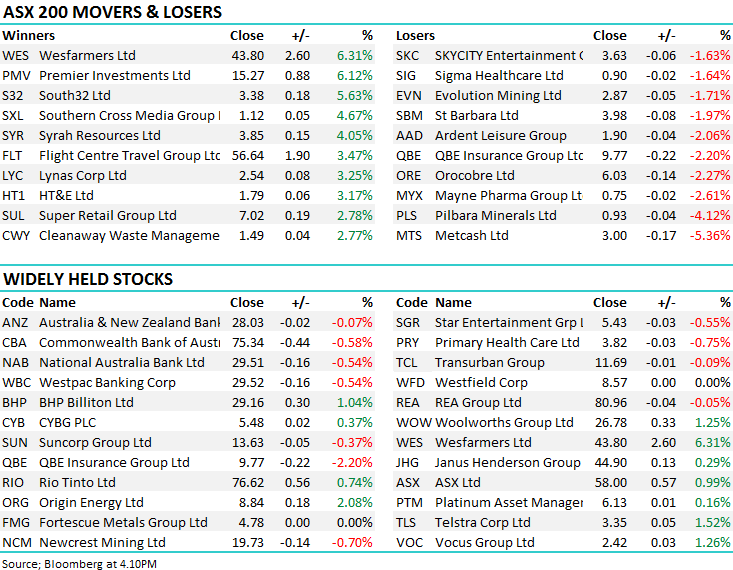

Banks were in the cross hairs again today with the sector providing most weight from an index perspective – largely offset by a 6.31%rally in Wesfarmers (WES) after they announced plans to spin off Coles - more on that later. Elsewhere, Premier Investments (PMV) was strong, adding 6.12% on the back of a good half yearly report – the retailer with brands like Peter Alexander, Smiggle, Just Jeans and Jay Jays printed underlying profit growth of ~10% which is obviously strong in a generally weak retail environment.

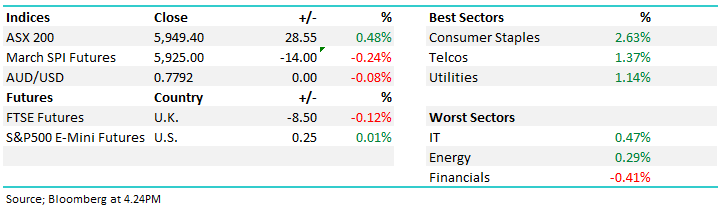

On the broader today, the index edged higher up 28pts or +0.48% with the index settling at 5947 – Consumer Staplesproviding the biggest weight on the mkt.

ASX 200 Chart

ASX 200 Chart

For the week, the market was lower overall which is a poor outcome considering the strong move last Friday night in the US. The market has failed to rally on what ‘should’ have been very positive news (employment strong, wages contained) yet it’s continued to struggle. Following Wednesday’s close by the ASX200 below 5950 we are now short-term neutral local stocks needing a close back above 6030 to switch us bullish. We are very much in the camp of selling strength in stocks, not a buyer of weakness.

Sectors this week

Stocks this week

CATCHING OUR EYE

Wesfarmers (WES) +$2.60/+6.31% to $43.80; A big announcement today for Wessies with the planned spin out of Coles – the market liked the sound of it given additional clarity and transparency likely with respect to Coles and easier to value remaining WES parts (post Resources divestment) Here’s the take from Shaw’s WES Analyst Danny Younis post the conference call…

Nothing really ground breaking emanated from the teleconference – clearly early days in this mooted demerger and it is (obviously) a significant portfolio restructure for WES. Points discussed included:

- Why does WES keep 20% vs. “clean” exit? WES 20% maximum stake in Coles a function of enable cash release to shareholders (no escrow as not selling the business). Coles remains independent irrespective of 0% to 20% (proportional Board representation).

- Rationale? Why no straight sale of Coles vs. demerger? Open to offers (!) if can overcome regulatory issues and pay a healthy premium for control.

- Demerger vs. IPO? Tax benefits to shareholders in demerger. Capital gains tax relief valuable, especially to retail shareholders (significant part of register).

- Update on Coles performance? CEO did note that there was “no material change” in Coles’ to date 2H18 performance from previous 1H18 commentary (positive momentum).

- Coles landlord land values? Structure of leases will have no material issues, and Coles will continue to develop its property portfolio (small) but majority of Coles stores are leasehold.

- Bunnings considered for demerger? Not as impactful as Coles and market has better visibility on Bunnings.

- Update on Resources divestment? Returns profile vs. its future weighed. Working through conditions precedent on Curragh and strategic review on interest in Bengalla now

- Kmart/Target + Coles combined? DDS stores are low growth (but good cash generators, notably Kmart) but pure play focus on supermarkets preferred), whilst Coles has low ROC of 9% (vs. Bunnings a whopping 47% and DDS 26%).

- Flybuys structure? – jointly owned by WES + Coles.

- Next arm of acquisition in WES? Further opportunities to invest in existing businesses (operationally and data and digital-wise).

Further detail, including Coles’ proposed capital structure, dividend policy, separation, and governance arrangements will be announced in due course.

If approved, the demerger would be expected to be completed in FY19.

WES also announced that Steven Cain (MTS IGA chief and ex-Coles) will be the next MD of Coles, succeeding John Durkan, who will step down later this year after 10 years in senior leadership positions at Coles, including four as MD

Wesfarmers (WES) Chart

Fortescue Metals (FMG) unch @ $4.78; We had the reasonably new CFO in today to run through FMG numbers + ask questions around the current discount, underperformance in the stock and current operations + they obviously have a first-hand take on China from their marketing guys in the region. As with any company, we take on board their commentary / insight with the understanding that companies often ‘talk their book’ and they have an agenda to push, simply that’s what (as shareholder) we expect our companies to do. That said, they do have insight and we typically like FMG’s direct approach.

The key to the stock is obviously the iron ore price and the markets appetite for FMG’s lower quality product. FMG have guided for price realisation for the year of 70-75% however at the moment they are tracking below that level (~68%). They reckon that the price discount has pushed out because of (currently) high profitability from Chinese Steel mills which makes them more comfortable paying for premium product. The other issue has been around Chinese production curtailments which have rolled off this week which have reduced overall demand for Iron Ore. We’re hearing that a number of blast furnaces are now being turned back on. They also talked about the dividend which was a disappointment at the half year result (paid 40% of earnings versus guidance of 50-80%) – they implied a strong second half skew is likely to meet guidance.

All in all – we’re comfortable with our current positon in the income portfolio.

Fortescue Metals (FMG) Chart

OUR CALLS

No trades on the MM Portfolios today

Have a great night!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/03/2018. 4.20PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here