WBC now predict 2 rate cuts this year (WEB, WES)

WHAT MATTERED TODAY

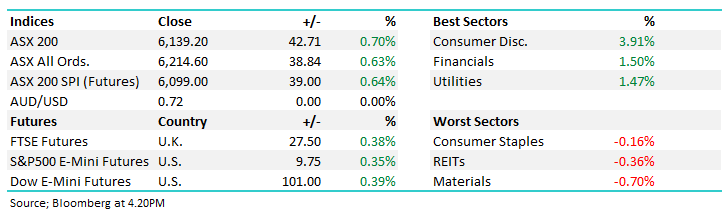

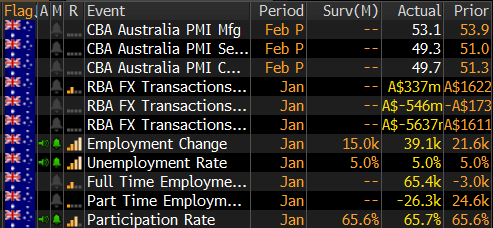

A volatile session today as the market was sold off early following stronger than expected employment data which initially saw the market lower, the AUD higher as traders paired back expectations for lower interest rates, however that theme was short lived thanks to a new ‘bearish’ call from Westpac who cut their expectations for economic growth and think interest rates will be cut twice this year, once in August and again in November taking the cash rate down to just 1%.

39k jobs were added in January v 15k expected and the unemployment rate stayed steady at 5%...however clearly the call from WBC overshadowed these numbers!

The WBC call for lower rates spurred strong buying across the markets, banks in particular were bid up hard. However there was also an article out on Reuters saying a trade deal was underway. The article quoting unnamed sources said that a broad outline of what could make up a deal is beginning to emerge ahead of the March 1 deadline. Apparently, negotiators are drawing up six memorandums of understanding (MOU’s) on the more curly parts of the negotiations like cyber security. The article went to suggest that a deal may still fall over however the market is now certainly positioned for a positive outcome.

Banks led our market higher (plus WEB and WES supported the Consumer Disc sector) while US Futures also rallied during our time zone – ditto for Asian markets which were also in the green. Even AMP finished up on the session!

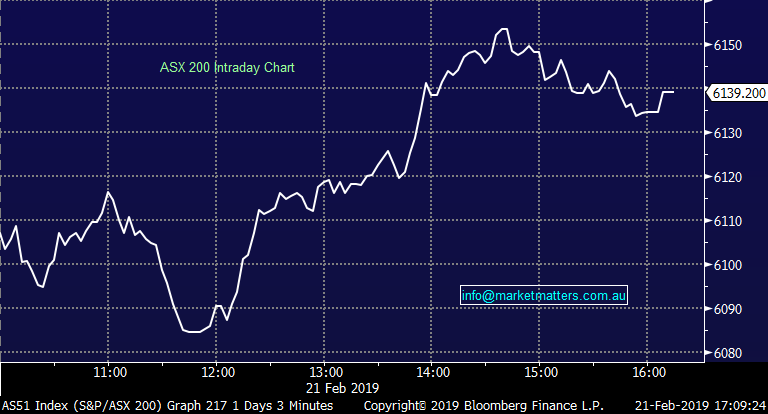

Overall, the ASX 200 added +42points or +0.70% to 6139. Dow Futures are currently trading up 91pts / 0.35%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

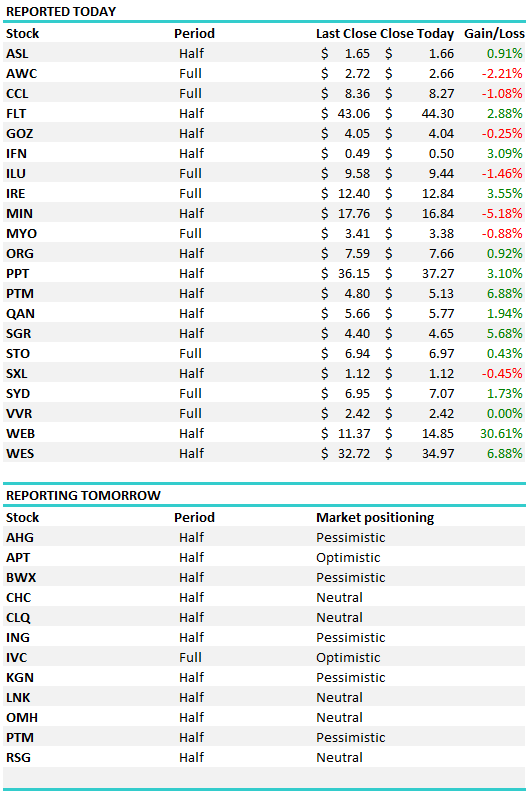

Reporting today; Another big day on the reporting front stoking some big stock specific moves, Webjet (ASX:WEB) the star of the day adding +30% to close at $14.85 after delivering a strong set of numbers – Harry covers below along with Wesfarmers which put on +6.88% thanks largely to the announcement of a $1 special dividend. Most in the market calling WES a beat, and it must have been given the SP reaction however slower growth in Bunnings which is now the key driver for it should be a concern, although that clearly wasn’t the case today.

