Webjet (WEB) extend debt with convertible note deal

Webjet (WEB) -2.8%: the rest of the travel stocks were broadly higher today, but Webjet slipped from the pack, falling nearly 3% after pricing up a €100m convertible note deal. The proceeds will be used to reduce debt stress on the balance sheet, with $50m of near term debt repaid and the remaining facility extended out to 2022. The deal was on the cheap side for Webjet at just 2.50% out to 2027, but it continues to raise concerns about the ongoing viability of the company while travel remains under pressure given they raised equity just a few months ago. Adding to the frustraton for shareholders, its another dilution to per share earnings. We prefer other names in the space to get leverage to an “early” reopening of travel.

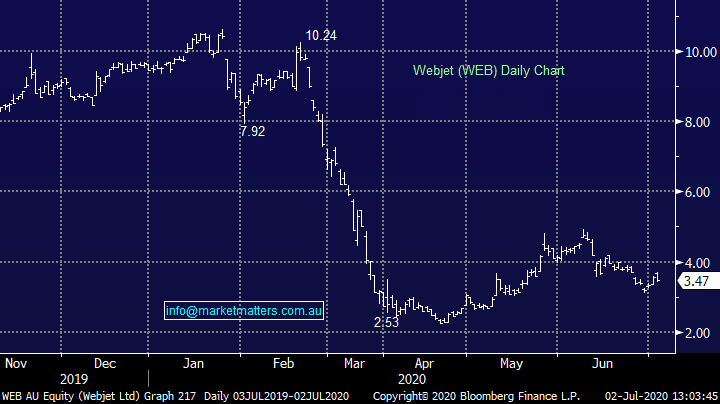

Webjet (WEB) chart