Wesfarmers beats on Bunnings, sells down Coles stake

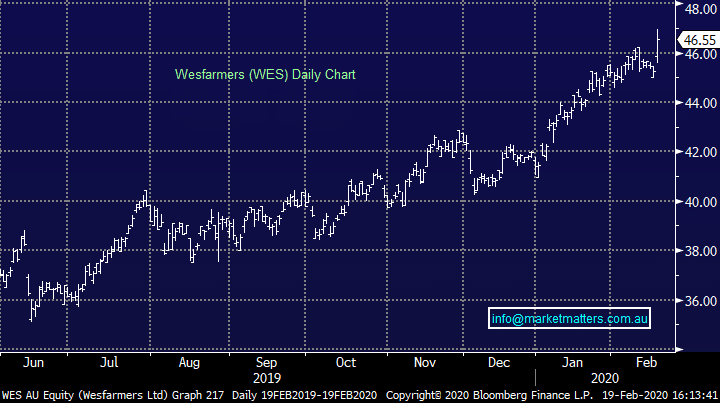

Wesfarmers (WES) $47.05

First half result yesterday for Wesfarmers reasonably close to market’s expectations, however the stock was bid up one some signs the slowdown in Bunnings' sales growth may be behind it. Revenue and earnings were both up around 6% on a comparable basis. Bunnings, which now accounts for more than half of the earnings, saw EBIT rise around 3% while same store sales grew 4.7% for the half. This compares to +4.0% in 1H19 and +3.8% in 2H19 with the company attributed the good result to improvements both in store and online. Kmart Group, which includes Target, saw revenue up 7.6% which was all driven by a standout half from Kmart, while Target slipped with the company not expecting a rebound any time soon. The last retail brand is Officeworks which added 4% to EBIT in the half to beat expectations.

Wesfarmers smaller chemicals, energy & fertilizers and industrials & safety units continue to track higher. They continue to splash cash here to diversify their earnings, acquiring lithium name Kidman Resources in the half. Interestingly, alongside the announcement Wesfarmers sold part of their stake in Coles (COL) a day after their result. The 4.9% stake represents around a third of the holding and was sold at $16.08 – Coles closed the day down 4.24%, a small discount to the deal.

Wesfarmers (WES) Chart