Volatility drops – stock specific news back in focus (ALL, RIO, TLS, COH)

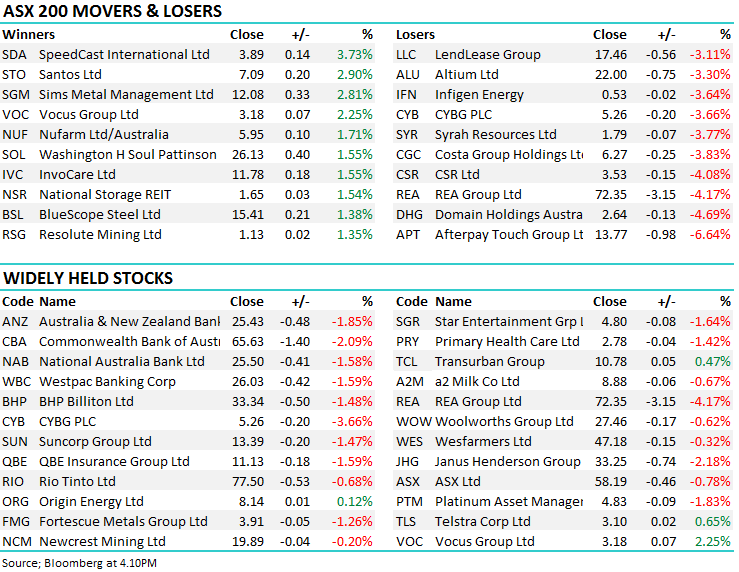

WHAT MATTERED TODAY

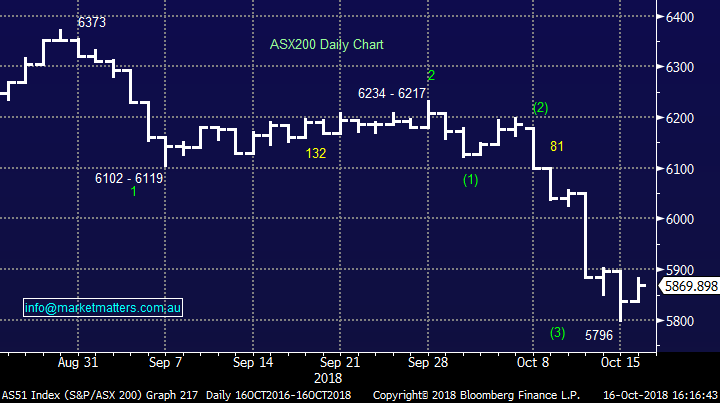

The index / volatility both in Australia and around the region settled down today with the ASX ticking higher throughout the day supported by reasonable buying across Asia + US Futures were very quiet, but positive overall. It was back to good old stock specific news flow today after a week of bigger picture macro influences – volatility took a hit during the day which was good for anyone short volatility through options. The obvious Q now becomes whether or not the market is being lulled into a false sense of security before it gets whacked again. That’s certainly a strong possibility given US stocks have traded down to the midpoint of the trading range, selling was aggressive while buying was less so.

Across our own portfolios, we’ll be looking to re-jig exposures into this weakness to take advantage of the bounce when it arrives. Our ‘gut feel’ in the short term is the market will roll once again after pushing up into the 5900/5950 region, however ultimately we now need to let the market show its hand. Another day of decent strength for the ASX and we’ll likely look to increase some cash / put back on some hedging positions.

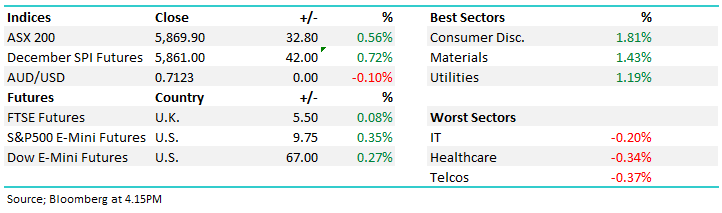

Today the ASX 200 closed up +32 points or +0.56% at 5869. Dow Futures are up +64pts/+0.25%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Concerns about the outlook for the U.S. housing market, changes in management and demand growth have seen James Hardie fall to its cheapest relative valuation in 10 years, Morgan Stanley reckon as they upgraded the stock. “This discount ignores the unique and attractive characteristics of the business and represents valuation too attractive to ignore”: Morgan Stanley

