US Fed fails to ignite the local market (FMG, WSA)

WHAT MATTERED TODAY

Given the commentary from Jerome Powell (US Fed Chair) overnight, specifically around the trajectory of interest rates in the US (lower for longer) but more importantly the ability (and willingness) of the Fed to use unconventional measures to support the economy, trade in the US after the press conference and more importantly to us, the weakness across our market today was a bit of a surprise. I still remember the day that Fed Chair Ben Bernanke detailed his ‘whatever it takes’ approach to US policy which included a massive expansion of the Central Bank balance sheet. Overnight, Jerome Powell essentially said a similar thing and while markets reacted positively, Mr Powell received around 2c on the dollar relative to Mr Bernanke who got multiples on his investment…A bit of ho-hum response to Powell.

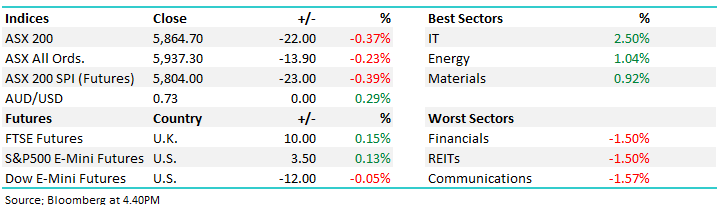

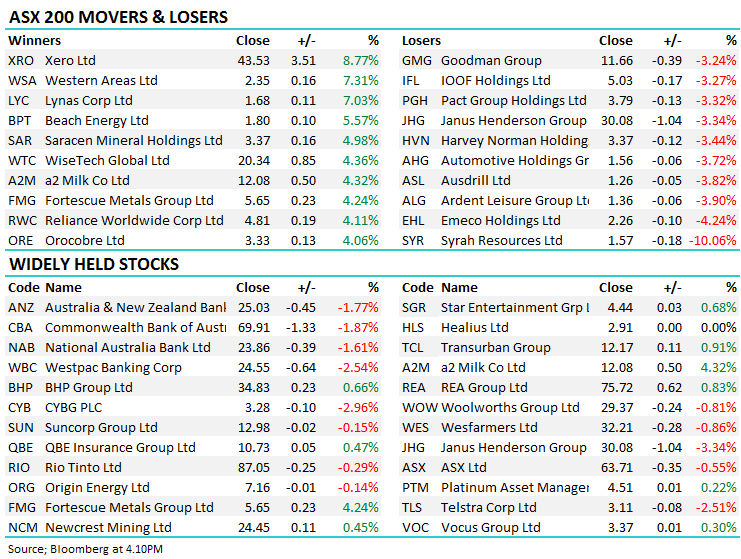

Asian markets were higher today in response to the Fed, Hong Kong up +1%, however the move was muted. The ASX was weak, the index getting hit harder towards the end of the session as banks weighed – the majority closing on their lows ahead of the Royal Commission findings next week (Monday afternoon report is released). I had a discussion with an investor about that yesterday, and I suggested that it’s all ‘known knowns’ and surely the market has already factored this in? Seems not. CBA whacked 1.87%, ANZ -1.77%, NAB -1.61% & WBC hit hardest off -2.54%.

China - Official PMI (manufacturing) data out today and Caixan tomorrow.PMI better QoQ and Vs Street. Official manufacturing PMI was 49.5 in January, compared to consensus 49.3 and 49.4 in the prior month. However, still below 50 though = contraction. While better than expected, activity remained in contraction for the second straight month.

Overall today the ASX 200 closed down -22points or 0.37% to 5864. Dow Futures are currently trading up +3pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Overnight Moves in Tech; Tech stocks were the strongest link in the US overnight thanks largely to a cracking result from Facebook and strong buying in Alibaba & Apple. I met with large US Investment Manager Alliance Bernstein today to talk about their outlook for US stocks. They manage $500b+ so have a fair handle on US equities. They love Facebook, are very keen on US tech for growth including Apple, Alibaba & Microsoft and are also large holders of Tencent.