Flight Centre (ASX:FLT) +2.88% was weak early following a lacklustre result + guidance that suggested they were tracking at the lower end of the prior range – they had guided to profit before tax of $390-$420m – the market was already at $408m so it was a clearly a downgrade, however once again, the announcement of a special dividend did the trick and the market overlooked to soft trends and bought the stock. A potential income play here although trends are weak

Flight Centre (ASX:FLT) Chart

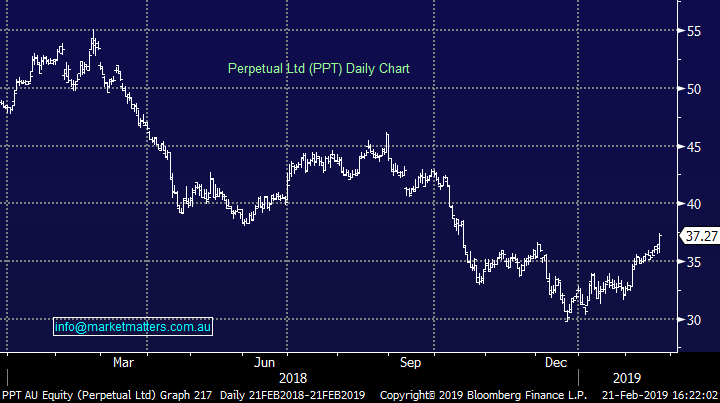

We hold Ausdrill (ASX:ASL) +0.91% in the Growth Portfolio while the Income Portfolio has Alumina (ASX:AWC) -2.21% and Perpetual (ASX:PPT) +3.10% that reported today. AWC was a beat, by around 3% at the profit line and 8% in terms of the dividend, however they were less upbeat about the 2H - the stock closed lower after putting on more than 3% early on. Perpetual delivered an ‘inline’ result in terms of profit (~$60m) and the dividend ($1.25 FF) was a slight beat. They remain on track for their full year numbers and the stock rallied +3.10% to close at $37.27 – up from a sub $30 low.

Perpetual (ASX:PPT) Chart

ASL was a strong result both in terms of profit for the half but also in terms of forward guidance. For the full year they now expect profit of ~$98m which is an uplift on the ~$94m pencilled in by the market. Stock was strong early, but strength sold into. They had been bid up into the news but still, this one should track higher from here…

Ausdrill Chart

QANTAS (ASX:QAN) +1.94% came in line with expectations even though the fuel bill was up significantly - their guidance for full year fuel consumption in line with expectations I’ve seen as was Capex guidance of $1.6bn. The market obviously liked the ~$300m share buy back.

Elsewhere, Aristocrat Leisure (ASX:ALL) +3.86% enjoyed a strong turnaround thanks to commentary at their AGM. This is a company that can talk a big growth game and they delivered on that today, the stock rallying from a low of $23.80 to close at $25.72. We hold in the Growth Portfolio.

I had a few questions on Afterpay Touch (ASX:APT) -2.47% this morning given weakness yesterday and again today. A few things worth noting. The report from the senate enquiry into buy now pay later services is due out tomorrow and from what I hear, APT contacted a few analysts booking meetings for that day to discuss the outcome. Seems premature and somewhat alarming and it now it appears the regulator is onto it. APT is a momentum stock, and we saw some big lines through early on yesterday which prompted more momentum money to exit , plus, why take the risk into tomorrow’s news. I can’t see the any upside (from the Senate outcomes) for APT’s model - at best the findings could be neutral. If I’m an APT shareholder (which I’m not), why not take profit and see the outcome + they report on the 26th and already upgraded guidance recently.

Afterpay Touch (ASX:APT) Chart

Star Entertainment (ASX:SGR) was also a beat to expectations today and I’ll cover that in more depth tomorrow, still on our radar while Nine Entertainment (ASX:NEC) also traded up +7.17% following their results – two stocks worth watching.

Webjet (ASX: WEB) +30.61%; Easily the best performer for our local market today was travel bookings company Webjet which followed the lead of peer Corporate Travel (ASX: CTD) which reported eysterday. The stock soared over 30% as the company grew earnings 37% for the half, and gave better than expected outlook which helped the stock higher. Webjet had been under a cloud over the past few months following the disappointing European summer for their partner Thomas Cook which saw lower bookings on a hot UK period, plus Brexit impacting many peoples travel plans. Today that cloud was lifted as the company reaffirmed full year guidance of at least $120m EBITDA with WebBeds continuing to power growth for the company.

Despite the somewhat subdued leisure travel market, business travel continues to boom helping profits grow substantially for the business. Acquisitions have also bolstered Webjet, with the purchase of JacTravel and Destinations of the World lifting the company to a record result. The 30% jump today seemed a little exuberant for us here. For that, we aren’t keen on WEB at these levels.

Webjet (ASX: WEB) Chart

Wesfarmers (ASX: WES) +6.88%; the first result for Wesfarmers ex-Coles was welcomed by the market today, with strong capital and some reasonable growth enough for the stock to add nearly 7% today. Bunnings now accounts for around 50% of the group’s earnings and is set to drive the business growth over the near term. The problem is that the growth here seems to have hit a speed bump. After adding around 8-9% like-for-like (LFL) sales over the past few years, this period managed a softer 4% growth in sales for Bunnings with the blame being pointed to wet weather and a housing slow down.

Elsewhere, Kmart & Target missed the lower end of the reported range in January which is concerning but it wasn’t enough for the company to miss expectations thanks to a decent effort from the Officeworks business. Consensus EBIT was after $1.61b while the company came in at $1.62b – not a big beat but not a miss. The highlight for many is the $1 special dividend, to go along with the $1 interim div, working out to be 6% fully franked just for 6 months of the year. Wesfarmers ex-Coles is in a very strong capital position, even after the dividends are paid, and now go in search of acquisitions with a number of targets already being speculated. For us cracks are starting to appear in the business. The Bunnings slowdown is concerning. It also seems pointless to drive a stock up over $2 to receive a $1 special dividend. We would be selling this strength.

Wesfarmers (ASX: WES) Chart

Broker Moves;

· Charter Hall Retail Cut to Sell at Moelis & Company; PT A$4.28

· Fortescue Downgraded to Hold at HSBC; PT A$6.50

· Fortescue Downgraded to Neutral at Credit Suisse; PT A$6

· Stockland Downgraded to Neutral at Citi; PT A$3.88

· Stockland Downgraded to Underperform at Credit Suisse; PT A$3.17

· APA Group Upgraded to Buy at Deutsche Bank; PT A$9.90

· APA Group Upgraded to Neutral at Credit Suisse; PT A$8.75

· Lovisa Upgraded to Buy at Bell Potter; PT A$11.50

· Helloworld Downgraded to Hold at Bell Potter; PT A$5.75

· A2 Milk Co Downgraded to Sell at Bell Potter; PT A$11.50

· A2 Milk Co Downgraded to Hold at Morgans Financial

· Pact Group Upgraded to Outperform at Credit Suisse; PT A$3.85

· Pact Group Upgraded to Hold at Morgans Financial; PT A$2.62

· Regis Resources Downgraded to Sell at UBS; PT Set to A$5

· Regis Resources Cut to Sell at Deutsche Bank; PT Set to A$4.50

· Regis Resources Downgraded to Hold at Canaccord; PT A$5.70

· Sonic Healthcare Cut to Hold at Deutsche Bank; PT Set to A$24.70

· Sonic Healthcare Downgraded to Neutral at Citi; PT A$24.75

· Sonic Healthcare Raised to Neutral at Evans and Partners

· Sonic Healthcare Upgraded to Overweight at JPMorgan; PT A$27.40

· Sky Network TV Downgraded to Neutral at Macquarie; PT NZ$1.70

· Cochlear Downgraded to Hold at Wilsons; PT A$188

· IOOF Holdings Cut to Hold at Baillieu Holst Ltd; PT A$6.50

· McMillan Shakespeare Upgraded to Buy at Morningstar

· SCA Property Upgraded to Hold at Morningstar

· Santos Downgraded to Hold at Morningstar

· Scentre Group Downgraded to Neutral at Credit Suisse; PT A$4.20

· St Barbara Downgraded to Underperform at RBC; Price Target A$4

· St Barbara Downgraded to Neutral at Goldman; Price Target A$5.30

· AP Eagers Upgraded to Add at Morgans Financial; PT A$8.03

· AP Eagers Upgraded to Overweight at JPMorgan; PT A$7.50

· NRW Holdings Upgraded to Buy at Moelis & Company; PT A$2.66

· EBOS Reinstated at Morgans Financial With Hold

· OceanaGold GDRs Upgraded to Hold at Canaccord; PT A$4.50

· Senex Downgraded to Neutral at JPMorgan; PT A$0.40

OUR CALLS

No Changes today although on our radar is BOQ, PGH, NEC & SGR…

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.