RATINGS CHANGES:

· Wesfarmers Upgraded to Neutral at Citi; PT A$45.80

· WiseTech Upgraded to Neutral at Macquarie; PT A$18.70

· James Hardie GDRs Raised to Overweight at Morgan Stanley

· Ardent Upgraded to Buy at Morningstar

· Steadfast Upgraded to Buy at Morningstar

· Ansell Upgraded to Buy at Morningstar

· Stockland Upgraded to Buy at Morningstar

· Emeco Rated New Buy at Goldman; PT A$0.47

· Iress Upgraded to Add at Morgans Financial; Price Target A$14.52

· ERM Power Upgraded to Overweight at JPMorgan; PT A$1.90

· Whitehaven Rated New Buy at Bell Potter; PT A$6.30

· Bathurst Resources Rated New Speculative Buy at Bell Potter

RIO Tinto (RIO) $78.70 / +1.55%; Production numbers out today for Q3 were okay - Iron ore production was softer than the previous quarter, but this was been expected – Rio was going full tilt in Q2 and maintenance was planned, although full year guidance was maintained here at the upper end of prior guidance. Copper production continued its trend higher, with guidance moved to the top end of the 510-610kt range. Aluminium was soft, and guidance moved to the lower end of previous guidance as a result of strikes at Rio’s Canadian smelter. Coal took a hit, but all expected with asset disposals reducing Rio’s exposure here Elsewhere, alumina, diamond & uranium guidance was all maintained and production more or less as expected. Bauxite production was down 4% QoQ, but guidance lifted slightly to 50-51Mt. All okay for RIO’s production deck today – BHP due out tomorrow.

Rio Tinto (RIO) Chart

Aristocrat Leisure (ALL) $29.04 / +4.05%; A stock we added to the Growth Portfolio recently and was strong today – Charlie Aitken was pushing it this am in a good article – some of which I’ve borrowed. We like the stock targeting new highs above $33. From Charlie…Firstly, we have seen globally and locally a rotation from higher PE “growth” stocks to lower PE “value” stocks. Secondly, the Australian Dollar appeared during September to have made a short-term bottom and ALL is a majority USD earner: that AUD rally has since reversed in October. And thirdly, analysts have been trimming their Aristocrat EPS forecasts marginally to reflect higher Design & Development costs (D&D) as management has guided to a step up in content development at the newly acquired digital subsidiaries Big Fish and Plarium. There has also been speculation of a large transition based seller of ALL, driven by an investment mandate loss.

While I strongly believe we are witnessing the early stages of a rotation from growth at any price (GAAP) to value/growth at a reasonable price (GARP) as long bond yields break higher, inside that rotation there will be stock specific bottom-up investment opportunities where the rotation has gone too far.

I believe ALL around $28.00 now represents one of those opportunities as the investment arithmetic is compelling.

Aristocrat Leisure (ALL) Chart

I spoke with Charlie a little while ago talking about why the market could drop 10% - now we more of less have, it’s worth revisiting – CLICK HERE OR ON THE IMAGE

Cochlear (COH) $185.85 / +0.18%: AGM today and they re-iterated FY earnings expectations – not a lot of new news other than the coy saying growth is expected to broadly continue across the business in FY19, underpinned by the significant investments made in product development and market growth initiatives over the previous few years. The guidance they gave in August held firm which means profit should be up 8-12% yoy. We bought this stock into recent weakness.

Cochlear (COH) Chart

Telstra (TLS) $3.07 / -0.97%; AGM today and they continued to sell the new strategy for a streamlined / innovative customer centric TLS, while there was also some talk about TLS buying the NBN – they’d get it for a song you’d think then it would be back to the future, but only better! Importantly, they reconfirmed earnings guidance + free cash flow expectations. The market doesn’t believe them in terms of free cash flow with consensus sitting below TLS guidance here. It’s really a Q of whether or not you think TLS will really transform or its more rhetoric, I tend to think they can but there’s not many of us out there. Most mainstream news this afternoon will about remuneration and the large vote against management pay packets, but that’s not the real issue for TLS going forward. We own TLS.

Telstra (TLS) Chart

OUR CALLS

No changes today, although we’re planning to rejig a few things in the Income Portfolio tomorrow.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.