Wesfarmers (WES) shares trade higher on result

Stock

Wesfarmers (WES) $39.24 as at 27/08/2019

Event

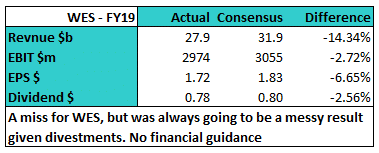

The new Wesfarmers – ex-Coles, BUKI, Quadrant Energy and others – reported its full year result today with the stock trading marginally higher despite what looks like a slight miss, although a messy set of number given the significant change in the composition of the business over the period. EBIT from continuing operations came in around 2.5% below expectations.

The new group generates the bulk of its revenue from Bunnings which saw like-for-like sales grow 3.9% in the year. For most retailers this would be more than enough however given the track record of Bunnings often seeing LFL in the high single digits, this result missed expectations. “Moderated trading conditions are expected to continue” said the company, once again pointing to falling house prices impacting sales.

Kmart saw no sales growth in the year, while Target saw LFL sales fall -0.8% with EBIT for the combined group down 16.7%. The discount department stores continue to come under pressure which led to the acquisition of Catch Group during the year, which will be rolled into the Kmart group to drive its e-commerce capabilities and sales. Officeworks, the smallest retail component of Wesfarmers, saw EBIT up 7.1% on +7.6% LFL sales growth for the year – a pretty solid outcome.

Industrials, where Wesfarmers combine Chemical, Energy & Fertilizers with industrial & safety businesses saw EBIT growth of 4.4% with all growth coming from C, E & F. This area is considered the growth frontier for Wesfarmers. With a strong balance sheet, the company has made its acquisition intentions no secret.

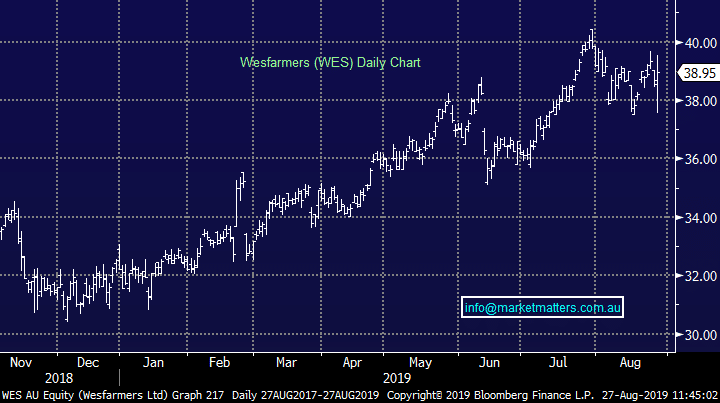

Wesfarmers (WES) Chart

The new group generates the bulk of its revenue from Bunnings which saw like-for-like sales grow 3.9% in the year. For most retailers this would be more than enough however given the track record of Bunnings often seeing LFL in the high single digits, this result missed expectations. “Moderated trading conditions are expected to continue” said the company, once again pointing to falling house prices impacting sales.

Kmart saw no sales growth in the year, while Target saw LFL sales fall -0.8% with EBIT for the combined group down 16.7%. The discount department stores continue to come under pressure which led to the acquisition of Catch Group during the year, which will be rolled into the Kmart group to drive its e-commerce capabilities and sales. Officeworks, the smallest retail component of Wesfarmers, saw EBIT up 7.1% on +7.6% LFL sales growth for the year – a pretty solid outcome.

Industrials, where Wesfarmers combine Chemical, Energy & Fertilizers with industrial & safety businesses saw EBIT growth of 4.4% with all growth coming from C, E & F. This area is considered the growth frontier for Wesfarmers. With a strong balance sheet, the company has made its acquisition intentions no secret.

Wesfarmers (WES) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook