Turnbull rocks the gas industry

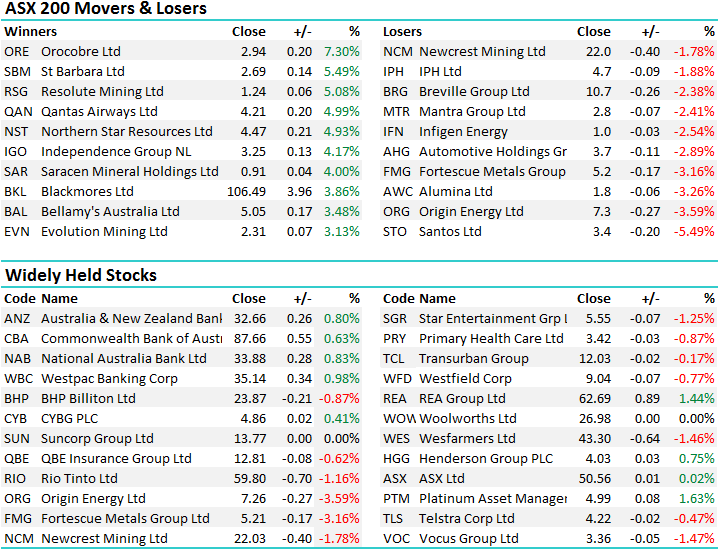

Stock options expiry today so a busy day on the desk and we also made some amendments to the portfolio, selling our holdings in Star Entertainment (SGR) + we also hoped to offload Ansell (ANN) however that order remained unfilled with a $24 limit price. Overall the market had a reasonable session with banks and other financials once again adding most weight to gains. The BIG 4 adding almost 12 index points to the 200 with all the majors’ trading at their highest levels since 2015. As we’ve discussed recently, we’ve got a high allocation to financial stocks in the MM portfolio and we continue to enjoy upside here, however we’re getting close to reducing this exposure.

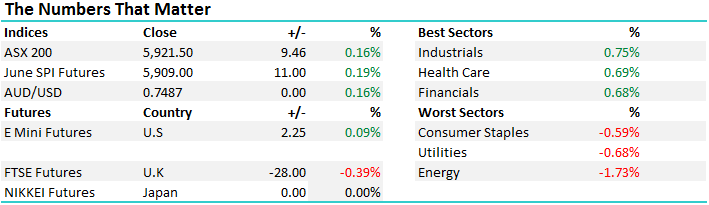

On the market today, we had a lower open before a gradual grind higher throughout the session. A reasonably tight range of +/- 17 points, a high of 5924, a low of 5906 and a close of 5921, up +9pts or +0.16%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Energy stocks, particularly those that are exposed to domestic gas were the big movers today, with Santos (STO) down -5.49% to $3.44 and Origin Energy (ORG) off by 3.59% to $7.26 after PM Turnbull announced plans to reduce gas exports in the event of domestic shortages. They call it the Australian Domestic Gas Security Mechanism and no doubt an abbreviation will be forthcoming in the days ahead however the essence of the plan is that if an exporter draws more from the domestic market than they put in they will need to show how they will fill the shortfall as part of their overall production and exports.

Santos is squarely in the cross hairs, given it uses a lot of domestic gas to feed its Gladstone LNG project and theoretically that could cap the amount of LNG that it will be able export. They were vocal today about the new Govt plans and you can understand why – they’ve planned and built a multi-billion dollar project under one set of government regulations and by the time it starts to kick into gear, the regulations have changed. This is called sovereign risk and the last time it was getting attention was during the Government’s plan to tax the ‘super profits’ in the mining sector just as the top was forming.

Clearly there is a shortage of gas available for domestic consumption and this is pushing up prices, however there are many factors driving this, not just export flows. Govt red tape meaning a lack of approvals, cost of exploration etc to name a few. The U.S made energy security a priority for them some time ago and set up a structure during the infancy of gas development in that country. They provided a framework for producers that was known and new ground and facilities were developed under that regime. Changing the regulatory environment after massive investments have been made sends the wrong message, and we can see why energy companies are annoyed. More on this topic tomorrow morning including our views on the companies involved.

Santos (STO) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here