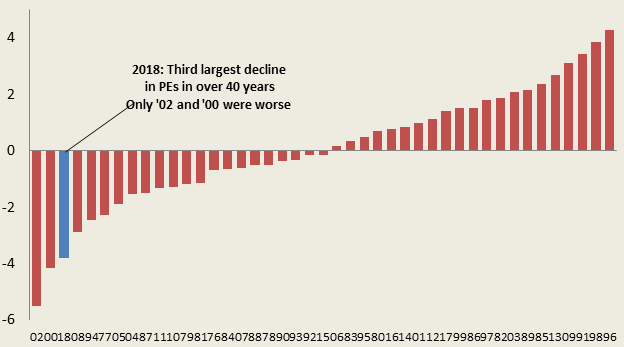

They showed a chart (below) which outlined the P/E re-rate we’re seeing in US stocks. Between 2014 and 2018 P/E’s expanded from 15 to 18 meaning that along with earnings growth, P/E expansion drove US stocks higher. We’ve now seen a big P/E re-rate (nearly -4 P/E points) happen on the back of falling earnings growth – they highlight (below) that it has actually been the third biggest re-rate, only behind 2000 & 2002. Overall, they don’t think US earnings will fall out of bed, and for that reason they’re investing as usual, mainly towards well priced growth.

PE Re-rate – currently experiencing the 3 largest P/E decline – investors are concerned

Just staying on tech, Xero (ASX:XRO) had a very good session today adding +8.77% to close at $43.43…while Appen (ASX:APX) traded up 1.66% to close at $15.95. We sold APX today from the Growth Portfolio for a good profit.

Big volume – Last day of the month; Big volume today through the market ~$10bn for the end of the month. For Jan we saw the index up +3.87% supported mostly by Energy and Tech, while the Financials where the only sector to end down.

Foretscue Metals (ASX:FMG) +4.24% - another solid move in iron ore and a decent quarterly print for Fortescue helped the stock higher again today. Total ore shipped rose 5% on the same period in FY18, climbing to 42.5mt, while at the half way point for the year they have shipped a total of 82.7mt, well on track to meet the full year guidance. Costs also moved lower in the quarter, which is unsurprising given the maintenance undertaken in the first quarter.

The key for Fortescue through the quarter was a reduction in the discount received on their 58% product, vs the global standard 62% price index. The discount blew out to 40% early in the quarter, but has since tightened to around 20% helping FMG print cash. Fortescue also begun shipping a higher grade ore in the quarter, which the company plans to build to around 25% of product out by 2020. Big run from the miner!

FMG Chart

Western Areas (ASX:WSA) +7.31% - a great session on the back of the Nickel price. As one punter wrote on BB today, WSA looks as hot as Sydney feels today!

We remain bullish WSA with $2.50 looking likely in the near term.

WSA Chart

Broker Moves;

· Adelaide Brighton Downgraded to Sell at Deutsche Bank; PT A$4

· Air NZ Downgraded to Underperform at Macquarie; PT NZ$2.55

· GUD Holdings Upgraded to Buy at UBS; PT A$12.30

· Sandfire Downgraded to Hold at Deutsche Bank; PT Set to A$7.25

· DuluxGroup Upgraded to Outperform at Macquarie; PT A$7.85

· Challenger Upgraded to Equal- weight at Morgan Stanley; PT A$7.85

· Qantas Upgraded to Hold at Morningstar

· Steadfast Upgraded to Buy at Morningstar

· Newcrest Downgraded to Underperform at Credit Suisse; PT A$20.30

· Newcrest Downgraded to Neutral at JPMorgan; Price Target A$25

· Fortescue Upgraded to Neutral at Goldman; PT A$5.10

· Super Retail Downgraded to Neutral at Credit Suisse; PT A$7.75

· Premier Investments Raised to Outperform at Credit Suisse

OUR CALLS

Growth Portfolio; We sold our position’s in Appen for a nice profit and Challenger Financial for a loss today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.