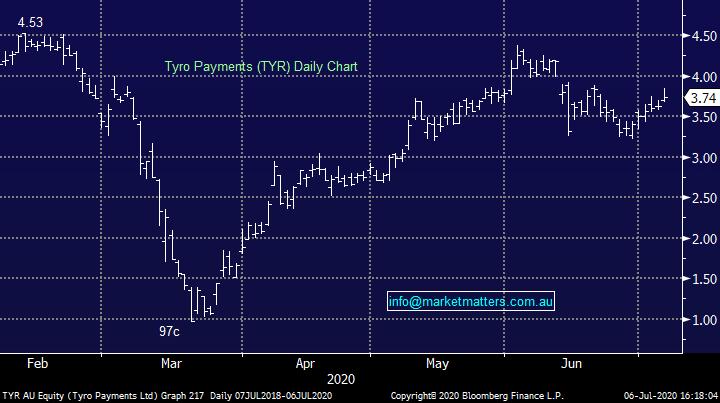

Tyro (TYR) weekly sales growth slows

Tyro Payments (TYR) +3.03% : We’ve been tracking the weekly payments data provided by TYR as a proxy for the broader domestic economy – TYR was/is the fastest growing payments terminal provider and likely to be a good indicator of broader offline sales. TYR results are continuing to show a broader economic recovery although week on week volume growth looks to have plateaued and with further restrictions coming into force into Victoria this puts overall discretionary spend as back and comping materially lower year on year.

Key takeout’s

· Weekly Transaction value (TV) to end of June was $58.7m a day. This is up 1.5% on the prior week, a less significant increase in weekly growth;

· TV per day bottomed in Mid-April (week of 17th) at $27.8m and on a MoM basis TV is now comping ~13% higher. TV YoY for June was +7%, versus -46% at the peak of COVID restrictions. Typically, June is a high spending period (skew) and TYR volumes look to be ~25% lower than on a BAU run-rate; and

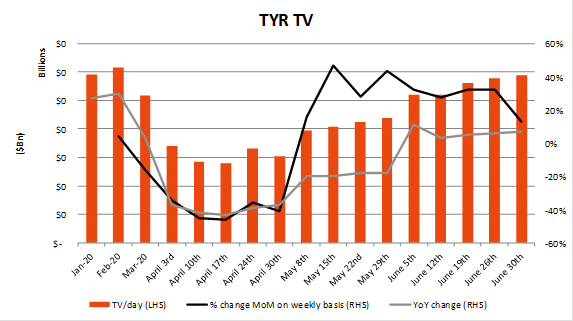

· On these run-rates and with further restrictions it looks unlikely that TYR volumes will recover to pre-COVID levels by August (as was previously thought). Further, the current $58m+ a day should be $73m+ a day with the previous run-rate of TYR. Considering the stock price is back to pre-COVID levels the stock seems rich.

TYR Transaction Value – Growth slowing

Source: Shaw and Partners

Tyro Payments (TYR) Chart – stock looks rich

Source: Shaw and Partners

Tyro Payments (TYR) Chart – stock looks rich